Banking in 1928—Financial Activity — Rise in Deposits—Loans Expand IN examining the

banking figures as set out in the annual • balance sheets, not merely for last year, but over the years which have followed since the War, there is one central thought which it may be well to keep in mind. Conditions during the decade have varied enormously, but there has been one feature which has been more or less persistent throughout the whole of the period, namely, a constant demand for loanable capital.. Sometimes • it has been trade which has made considerable demands, as in 1920. Sometimes it has been the financial aid required to keep some impoverished industries on their • feet. Sometimes it- has been purely financial, as distinct from industrial activity. Sometimes it has been inter- national rather than home trade which has made demands on banking resources, all over the world. And sometimes, it has been the activity in loans both by countries and corporations, and also by industrial concerns which • has made special demands upon credit. This central • fact may explain the consistent activity of banking • all over the world, even when in places trade may have been dull. It should also suggest that while credit facilities have always been available, there has been the inevitable tendency for them to gravitate towards the direction where the highest interest charges, com- bined with security, have been obtainable.

A LARGE TURNOVER.

So far as this country is concerned, the experiences of the past year have been of a complex, and in many respects of a conflicting character. It has been a year -fib"-from'diatiirbtmees in the shape of- labour conflicts, while international trade has undoubtedly beenquickened and helped by . more stable exchanges, and the Wider distribution of gold over- the different countries. Moie- osier, while many staple industries in Great Britain have again experienced a year of great depression, other industries, and particularly some of the newer trades and those connected with luxury articles, have prospered greatly, and have made considerable demands upon bankers' loanable resources. And, most of all, perhaps, the year has been characterized by great financial activity both national and international. Both in New Yor),:. and London, there has been phenomenal activity on the Stock Exchanges, while the new capital flotations haVe also been the highest for some few years. These develop- ments have all left their mark upon the figures of the bankers' balance sheets, and- account for a geneVal expansion in banking turnover, an expansion well reflected in the aggregate of the figures of bankers' clearings which, for- 1928, show an increase of no less 4han t2,054,000,000, or abthit 6.8 per -cent.

RISE IN DEPOSITS.

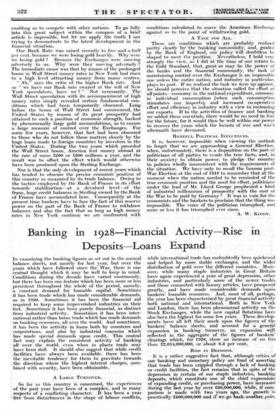

It is a rather suggestive fact that, although critics of our banking and monetary policy are fond of asserting that trade has been crippled through a lack of banking or credit facilities, the fact remains that in spite of the depression in certain of our staple industries, banking deposits, which constitute one of the chief expressions of expanding credit, or purchasing power, have increased during the last year by over £60,000,000, while, if com- parison is made with two years ago, the growth .`is -practically £100,000,000 and .if we,go back -another .yeAr, the expansion is over £150,060,000. ' The actual figures

Dnrosrrs: Dec. 31st, 1926.

£

Barclays Bank 309,883,691

14loyds Bank .. .-, • 346,132,533

Midland Bank, . 366,433,103 National ProVincial Bank 259,249,807 Westminster Bank .; 285,406,068 Dec. 31st, 1927. £ 318,373,472 357,184,897 • $74,375,146 273,597,202 280,612,620 Dec. 31st, 1928.

335,081,222 352,157,420 394,591.227 290;310;252 ' 294,086,580 , Total- .. 1,567,095,192 1,604.142,737 1,666,226,701 District Bank .. 52,321,532 53,721,367 52,254,949 Lancashire & Yorkshire

' Pisa '1" . '

23,660,581

24,026,215 '*

Manchester & County Bank 19,248,593 19,178,506 .19,587,527 Martina Bank 59,819,326 62,890,872 82,932,881 National' Bank . . 36,814,913 36,577,997 37,476,168

Union trailk of Man- ' chesler

17,434,522 17,734,302 18,069,360 Williams Deacon's Bank 32,438,363 - 32,662,567 32,221,394

241,731,830 246;791,820

242,542.,219

*Now absorbed by Martins Bank.

