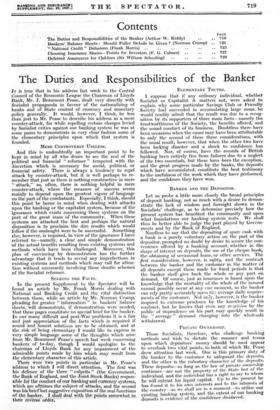

The Duties and Responsibilities of the Banker

IT •is true that in his address last week to the Central Council of the Economic League the Chairman of Lloyds Bank, Mr. J. Beaumont Pease, dealt very directly with Socialist propaganda in favour of the nationalizing of banks and of State control of currency and monetary policy generally. It would, however, I think, be less than just to Mr. Pease to describe his address as a mere counter-attack, for while repelling certain charges levied by Socialist critics against our banking system he was at some pains to demonstrate in very clear fashion some of the elementary principles upon which that system is founded.

MERE CONTROVERSY USELESS.

And this is undoubtedly an important point to be kept in mind by all who desire to see the zeal of the political and financial " reformer " tempered with the discretion which is necessary for social, political, or financial safety. There is always a tendency to repel attack by counter-attack, but it is well perhaps to re- member that just as there is nothing constructive in mere " attack," so, often, there is nothing helpful in mere counter-attack, where the measure of success seems mainly to depend upon the greatest vigoUr of language on the part of the combatants. Especially, I think, should this point be borne in mind when dealing with attacks upon the blinking or the capitalist system, because of the ignorance which exists concerning. those systems on the part of the great -mass of the community. When these systems are attacked the first and perhaps the natural disposition is to proclaim the dire results which would follow if the onslaught were to be successful. Something else, however,is required, in view or the ignorance I have referred to—namely, a clear and simple demonstration of the actual benefits resulting from existing systems and methods which have been challenged. Moreover, this plan of convincing by demonstration has the further advantage that it tends to reveal any imperfections in existing systems and methods which may call for atten- tion without necessarily involving' those drastic schemes of the Socialist reformer.

SEEKING THE FACTS.

In the present Supplement to the Spectator will be found an article by Mr.' Frank Morris dealing with National and Banking Credit and the vital distinction between them, while an article by Mr. Norman Crump, pleadirig for greater " information ' in bankers' balance sheets,' will demonstrate, if demonstration were needed, that these pages constitute no special brief for the banker. In our many difficult and post-War problems it is a fair and just appreciation of the facts which is required if sound and honest solutions are to be obtained, and at the risk of being elementary' I would like to express in very simple language some of the thoughts which arise from Mr. Beaumont Pease's speech fast week concerning bankers of to-day, though I would apologize to the chairman of Lloyds Bank for any impairment of the admirable points made by him which may result from the elefnentary character of this article. There were two point's in particular in Mr; Pease's addresi to which I will direct attention. The first was his defence of the three " culprits " (the Government, the Bank of England, and the Joint Stock Banks) respon- sible fot the conduct of our banking and currency systems, which are ofttimes the subject of attacks, and the second was his:brief but suggestive exposition of the real functions of the banker. I shall deal with the points somewhat in their reverse' -"

ELEMENTARY TRUTHS.

I suppose that if any ordinary individual, whether Socialist or Capitalist it matters not, were asked to explain why some particular Savings Club or Friendly Society had succeeded in accumulating large sums, he would readily admit that the result was due to a recog- nition by its supporters of three main facts—namely the trustworthiness of the Society, the benefits offered, and the sound conduct of its business. Doubtless there have been occasions when the cause may have been attributable to only the second of these three considerations, with the usual result, however, that when the other two have been lacking disaster and a shock to confidence has followed. Nor, of course, have the records of British banking been entirely free from failures due to a neglect of the two essentials, but these have been the exception, and the great progress made by the banks, the deposits which have accumulated, constitute the best testimony to the usefulness of the work which they have performed, and the confidence they have won.

BANKER AND THE DEPOSITOR.

