Finance Companies By J. W. HUNTRODS F 1NANCE companies operate by

borrowing money and using it to extend credit on legal contract to those wishing to acquire durable goods, which may range from motor-cars and ,machinery to radio and television sets. Until comparatively recently most of the money needed was borrowed from the banks and certain other specialist lending institutions. But because they are no longer permitted to turn to their bankers, and because they are prevented from raising new capital by the Capital Issues Committee, the finance companies have met the growing demand for their services by offering deposit-account facilities to the general public.

It is usual for finance companies to receive a monthly income from instalment payments equivalent to approximately 10 per cent. of the outstanding balances owed by their customers. Furthermore, experience has proved that this level of income is remarkably stable, even in periods of quite severe recession. The volume and relia- bility of instalment income therefore, confers an almost unmatched degree of liquidity on finance houses, making them an ideal outlet for short- term investment. It is usual for reputable finance houses to accept deposits at three or six months' notice of withdrawal. Therefore, since they re- cover about 10 per cent. of their outstanding balances every month, it will be readily seen that they are even less open to accusations of borrow- ing short and lending long than are the building societies and banks.

But what, people may ask, is going to happen if inflation is replaced by deflation, or if the demand for hire purchase is diminished, whether

by government interference or by force of economic circumstances? Past experience seems to indicate pretty conclusively that although the profits of finance companies may decline con- currently with a fall in the level of business activity, they do not incur big losses due to bad debts. The public becomes cautious with the onset of depression, and hesitates to take on new hire- purchase commitments. The effect of this on the finance companies is to produce an excess of income over disbursements in respect of new business, and therefore to reinforce their liquidity. So that although the shortage of new business may reduce profits, and if sufficiently severe or pro- longed may result in operating losses, the con- current strengthening of liquidity increases the capacity to meet obligations to depositors.

Shortages of business due to government inter- ference are likely to be limited in duration and in their impact on the level of business. It is now recognised that the finance companies play an important, perhaps vital, part in sustaining the demand for durable goods; particularly for the products of the motor industry. Hire-purchase controls are employed to help combat inflationary upsurges in the economy, but are never likely to endanger the structure of any well-established finance company. Although short-term setbacks may be looked for, there is good ground for thinking that a great expansion of hire-purchase credit will take place during the next ten or fifteen years.

The investor, however, should exercise some care in choosing a repository for his money. Everything said concerning the inherent strength of hire-purchase finance is dependent on the supposition that companies enjoy the benefit of skilled management, involving both financial expertise and experience of instalment credit. The artificial restraint on the expansion of well-

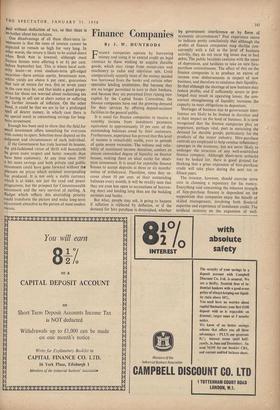

established companies, and especially the restric- tion on new capital issues, has made room for the invasion of the hire-purchase field by some hun- dreds of small new companies; some of indifferent quality. The intending depositor should beware of companies offering higher than average rates of interest, and at the present time should regard with suspicion anything over 81 per cent. for money at three months' notice. Depositors should also insist on seeing a balance sheet before com- mitting their money. Any company not sending a balance sheet on first inquiry should be passed over without further ado.

The figures shown in the balance sheet should also be scrutinised carefully, and investors are re,:ommended to approach cautiously any that show disposal of assets in mortgages or securities, whether quoted or unquoted. As has been so strongly emphasised, hire purchase gains its suit- ability as a repository for short-term funds from its rapidly self-liquidating nature. Advances on mortgage, and investments in securities or sub- sidiaries may not be easily or quickly realisable without loss.

Intending depositors should also be suspicious of those companies which allow the withdrawal of considerable sums on demand. Amounts of up to £250 or so are reasonable, and would be unlikely to embarrass a well-run company, even should events take place leading to a general lack of con- fidence among the investing public, and possibly to an unusually high level of withdrawals. Ostensibly generous withdrawal terms, however, may indicate the company which in certain cir- cumstances could fail to meet its obligations.

Providing a reasonably careful choice is made, the investor who puts his money into hire pur- chase is likely to have no cause to regret is. The long-term outlook for the business is excellent.

Previous page

Previous page