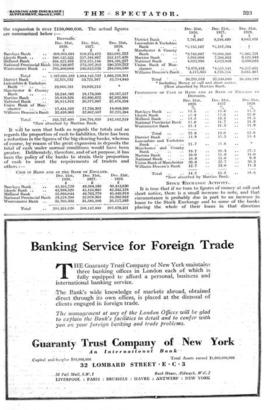

It will be seen that both as .regards the totals and as regards the proportion of cash to liabilities, there has been a reduction in the figures of the big clearing banks, whereas of course, by-reaSdn of the great expansion in deposits the total of cash under hortnal .tbriditions would have been greater.. Deliberately, therefore, and of set purpose; it has been the policy of the 'banks to • Strain their proportion of cash ' to meet the requirements of traders and others :-

•

. _ . 1 • -•CASH IN HAND AND AT THE DANK OF ENGLAND.

• Dee. 31st; • Dec. 31st, Dec. 31st, - 1926. • • 1927: 1928.

Barclays Bank , 45,105,729 49,564,180

50. •413f930

Lloyds Bank .. 42,998,320 45,155,865 42,345,128 Midland Bank - 52,994,044 49,763,778 45,440,918 National Provincial Bank 28,528,200 32,078,961 34,362,652 Westminster Bank . 31,705,333 31,585,106 35,117,593 Total

•

201,331,626 208,147,890 207,679,321

are summarized below -

Dec. 31st, 1926. Dec. 31st, - 1927. Dec. 31st, 1928.

District bank 7,791,947 8,246,430 8,043;459 Landashire & Yorkshire

Bank *5,135,167 *5,197,594 t Manchester & County

Bank .. • *3,782,687 *3,900,360 *5,381,751 Martins Bank - • 5,961,008 7,394,983 9,121,948 National Bank .. 4,023,990 4,023,898 3,698,033 Union Bank of Man- chester • • u •

*3478,419 . 4'4,451,541 4'6,557,651

Williams Deacon's Plank ,. 4,117,835 4,233,254 3,635, 407 Total ' 34,291,053 37,548,060 36,438,249 * Including Money at call and short notice. • • (Now absorbed by Martins Bank.

'PROPORTION OF CASH IN HAND AND AT BANK OF ENGLAND TO

DEPOSITS.

*Now absorbed by Martins Bank.

STOCK EXCHANGE ACTIVITY.:- , It is true that if we turn to figures of Money at call- and short notice, there is a small increase -to note, and that circumstance is probably due in part to an increase iin loans- to the Stock Exchange and to some of the banks placing the whole of - their loans in that direction

Dec. 31st, 1926.

% Dec. 31st, 1927

bi '

• Dee. 31st, 192$ ,l,, Barclays Bank .. ' .. 14.6 15.6 . 15 . 5 Lloyds Bank .. .. 12.4 12.6

12.0 Midland Bank .. .. 14.5 . 13.3

11.5 .National Provincial Bank 11.0 11.7

11. ft Westminster Bank .. 11.1 ' .. 11.3 '

11.9

12.8 13.0

12.6 District Bank .. 14.9 15.3 .. ;5.4 .Lancashire and Yorkshire

Bank 21.7 21.6

.0

Manchester and County

19.7 20.3

•

27.5 Martins Martins Bank .. 10.0 11.8

• •

11.0 ,National Bank 10.9

11.0

9.9 Union Bank of Manchester 20.6

25.7

36.3 Williams Deacon's Bank 12.7 13.0

11.3 Total .. .. 14.2 - . 15.2 .. 18.6,

under the head of money at call on short notice. It w411,4-tn-noted,...hewover, from the,following -table that in the case of the provincial banks, there is usually ,mall reduction in the volume of money at call on short notice, liSt. if§ '57 -pieViOirg table-4Ra "shown that in the case Of-those banks there was also a reduction in the v4lume- Of deposits. It will be seen that in this, and in othei‘Iables Martins Bank is. still included in the list of prOvinekg1 institutions,: althongh, of course, it is really one of the " clearing "--banks, fob -Indeed, its major , operations-are probably condtietcd iikthe prot

• £ ; Barclays Bank .. 21;284;818 26,041,049 23,988,400

Lloyds Bank . ..

16,458,305 26,623,546 26,819,228 Midland Bank : 22,786,851 27,509,077 27,681,297

National Provincial B•ank

18,769,651 • 21,017,455 25,920,942 Westminster- Bank; . . 27,370,85 1 "362202 - 14,813,607 Total .. 106,670,476 138;511,339 139,223,474

D'trict Bank ..

