Deferred Assurances for Children

PERHAPS the best of all policies is that which is taken out in childhood at an extremely low rate of premium, which remains unaltered through life.

For example, if a. policy is effected in the first year of a I child's life at a premium of £10 a year, the money is accumulated, as in a savings bank, up to age twenty-five. So far there is nothing especially attractive about the ‘. contract, but at age twenty-five the policy becomes . ordinary whole-life assurance for about £1,160, which, with bonuses in addition, is paid whenever the grown-up child dies, and the premium remains at £10 a year for life. By age forty-five the sum assured has increased to about £1,700, although the total amount paid in premiums has been only £450. Twenty years later the sum assured becomes nearly £2,500 at a cost of only £650.

The rate of premium for these policies is so low that it is often worth while to take endowment assurances rather than whole-life policies. A premium of £10 a year from birth secures a policy which would yield £952 in the event of death at age twenty-five, and would provide 11,850 on survival to age sixty, when the premiums would cease and this sum would be paid.

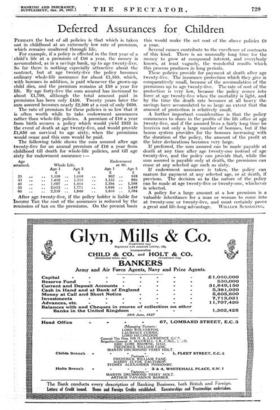

The following table shows the sum assured after age twenty-five for an annual premium of £10 a year from childhood till death for whole-life policies, and till age sixty for endowment assurance ;— Age Endowment

attained. Whole Life. at 60.

25 .. Age 1 £ .. 1,159 .. Age 5 £ 1,000 • .

i 35 .. .. 1,402 ..

1,2.10

45 • . .. 1,697 .. 1,464 i 55 .. .. 2,053 .. 1,771 ..

60

.. 2,259 .. 1;948 ..

After age twenty-five, if the policy holder is liable for Income Tax the cost of the assurance is reduced by the remission of tax on the premiums. On the present basis

Age 1 £

Age 5 £ 952 • •

989108

1,152 ..

1,394 • • 1,198 1,686 • • 1,449 1,855 • • 1,594

this would make the net cost of the above policies £0 a year: Several causes contribute to the excellence of contracts of this kind. There is an unusually long time for the money to grow at compound interest, and everybody knows, at least vaguely, the wonderful results which this process produces in long periods.

These policies provide for payment at death after age twenty-five. The insurance protection which they give is comparatively small, because of the accumulation of the premiums up to age twenty-five. The rate of cost of the protection is very low, because the policy comes into force at age twenty-five when the mortality is light, and by the time the death rate becomes at all heavy the savings have accumulated to so large an extent that the amount of protection is relatively small.

A further important consideration is that the poliey commences to share in the profits of the life office at age twenty-five, and if the assured lives a fairly long time he receives not only a large number of bonuses, but if the bonus system provides for the bonuses increasing with the duration of the policy, the amount of the profit at the later declarations becomes very large.

If preferred, the sum assured can be made payable at death at any time after age twenty-one instead of age twenty-five, and the policy can provide that, while the sum assured is payable only at death, the premiums can cease at any selected 'age such as sixty. If endowment assurance is taken, the policy can mature for payment at any selected age, or at death, if previous. The decision as to the nature of the policy can be made at age twenty-five or twenty-one, whichever is selected.

A policy for a large amount at a low premium is a valuable inheritance for a man or woman to come into at twenty-one or twenty-five, and must certainly prove a great and life-long advantage. WILLIAM SCHOOLING.

Previous page

Previous page