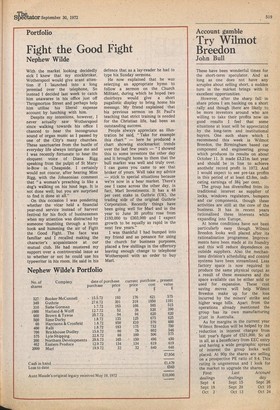

Account gamble

Try Wilmot Breedon

John Bull

These have been wonderful times for the short-term speculator. And as long as one does not have any scruples about selling short, a sudden turn in the market brings with it excellent opportunities.

However, after the sharp fall in share prices I am banking on a short rally and though there are likely to be more investors around who are willing to take their profits now on good results I feel that some situations at least will be appreciated by the long-term and institutional buyers. One such share which I recommend this week is Wilmot Breedon, the Birmingham based car component and engineering group which produces its results on about October 11. It made £3.21m last year and should be in line to achieve anothehr record profit in 1972. And I would expect to see pre-tax profits in this period of at least £3.8m, indicating earnings of 38i per cent.

The group has diversified from its traditional interest as supplier of locks, windows regulators, bumpers and car components, though these activities are still at the core of the business. It has in recent years rationalised these interests while expanding into Europe.

At home conditions have not been particularly easy though Wilmot Breedon looks well placed after its rationalisation programme. improve ments have been made at its foundry and this will reduce dependence on outside suppliers. Also the mechan isms division's scheduling and control systems have been streamlined. Less factory space is naw required to produce the same physical output as a result of these measures and the space available can be either sold or used for expansion. These cost saving moves will help Wilmot Breedon make up for the loss incurred by the miners' strike and higher wage bills. Apart from the operations already mentioned the group has its own manufacturing plant in Australia.

As for margins in the current year Wilmot Breedon will be helped by the , reduction in interest charges from last year's figure of £521,000. So all

in all, as a beneficiary from EEC entry and having a wide geographic spread of interest the group looks well placed. At 90p the shares are selling on a prospective PE ratio of 9.4. This rating is ungenerous and I look for the market to upgrade the shares.

First Last Account dealings dealings day Sept 4 Sept 15 Sept 26 Sept 18 Sept 29 Oct 10 Oct 2 Oct 13 Oct 24

Previous page

Previous page