4,590,420 5,786,620 4,724,125

ins Bank ..

5,826,728 6,679,533 5,420,745 National Bank .. *4,181,400 *4,433,565 *5,499,400 Union Bank of Man- chester .. ..

Williams Deacon's Bank 2,957,233 2,952,915 2,871,374 Total .. 17,555,781 • 19,852,633 18,515,664 *Including Stock Exchange Loans and Treasury Bills.

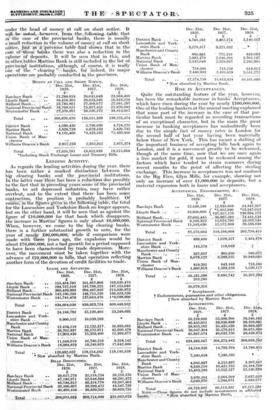

LENDING ACTIyITY. • As regards the lending activities duEing the.year, there has been rather a _marked .diitinetion . between the big clearing banks and the_ provincial institutions. Iii the latter ease therebeen a4eatietiondne possibly to the fact that ih p-retedineyears:sonie iforthe provincial banks, to aid depressed industries, may have rattier overlent, and to the extent that there has been some contraction, the position is probably,- healthier. Of coliitein-the firutes-kiren-in the ItiltaiVink table, the total for the Lancashire and Yorkshire Bank no longer appears, but on the other hand, it will be seen that as against the figure of £10,000,000 for that bank which disappears, the- increase in Martins' figures is only about £6,000,000. Yhen, however, we come to the big clearing banks. there is a further substantial growth to note, for the year of _ilea* L86;000,000; while if comparison were made with three tears ago, the expansion would be about £76,000,000, not a bad growth for a period supposed to have been characterized by trade depression.. More- over,- the movement must be taken together with the `advance of £22,000,000 in bills, that operation reflecting -another form of the devotion of credit facilities to trade. MONEY AT CALL AND SHORT NOTICE

• Dec: 31st, Dec. 31et, 1926. 1927. 1928.

LOANS AND ADVANCES.

Barclays Bank Lloyds Bank .. .. Midland Bank.. . ; National Provincial Bank Westminster Bank -..

Total ..

District Bank 'Lancashire and York- Dec. 31st, 1926.

£

_ 155,454,705 194,757,519 200,459,993 142,190,250 141,741,479

Dec. 31st, • • • 1927. £ 1.61,867,906 187,798,225 206,487,910 146,715,210 137,054,470

Dec. 31st, 1928.

£ 168,620,475 187,155,085 214,050,972 150,523,520 119,098,900

834,604,036 - 839,923,724 869,448,852

24,188,702.

25,120,405 23,249,695 shire Bank . 9,900,512

. 10,039,268..

*

, Manchester and County

Bank - _ 12,464,118 .12,132,3.1-7._ 10,995,681 Martins Bank 36,702,937 36,572,971 42,600,178 National Brink

I5-,003;430 -1 ,'3b9,400

15,393,877 Union Bank of- -Man- -= • - - . .

cheater .. 11,548,019 10,780,258 9,258,142 Williams Deacon's Bank 18,984229 18,249,923 . - • 17,642,888 Total „ •. -129,692,631 128,254,542 119,140,559 • Now absorbed by Martins Baiik.

BILLS DISCOUNTED.

• Dec. 31st, • • 1926. £ Dec. 31st, • 1927.

£ Dec. 31st, 1928.

Barclays Bank 36,617,279 32,518,234 38,258,570 Lloyds Bank .. .. 47,182,971 62,048,834 49,281,472 Midland Bank - .. 46,744;312 • 49,314,778 63,347,503 National Provincial Bank 35,100,607 38,993,472 43,547,739 Westminster Bank .. - 40,406,456 - 36,889,342 - .38,626,735

Total 206,051,626

209,714,860 ...V31,062,019 , District Sank ; - i.

c And ' York- Dee. 31st, 1926.

. 4,788,582

Dec. 31st, 1927.

,£ . 3,402,14 Dec. 31st, 1928.

£ L146,317 i . shire Bank . . .--.. . _. 3228,317 6,221,102.

'

Manchester and County

Bank• • 865,863 ' 771,310 849,083 Martins Bank .. 2,981,4'79 2,646,294 3,702,147

-National Bank

2,535,048 2,329,697 2,292,965

Union Bank of Man.-

cheater .. - .

