POLITICO-STATISTICAL DISCLOSURES

. B Y NICHOLAS

DAVENPORT

IE the next Labour Government attempts to plan and direct the national economy, industry by industry, it will have to pass a vote of thanks to Mr. Harold Macmillan for making this possible. For without the improvement in the official statistical ar- moury which the present Chancellor is making it would be hopeless for any gov- ernment seriously to engage in the battle for economic control. Looking back, one marvels at the, impertinence of former Ministers in imposing taxes here and con- trols there without even knowing for cer- tain exactly what wassoing wrong with the different parts of the economy. The ten- dency has been to blame the poor consumer for everything, especially if he is addicted to hire purchase, and to ignore the excessive demands which the Government itself is 'making on the economy. Now most short- term disturbances in the economy are caused by businessmen adding to or run- ning down their stocks, increasing or de- creasing their capital expenditures, two forms of activity which the official statistics in the past have only partially and very belatedly reported. It is this vital gap in the Government's economic information which Mr. Macmillan is trying to bridge and the latest blue book on the National Income and Expenditure .shows that he is achieving some success. For the first time official estimates are given of the net national investment, that is, of the amounts hich should be deducted from gross in- vestment to allow for the using-up of capi- tal resources in the process of production through wear and tear and obsolescence. '1 his is a vital statistic, for no government can be sure that the nation is going uphill or downhill unless it can accurately measure he net addition made each year to its stock of productive capital assets.

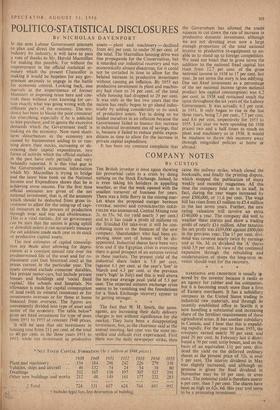

'1 he new estimates of capital consump- tion ai;e thade after allowing for depre- ciation at a constant annual rate over the Predetermined life of the asset and for re- placement cost (not historical cost) at the prices current in the particular year. The assets covered exclude consumer durables, like private motor-cars, but include private houses and buildings and 'social fixed capital,' like schools and hospitals. No allowance is made for capital consumption of land (with its mineral resources) or for investments overseas or for those at home financed from, overseas. The figures are conveniently divided into type of asset and sector of the economy. The table below* gives net fixed investment for type of asset from 1951 to 1955 at constant 1948 prices.

It will be seen that net investment in housing rose from 211 per cent, of the total to 40 per cent. in the three years 1951 to 1953. while net investment in productive

assets — plant and machinery — declined from 461 per cent, to under 30 per cent, of the total. The Macmillan housing drive was fine propaganda for the Conservatives, but it retarqd our industrial recovery and was economically almost disastrous, for it could not be curtailed in time to allow for the belated increase in productive investment without causing an inflation. By 1955 net productive investment in plant and machin- ery had risen to 34 per cent. of the total while housing had dropped to 29 per cent.' It was only in the last two years that the nation has really begun to go ahead indus- trially by adding considerably to its stock of productive assets. Yet in doing so we landed ourselves in an inflation because the Government failed to finance this increase in industrial investment out of savings, that is, because it failed to reduce public expen- ditures in time to allow for the increase in

private capital expenditure. • It has been my constant complaint that the Governibent has allowed the credit squeeze to cut down the rate of increase in productive domestic investment, although we are not devoting even now a large enough proportion of the total national income to productive re-equipment to en- able us to stand up to foreign competition. We need not bdast that in gross terms the addition to the national fixed capital has risen from 12.7 per cent. of the gross national income in 1938 to 17 per cent. last year. In net terms the story is less edifying. Our net fixed investment as a percentage of the net national income (gross national product less capital consumption) was 6.2 per cent. in 1938 and remained much the same throughout the six years of the Labour Government. It was actually 6.3 per cent: in 1951. it only began to rise in the last three years, being 7.3 per cent., 7.7 per cent. and 8.6 per cent. respectively for 1953 to 1955. Last year we were spending (at 1948 prices) two and a half times as much on plant and machinery as in 1938. It would be madness to throw this recovery away through misguided policies at home or abroad.

Previous page

Previous page