TITHES AND CORN-LAWS.

THE Examiner of last week, in an elaborate -leading article, en- forces "the necessity of uniting- the question of Tithes with that of the Corn-laws." Our contemporary is of opinion, that a con.a- promise should be made with the Landholders—that they should give up the duties on foreign corn, and in returrr be relieved from the payment of tithes. He says, that " Some equivalent, prcbably, will this time be given to the Clergy, for at least a portion of the tithe. Let their expenses, then, be borne by the nation at large. Let these beincluded in the Estimates of every session, with the other yearly expenses; or let Stock: to the necessary amount be created-for the pur- pose, and places!, as Lord Henley proposes, in the name of a Parliamentary Commission."

With regard to the compensation to be made to.the Clergy, we I ace no doubt, looking to the composition of the new House of Commor s, that it would be ample.. .The lay impropriators also would •ake care of themselves. We think that there would be no great dill culty in bringing both these classes to assent to the plan proposed. But the Examiner seems to fear that the Agricultu- ralists (meaning, we suppose, the Landholders) would object

to it-

" The Agriculturalists, indeed, if the, matter were propounded in the abstract, might question the sufficiency of the compensation; but they would scarcely do so when their attention was drawn to the fact, to how very low a fixed duty the present Corn-law is equivalent." Now, in the consideration of this question, we roust distinguish between Hu se landholders whose land- is tithe-free, and those who are liable to the payment of tithe. That there should be any ob- jection on the part of the latter to accede to our contemporary s suggestion, is perfectly incredible. They cannot be such enor- mous fools. For how would the amount stand between them. and

the country ? - '

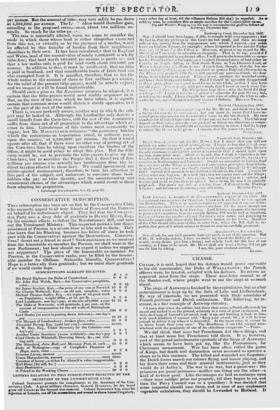

Mr.MACCULLOCH* calculates that th3 Landholders derive an in- creased rent, c. usequent upon the Corn,:luties;of about 1.4460,0001.

• COD =vial Dictionary; article Corn-laws, ke„ •

per Untitun. But the amount of tithe; may very safely be pui down

Alt 4,00,0001. per annum. The 'Li Aders would therefore gain, meetording to the proposed arrangement, about two millions • an- nually. So much for the tithe-pko-,;.

'The case is materially altered, when we come to consider the mode inwhich those whose land is either altogether exemoted from this tax, or virtually so by the payment of a modes, watild be affected by this transfer of biuden froni their neighboars' shoulders to.their own. It has been calculated,t that in England u ndWales, land of the annual value of nearly 8,000,000/. is wholly tithe-free; that lend worth 800,000/. per annum is partly so and that a low modus.only is paid for land:worth about 500,0001. per -avinum. In addition to this, it must be recolketed, that no tithe is paid in Scotland, and that considerable tracts of Irish land are also exempted from it. It is manifest, therefore, that to tax the Whole nation to the amount of three or four millions pr annum, for the relief of the present tithe-payers, would be utterly unjust;

B Ild, we suspect it will be found impracticable. ; Should such a plan as the Examiner proposes be adopted, it is eertana.that the tithe-payers would most readily acquiesce in it: But, on the view of the case which we have taken, it is ,eqtnally certain that common sense would dictate a sturdy opposition.to it

on the part of the rest of the nation. •

- There is,-we are perfectly aware, aootherway in which the sub- jecitriay be looked at. Althongh the Landholder only derives a sinall benefit from the Corn-laws, still the rest of the community suffer from them out Of all proportion to the advantage which ac- crues to him.. .Calculations of, this patine must necessarily be vague; but Mr. Macey:Amen estimates "the pecuniary burden which the restrietions on .importation entail, in • ordinary yeais, upon: the country,- at 9,100,0001. per annum. So that it wknild .appear after all; that if there were no other way of getting rid of :the.. Cora-laws than by taking upon ourselves the burden of the

'tithes, it might be good policy to adopt this plan. But the di&

.ctilty would be, not to persuade the tithe-payers to gi-ce up the Corri4aws,- but to sonvinee the People that a - direcT fax of four ortilliona per annum was actually less burdensome ti4an the in- direct taxation effected by those laws. We would recce-mete:A our pfiblie-aphited contemporary, therefore, to turn his attention to this part of the subject, and endeavour to convinee those land- holders Ow pay no tithe directly, and the inanufiteturing and cOmm.ereial-classes„of the advantages which would result to them frcin adopting his proposition.

; - • • , Eqinburgh Eneyelopmdia, Vol: IX, page 3it. •

Previous page

Previous page