Shares in the doldrums

Nicholas Davenport

The complacency with which the Government is viewing the troubles of our greatest industry — motor manufacturing — can only be explained by the fact that it must really want to cool down an over-heated economy. Even by Putting out some steel furnaces. The ridiculous strikes which are holding up production at Chrysler, British Leyland and Ford should have brought into action all the conciliation machinery of which the Government is capable. Especially as the industry in the first six months of the year lost 290,000 cars by stoppages against 225,000 during the whole twelve months of 1972. But nothing has been done as I write — not even to settle the awkward 156 electricians or the walk-out over the dismissed man who hit a foreman With a chair leg. Being a rich country with a Widely spread manufacturing capability we shall not be ruined even if our motor industry were to collapse but its failures have been adding greatly to our worsening balance of payments, Ministers like Mr Walker of the DTI and Lord Limerick, Under-Secretary ot State for Trade: have been crowing about our wonderful exPort achievements—which are only to be expected when we have an undervalued £ — but they keep Silent about the fact that our share of world trade is still declining and that our import bill is rising higher and higher mainly because our consumers cannot obtain delivery Of the home manufactures they need. In the past three months imports of motor vehicles were actually 19 per cent higher than in the previous three months. Foreign cars accounted for 32 per cent of new registrations in August. „, One would imagine from these figures that evil revolutionaries are at work deliberately disor ganising the motor industry but it Is the stupidity of both

Managements and unions which is

the chief cause of the trouble. We alI know that a motor assembly me is the most boring manual job In the factory world but why are Are not trying to reorganise it and Take it more interesting as the wedes are doing?

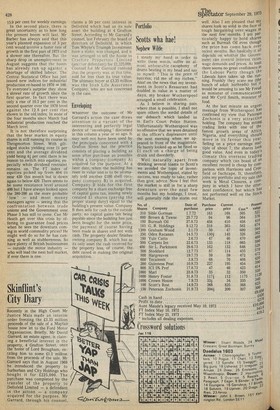

It is small wonder that you can noW buy British Leyland 25p shares at a shade below their par value — and at 50 per cent below their net asset value — to yield N Per cent. They are selling at only 6

times their prospective earnings per share this year. Yet they remain friendless. Investors are scared of them. They are also scared of engineering shares generally because of the labour risk. The top five companies — Vickers, Tubes, Metal Box, Delta and Renold — are selling on an average price-earnings ratio of 11. This is only slightly below the average price-earnings ratio for 108 leading companies taken from a leading broker's list. Can it be that institutional investors have lost their faith in the future of British industry? And the small investor too? The net sales of units by the unit trust movement dropped from £13 million to £8.9 million last month — the lowest for the year. The growing unpopularity of the Stock Exchange is a problem which is worrying a lot of brokers.

I do not believe that it can be explained away as sheer funk of trade union power. There are two great uncertainties which at the moment are prohibiting new investment on the Stock Exchange. The first is the uncertainty about company profits under Phase 3. The CBI have put up a strong case for the abandonment of the unit cost method of calculating price increases. The Phase 2 code penalised efficiency by actually reducing profit margins on domestic sales with each application for a price increase. Sir Michael Clapham, the president of the CBI, has said that he believed the Price Commission had been instructed to be "as bloody as it can be." If the Government does not budge it could well be that company profits will be badly hit, particularly in the retail trades if gross margin control is replaced, as in the US, by cash margin controls.

On the question of pay the CBI has told the Government that it prefers a straight percentage increase instead of the £1 plus 4 per cent of Phase 2. It is said that they favour something in the region of 8 per cent to 9 per cent but this is bound to provoke the unions into militant action. The wage increases in August over the previous twelve months was 151 per cent for basic hourly rates and 15.9 per cent for weekly earnings.

In the second place, there is great uncertainty as to how long the present boom will last. Mr Barber has always said that this year's planned expansion of 5 per cent would involve a faster rate of growth in the first part of 1973 and a slower one thereafter. But the sharp drop in unemployment in August suggests that the boom has already run up against a shortage of skilled labour. The Central Statistical Office has just issued new indices for industrial production re-based to 1970 = 100. To everyone's surprise they show a slower rate of growth since the first quarter. In fact there was only a rise of 10.3 per cent in the second quarter over the 1970 level against the 12.8 per cent rise, shown in the old, index. In none of the four months since March had industrial production reached the March level.

It is not therefore surprising that the bear market in equity shares is still running its course in Throgmorton Street. With giltedged stocks yielding over 11 per cent and the average dividend yield being 4i per cent there is no reason to switch into equities, especially while dividend restraint remains on. The FT index of equities picked up from 404 to near 430 this month but is down again to below 420. There seems to be some resistance level around 400 but I have always looked upon the 380-390 as the more probable 'low' — and most money managers agree — seeing that the confrontation between trade unions and the Government over Phase 3 has still to qome. Can Mr Heath get over this crisis by offering to guarantee food prices when he sees the downturn coming in world commodity prices? He might well do so for he has cunning as well as stubbornness. So have plenty of British businessmen — outside the motor industry — who will lead the next bull market, if ever there is one.

claims a 50 per cent interest in Dellofeld which had as its sole asset the building at 4 Grafton Street. According to Mr Garrard's counsel, last February the board of directors of Dellofeld, in which Tom Whyte's Triumph Investment have a stake, was changed, and it was arranged to sell the house to Crashire Properties Limited (another defendant) for £1,325,000. Counsel for Mr Garrard contend that the property was, at this time, sold for less than its true value. The ultimate buyer at £3.35 million was the Irish Life Assurance Company, who are not concerned in the case.

Enveloping

Whatever the outcome of Mr Garrard's action the case draws attention to a variant of the interesting and perfectly legal device of 'enveloping' discussed in this column a year or so ago. It may well not have been used by the principals concerned with 4 Grafton Street but the practice consists of placing a building as soon after purchase as possible within a company (company A) acquired for the purpose. At a later date, when the building has risen in value and is to be ultimately sold another £100 shell company (company B) is acquired. Company B bids for the first company by a share exchange free of' capital gains tax, issuing newly created £1 shares (paying the proper stamp duty) equal to the building's present value. Company B then sells for cash to the outside party, no capital gains tax being payable since the building has just been bought for the same price, the payment of course having been made in shares and not with cash. The property dealer finishes owning company B, which has as its only asset the cash received for the property less, of course, the. debt raised in making the original acquisition.

Previous page

Previous page