Let us probe a little more closely the broad principles of deposit banking, not so much with a desire to demon- strate the lack of wisdom and foresight shown in the Socialists' challenge, as to determine precisely how the present system has benefited the community and upon what foundations our banking system rests. We shall then be better able to judge the part played by Govern- ments -and by the Bank of England. Needless to say that the depositing of spare cash with a bank is a purely voluntary action on the part of the depositor, prompted no doubt by desire to secure the con- venience offered by a banking account, whether in the shape of interest on deposits, the use of the cheque book; the obtaining of occasional loans, or other services. The first consideration, however, is safety, and the contract between the banker and the customer in the matter of all deposits except those made for fixed periods is that the banker shall give back the whole or any part on demand. Of course, just as insurance is based upon the -knowledge that the mortality of the whole of the insured cannot possibly occur at any one moment, so the banker can rely pretty accurately upon th average daily require- ments of the customer. Not only, however, is the banker inspired to extreme prudence by the knowledge of his contract, .but. he knows that even any suspicion by the public of imprudence on his part may quickly result in the " average " demand changing into the wholesale withdrawal.

PRIVATE OWNERSHIP.

Those Socialists, therefore, who challenge banking methods and wish to dictate the manner and terms upon which depositors' money should be used appear to overlook two vital points, to both of which Mr. Pease drew attention last week. One is this primary duty of the banker to the customer to safeguard the - deposits; and the other is the poluntary character of the deposits. These deposits—so long as the law of private ownership continues—are not the property of the State but of the individual, and the individual has a right to say to whoni he will entrust his liquid capital. Up to the present he has found it to his own interests and to the interests of the country—as we shall see in a moment—to utilize our existing. banking system, and. the extent_ of our banking deposits is evidence of the Confidence disnlavefl How DEPOSITS ARE USED.

Under our banking system, however, it is not only the depositor who benefits either by interest or banking facilities, but the country as a whole. Directly or in- directly, the use made by the banker of the deposits entrusted to him ministers to trade and general financial activity. Much of the growth in deposits already referred to is the result of loans made by the banks, which, even after they have been repaid, leave a net increase owing to the business which has been stimulated by the advances. Again, even when it is a question conceivably of foreign loans which have been aided by banking facilities, expe- rience has shown that sooner or later—and probably sooner—our exports are stimulated by purchases on the part either of the actual borrowing countries or on the part of other countries who have benefited indirectly thereby. And the safety of such advances is almost invariably secured by their having been made on sound banking principles with adequate security.

" SAFETY " OF THE STATE.

But, an objector will urge, do you seriously assert that when it comes to a question of safety, the private banking system is to be regarded as safer than the State ? The answer is unquestionably in the affirmative, and a moment's consideration should, I think, justify the assertion.

hWhen I say that a sound system of private banking offers greater protection than control of the deposits of the country by the State, I am not thinking of a situation where John Smith, the depositor, one day finds that the State refuses to meet his withdrawal of £50 or whatever may be the amount due. What I should be afraid of is that under a system of State control it might be that when the £50 was withdrawn it might not prove to be of the equivalent value of the £50 originally deposited. If the State pursued precisely the same course as that adopted by the banks of to-day the fear would probably not be -justified, but in that case there would be no motive in the Socialist desire for control. Confessedly that desire is to add to the State the power not only further to tax wealth but to control the liquid resources of the country, as eipreased in banking deposits,- and apply some portion to further social outlays which are not usually found to be of a reproductive character. Such a policy would, of course, lead to inflation and high prices and would Constitute severe taxation of a hidden character, so that it would be found that while the original £50 -deposited might be forthcoming in paper, its purchasing ower—which is what matters to the depositor—would ave diminished enormously. LESSONS FROM THE WAR.