-754,596

743,228 619,912 Williams Deacon's Bank . 2,440,903 2,499,629 3,551,272 Total • • . • 17,574,758 15,613,434 16,161,696 * Now absorbed by Martins Bank. RISE IN ACCEPTANCES.

Quite the outstanding feature of the year, however, has been the remarkable increase in banks' Acceptances, which have risen during the year by nearly £100,000,000. One of the leading bankers at the annual meeting explained that some part of the increase in the case of that par- ticular bank must be regarded as recording transactions of an exceptional character, but in the main the great increase in banking acceptances has undoubtedly been due to the simple fact of money rates in London for the second half of last year having been materially below those of New York. This has meant a shifting of the important business of accepting_ bills back again to London, and it is a movement greatly to be welcomed, though at the same time, now that we are once again a free market for gold, it must be reckoned among the factors which have tended. to strain resources during recent months to the point of affecting the sterling exchange. This increase in acceptances was not confined to the Big Five, Glyn Mills, for example, showing not only an increase of over £1,000,000 in deposits, but 'a material expansion both in loans and acceptances.

ACCEPTANCES, ENDORSEMENTS, &C.

Dec. 31st, Dec. 31st, Dec. 31st, ' 1927. 1928. • £ £ £ Barclays Bank • . 12,446,160 12,830,869 24,847,31-7 Lloyds Bank .. 16,950,606 { *5,952,941) • 13,347,012

t37,815,176 "t46-,994,172

Midland Bank..... 37,085,445. 7,4,4,41,144

NitiOhal Bank -9;16002 12;024;7110- 19;563;740

Westminster Bank .. 11,543,630 12,572,869 26,538,040 Total .. 87,172,663 118,194,008 205,758,415 District Bank .. 899,450 1,029,527 2,464,878 Lancashire and -York-. .

shire Bank -- ` .. 143,578 ‘.- 119,689' _ _ t Manchester and County

1 Bank -"- - - - :.,• --387-,851 - 3051850 • - - - 560,02 Martins ..s Bank .. .. 6,078,122 ' . • 6,389;255 - 10,949,041 Union Bank of Man- ■ ' cheater .. .. 818,391 643,163 713,185 Williams Deacon's Bank 1,800,918 1,393,259 1,520,117 Total .. • - 10,181296 9,880,742 18,207,293 103,280 10,078,316 * Acceptances. t Endorsements, guarantees and other obligations. Now absorbed by Martins Bank.

INVESTMENTS.

Dec. 31st, Dec. 31st, Dec. 31st,

- 1926. • 1927. 1928: -E 56,259,936 63,389,700 58,546,192 Barclays Bank 46,455,051 39,936;888 38,108,681 Lloyds Bank .. 38,853,582 35,435,530 • 36,868,07

Midland Bank.. • . . 36,947,304 35,078,615 , 36,975,669

ational Provincial Bank 46,867,674 40,032,750 38,438,974 estminster Bank Total .. 224,383,547 204,373,483 208,938213

14,544,836 14,793,704• 14,786,851

7,590,658 7,580,590 4,215,897 4,207,647 10,421,735 25,104,7%8 15,552,527 15,130218 .2,664,208 2,637,059 5284,671 5,349,677 .; Total • • .. 58,723,967 60,513,332 67,217,560

NoTE.—These figures do not include investments in affiliated *Now -ribeorbed• by 'Martins Bank,

:District Bank Lancashire and York: shire Bank .. .Manchester and County

iMartina Bank 4,065,897 sina Bank National Bank .. 9,349,216 Union Bank of itia•n•-• ••••••• 2,670,101 -1 chaster Bank 5,049,670'. brvEsTmExTs lIYGlIFB. - Refereuez has been made earlier in this article to the growth in deposits, and although in the main that growth has been due to the _circumstances already described, one small contributory. influence has been the slight upward tendency in the holding of investments by the lnkers as a whole. - For some few years the tendency has been downwards, .and a year ago the -figure showed a drop compared with two years previously of nearly E3G,000,000. During the past year, however, there has been an advance in the aggregate holding of investments by the banks of ; about £11,000,000. That I movement, of course, is one which reacts upon deposits, because when -the banks in the aggregate are purchasers of `securities, the result must necessarily be to add to the deposits of their customers.

Previous page

Previous page