Safeguarding Income

[CONTRIBUTED.]

ONE is often asked—what is the best form of personal LIMIT YOUR LIABILITY. _ family with the least possible sacrifice to himself. death. A further stipulation one comes up against in discussing £100 PER ANNUM INCOME POLICY.

and it should be arranged that this burden will not period, the first payment being made at death.

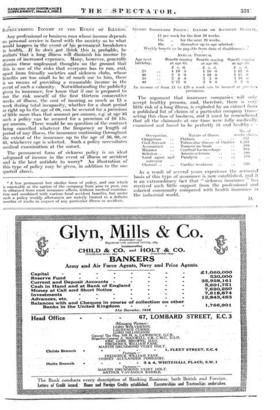

tions suggest that the best type of life policy is one Premium which provides an income at death for a sufficiently Payable 20 years. 15 years. 10 years. lling period as to tide over necessity, i.e. a period by the entry. Years. premium. premium. premium. end of which affairs will have shaped themselves. This £ s. d: -£ s: d. £ s. d. period can only be decided upon with reference to the 25 .. 35 • • 2 9 0 1 19 0 1 9 0 arranged which will provide a definite income for various 40 :. 20 3 10 0 special circumstances of each case, but policies can be 35 .. 25 2 17 0 periods of 10, 15, or 20 years certain. 45 15 6 0 0 3 10 0 INSURE INCOME RATHER THAN CAPITAL. event of illness of over one (in some eases a second) month's Approximate monthly premiums payable up to age 60 only, and date of death, whenever this takes place. 1 Age at over Monthly. Monthly Monthly 4 • 9 0 4 17 0 2 1 0 2 12 0 1 14 0 30 .. 30 2 17 0 2 6 0

SAFEGUARDING rNCONE IN TREE EVENT OF ILLNESS. INCOME

Any professional or business man whose income depends on personal service is faced with the anxiety as to what would happen; in.the event-of :his permanent breakdown in health— if he doel;,n ot...tficnk probable, he realize-Si that -a long illness will diminish his income by reason of increased expenses. Many, however, generally dismiss tlreSe Unpleasant. thoughts on the ground that this is one of the risks that everyone has to run, and, apart from friendly societies and sickness clubs, whose benefits are. too small- to- be of much--use to him, there is no means of providing a reasonable income in the event of such a calamity. Notwithstanding the publicity given to insurance, few know that if one is prepared to run the risk oneself of the first thirteen consecutive weeks of illness, the cost of insuring as much as £5• a week during total incapacity, whether for a short period or right up to the age of 60, can be secured for a premium of little more-than that-amount per annum,, e:g: at age 35 such a policy can be secured for a premium of £6 15s. per annum. There would be no question of the contract being cancelled whatever the frequency or length of period of any illness, the insurance continuing throughout the extent of the insurance up to the age of 50, 60, or 65, whichever age is selected. Such a policy necessitates medical examination at the outset.

The permanent form of sickness policy is an ideal safeguard of income in the event of illness or accident and is the best antidote to worry* An illustration of this type of policy may be given, in addition to the one quoted above.

*A less permanent but similar form of policy, and-one which is renewable at the option of the company from year to year, can be obtained from most insurance offices, without medical examina- tion and combined with various fatal accident benefits, but under such a policy weekly allowances are strictly limited to a definite number of weeks in respect of any particular illness or accident.

SAFEGUARD POLICY : ILLNESS OR ACCIDENT

BENEFIT.

fl per week for the first 26 weeks.

15s. „ for the next 26 weeks.

108. „ thereafter up to age selected.' Weekly benefit to be payable from date of disablement...! _ .

40 2'17 0 2 9 0

An income of froni £1 to f20 a week can be insured at pro nths'

premiums.

The argument that insurance companies will only, accept healthy persons, and, therefore, there is very little risk of a lOng illness, is exploded by an extract from a published list of claims of. a particular company trans- ; acting this class of business; arid it must be remembered' that all the clainiants at one time were fully medically, examined and found to be perfectly lit and healthy

No. of • Nature of illness. weeks clabn.i Phthisis 252 Tubercular disease of bladder 1.263

Timiour do brain .. .. 289 Cerebral haemorrhage " Arterio-sclerosis Paralysis

Cardiac weakness 536

- As a-result of several years experience the actuarial basis of this type of assurance is now established, and it is an extraordinary fact that " sickness insurance " has received such little support from the professional and salaried community compared with health. insurance in the industrial world. ANNUAL -Benefit-ceasing at age 65. £ s. d.

1 19 5 2 4 0 2 9 6 PREMIUM. Benefit ceasing at ago GO.

s. d.

1 16 0 1 19 0 2. 3 0 Age next birthday.

25 30 35 Benefit ceasing at ago 55. £ s. tl. 1 12 G 1 15 0 1 18 I; 2 3 ti Occupation. Clergyman .. Civil Servant .. Accountant .. Minister Solicitor.. .. Land agent and surveyor Chemist .. '183 290• 198

I).

Previous page

Previous page