But, some one will say, have we not in the War years and those immediately following experienced something like this even under our present banking system ? The answer, of course, is in the affirmative. Without actually Controlling or appropriating banking deposits the claims of the War were such that Government borrowing amounted almost to a claim upon a large proportion of the liquid wealth of the country, and inflation proceeded to such lengths that the purchasing power of the depre- ciated enormously, and many of those sound rules of banking and finance were temporarily abandoned under the strain of war demands. Not only in this but in other countries the State for a time usurped banking power and authority, which, though justified while the War was proceeding, made the task of recovery after the War a difficult and painful one, difficult in all countries, but most difficult and most painful in those countries where the sound laws of currency were most abused and Where reluctance was shown in relinquishing the power wrested temporarily from the central banks and the private bank- ing institutions.

GETTING BACK TO SAFETY.

Under the lead of the Bank of England, backed by the Treasury, this country led the way in a gradual return to sounder conditions, lxith as regards currency and banking freedom and a return to the gold standard, with incalculable benefit to the. community. It is quite true 414 in the lowering ofcommodity prices disturbances which always follow a period of inflation were experienced, but there can be no question that the benefits resulting from the fall in the price of foodstuffs and raw materials imported have materially offset the admitted inconveni- ences. Confidence and a gradual improvement in trade are now being stimulated, not by increased control of finance and industry by the State, but by the gradual diminishing of such control, and the reason, so far as banking and finance is concerned, is because under sound currency and banking laws outside the control of Governments an automatic check is imposed upon the inflationary tendencies which experience has shown are common to almost all Governments.

NATURE OF THE SAFEGUARDS.

If the control of. banking and currency were to rest in the hands of the Government, it is clear that political policy and expediency would be the motive forces operat- ing, whether that Government were Socialistic or Con-. servative, and banking and finance could never flourish under such uncertainties, the more so when it is remem- bered that the country is now bereft even of a strong Second Chamber acting as a check upon hasty and unwise legislation. It must be clear, I think, to all impartial observers that banking and finance require to be com- pletely removed from political influences, so that efficiency, and soundness shall be the one ruling principle. Expe, rience throughout all countries has shown that this end can best be secured by entrusting to the Central Bank of the country the power of regulating currency and credit, with full liberty to the other banks, subject, of course, to the banking and currency regulations themselves. The one direction in which the power of the State is required is to examine from time to time the working of the banking and currency system as a whole, and, should the result of expert inquiry demonstrate conclusively that modifications in the law are required, to carry the same into effect to see that the requirements are duly observed. This, in fact, is the system under which we have been working for many generations, and—subject to dis; arrangement of details occasioned by the War—are working to-day.

SOME BANKING TRIUMPHS.

I shall hope on some other occasion in the near future to return to the subject matter of Mr. Pease's speech, in which he demonstrated the services which had been performed within recent years by the three " culprits "--- the Government, the Bank of England, and the Joint Stock banks in co-operation—in the restoration of sounder conditions following the period of deflation. Meanwhile, however, I suggest that those who would be inclined to criticize our existing banking and currency system might do well-to. quietly consider such points as the following. Which was the country which stood the brunt of the strain of the financing of the Great War, both as regards its own outlays and those of its Allies ? Which was the country taking the lead in paying its debts after the War ? And, despite the war strain, and allowing for depression in certain key industries and even despite the labour unrest and strikes, which is the country where the rise in the general standard of living and comfort is most pronounced at the present day ? The answer is Great Britain, and that just as her financial power, which enabled her to stand the shock and strain of war in 1914, was achieved by a sound banking and commercial system untrammelled by State control, so in the future, whatever may be needed by way of modernizing and perfecting those systems, it is along those lines and not along the line of State ownership and control that we:may look for progress. At the present moment industries in the country are still handicapped by the heavy weight 44 - taxation. This, in its turn, is due to the fact that even under a Conservative administration, it seems vain to hope for _real economy in the National Expenditure. These are conditions, of course, which the banker is unable to alter or restrain, but it is reassuring to know' that resentment of the taxation constitutes at least some slight restraint on State piodigality. Much of this restraint would be removed if through a process of national-. izing banks the liquid resources of the community were actually controlled by the State.

Previous page

Previous page