Investment Notes

By CUSTOS

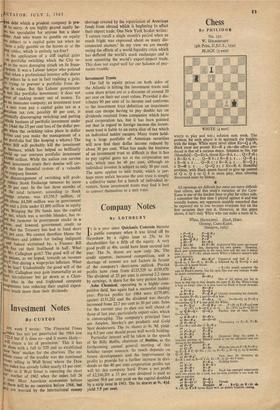

1 AST week I wrote: The Financial Times triindex has not yet penetrated the 1964 low " 322.6 but if it does so—and it seems likely— Create a lot of pessimism.' This it has „vg dune with a fall to 320 and so established e bear' market for the chartists. The im- °tate cause of the trouble was the continued ry°11s selling in Wall Street where the Dow les index has already fallen nearly 15 per cent. auks as if Wall Street is repeating the short ar' market of 1962 when the index fell 26 cent. Most American economists believe t there will be no recession before 1966, but tlY are worried by the international money

shortage created by the repatriation of American funds from abroad which is beginning to affect their export trade. One New York broker writes: 'I cannot recall a single month's period when so much fright was expressed about so many dis- connected matters.' In my view we are merely seeing the effects of a world liquidity crisis which has deflated the world's stock exchanges and is now squeezing the world's export-import trade. This does not augur well for our balance of pay- ments trouble.

Investment Trusts The fall in equity prices on both sides of the Atlantic is hitting the investment trusts and some share prices are at a discount of around 20 per cent on their net asset values. Provided it dis- tributes 90 per cent of its income and conforms to the investment trust definition an inv.estment trust can escape having to pay double tax on dividends received from companies which have paid corporation tax, but it has been pointed out that in regard to foreign income the invest- ment trust is liable to an extra slice of tax which an individual holder escapes. Many trusts hold- ing a large portfolio of American securities will now find their dollar income reduced by about 30 per cent. What has made the business of an investment trust so difficult is that it has to pay capital gains tax at the corporation tax rate, which may be 40 per cent, although an individual investor is subject to only 30 per cent. The same applies to unit trusts, which is per- haps more unfair because the unit trust is simply a collective name for a bunch of individual in- vestors. Some investment trusts may find it best to convert themselves to a unit trust.

Previous page

Previous page