Investment Notes

By CUSTOS Tannouncement that more deflationarY measures were coming this week had a sharp effect upon an already nervous equity market and the Financial Times index fell over live, points to below 315. This is a very bearish signal for the chartists. As government expenditure is sharply to be reduced, the shares in the build" ing, contracting, heavy electrical and power in' dustries came down on persistent, if small, selling. The support which the equity market used t° have from the unit trust managements is fading away as the public interest dwindles. June re' corded the lowest investment in unit trusts for two and a half years, net sales being £3.2 million against £6.2 million a year earlier. There are, precious few safe groups left for the investor In take refuge in. Perhaps bank shares are the most reasonable, but insurance shares, after their re" cent recovery, are now probably high enough,' That is the impression I get from an excellent and sober review made last week by the Economist. At long last the investor will realise that short-dated government bonds are the best haven. With yields of over 6} per cent they are discounting even a rise in Bank rate.

Retail Store Shares

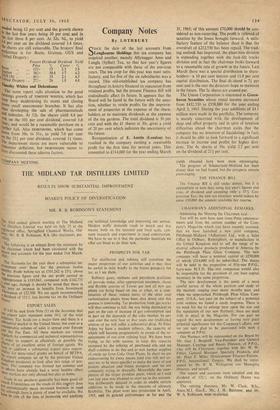

The prices of retail store shares have fallen almost twice as much as industrial shares as 5 whole, partly on the mistaken assumption that the Government was bound to stop the rise In incomes and disinflate consumer demand, partly on the more logical reason that the new cor- poration tax would hit those store shares whose dividends are traditionally covered by a 'via' tively narrow margin of earnings. I have been reading an excellent brokers' report on retail' trade investments which estimates the PO, growth necessary in each company to offset the adverse effect of a corporation tax at 40 Per . cent compared with the average profit growth realised in the past five and three years. The companies which come well out of this test are BOOTS, GRATTAN WAREHOUSES and GUS, While BRITISH HOME STORES, UNITED DRAPERY, WOO e WOR HI and TIMOTHY WHITES are little affected' MARKS AND SPENCER are close runners, the groWIP seeded being 12 per cent and the growth shown In the last five years being 10 per cent and in the last three 8 per cent. At 32s. 9d., to yield 4.4 per cent on the dividend covered 1.4 times, the shares are still vulnerable. The brokers' final Preference is for Boots, Grattan, GUS and United Drapery:

Present Dividend Dividend Yield Price Cover

,,ii°01s % 151- 12 2.3 3.8

pkJrattan 36/- 30.8 1.7 4.2 ) "OS (A) .. 41J- 35 2.1 4.3

United Drapery .. 27/- 26 1.8 4.8 Timothy Whites and Debenhams The same report calls attention to the good earnings growth Of TIMOTHY WHITES, which has been busy modernising its stores and closing down small uneconomic branches. It has also been developing the sale of pharmaceuticals and toiletries. At 12s. the shares yield 4.4 per

antes, on the 101 per cent dividend, covered 1.6 le and would be a reasonable purchase on a

further fall. Also DEBENRAms, which has come down from 38s. to 31s., to yield 7.0 per cent 9,n the 211 per cent dividend, covered 11 times. The department stores are more vulnerable to have deflation, but DEBENHAMS seems to 'lave discounted these adverse factors.

Previous page

Previous page