The Unit Trusts

By P. N. WISE

TN the Financial Surveys published by the 'Spectator in July, 1956 and 1957, a very strong case was made out for the Unit Trust Movement, particularly as applied to the needs of the small investor. These articles demonstrated that this type of investor had gained substantially in the inflationary period, with less of the risk that must be taken by the investor in individual equities.

It is therefore not surprising that, with the com- plete v6Ite-face in markets on September 19, 1957, by the sharp increase in the Bank rate to 7 per cent., the unit.trust holders have not suffered as badly as some other investors.

The popularity of this type of investment, through wider publicity, is growing; it is believed that about £75 million is now invested in this country, a third of which is placed through the Bank Insurance Group. So it seems that the Unit Trust Movement is reviving after a slow period. Originated by Municipal and General Securities in 1931, a feature of today's development is some most ingenious schemes, allied to insurance com- pany endowment policies, which protect the capi- tal invested, come snow or sunshine. the latest newcomer to this movement is the Unicorn Trust Savings Account, which got away to a good start in Noyember, 1957. Here, the small investor can open an account with as little as 10s. provided that a minimum of £10 is invested in one year. Similarly, the National Group has a Domestic Investment Savings Plan with a minimum monthly payment of £2. It is impossible to mention in an article of this nature the many attractive 'units'

that are available, but it should be noted that Allied Investors, with their Electrical and Indus- trial Trust, of which over 800,000 units have been sold in the past year; M. and G. Securities, with their Thrift Plan; Bank and Insurance Trust, with `Scotbits' (which can be bought over the counter at all Scottish banks), have gone a long way to- wards providing a very necessary medium of investment for the small investor.

The Stock Exchange has never catered for the small man (or woman), and still does not do so; broker advice for the small investor is totally inadequate. Furthermore, how can his slender resources and inexperience cope with the multi- plicity of tax vouchers, new issue notices, rights and bonus issues and other complex matters? The Unit Trust offers a trouble-free investment for

A.E.G.11 Gross yield

£ s. d.

A.E.G. 7/71-8/6 4 1 3

ALLIED§

Brit. Ind. Flew 1st .. 26/0-27/3 7 15 0 Brit. Ind.Flex 2nd .. 23/2-24/5 7 .19 6 Brit. Ind. Flex 3rd .. 24/7-25/10 7 12 3 Brit. Incl-Flex..4th .. 25/3-26/6* 7 15 9 Metals and Min. 9/5-10/2 8 10 3 Elec. and Ind. Dev. .. 13/2-14/2* 8 . 1 3

BANK INSURANCE Bank-Units 24/3-25/9. 4 18

Insurance-Units. 25/9-27/41* 4 14 107 Investment Trust Units 16/3-17/44 5 2 7 Bank-Insurance-Trust.. .. 23/41-24/101 5 0 9

5 0

"Scotbits:" . • • • 10/9-11/72/01* "Consolbits" 20/71 -2 5 3 2

CALVIN'BULLOCK FUNDS0

Canadian,. Fund - Inc. .. 120/10025/ If 2 9 011 Canadian Inv. Fund 61/44-64/71 4 4 10

Dividend Shares Inc. 18/9-19/41 3 10 011

him, in which experts manage his savings and do all the book and donkey work for him for only a small charge.

This is the type of investment which, under sound management, is going on growing. It is common sense that the greater proportion of savers who can be persuaded into such a move- ment will become a permanent core and part of the backbone of British industry. There is a natural revulsion against the dear money of today, but we must face it, that unless the next Budget provides a current revenue surplus for the whole• of the Government's capital expenditure, then the imposition of the 7 per cent. Bank rate will have been in vain.

In view of the dubious business outlook at home, in theUnited States and Canada, it must be

COMMERCIALI Gross yield

£ s. d.

Universal 2nd 25/0-26/6 6 12 9

Commercial Cons. .. 12/71-13/71* 6 13 10

DILLON WALKERSS

Unicorn Trust .. 9/4-9/10 5 6 5

DOIVIESTICV Dom. Invest. 2nd 7/6-8/0 6 6 0 FIRST PROVINCIAL

Unit "A" 2nd .. .. 12/6-13/6* 6 1 5

Unit "B" 2nd 14/01-15/0 6 18 6 Unit Reserves 2nd 23/0-24/3 6 17 2

KEYSTONE-FUND Keystone Fund of Canada .. 76/0 80/

1VIOORGATE1 Security First 2nd .. 7/0-7/6 6 18 2 Prov. Invests. 2nd .. 6/41-6/10f 6 11 4 100 Secs. 2nd 21/6-23/0 6 16

Inv, Gas and Elec. 2nd 18/9-20/3 7 1 10 Inv. Gent. Tst. 11/44-12/44 6 15 10 Inv. 2nd Genl. 16/6-18/0 6 5 10 good advice, at this stage, to look for safe income rather than capital appreciation. Good yields are now obtainable on fixed-interest stocks. It is worth noting that a year ago the difference be- tween the yield on 24 per cent. Consols and lead- ing industrials was much the same as it is today. If this margin is maintained and we can hope for a reduction in the Bank rate, then the safety-first investment for the next twelve months should be one that is widely spread throughout British industry to include a good leavening of fixed interest and gilt-edged stocks.

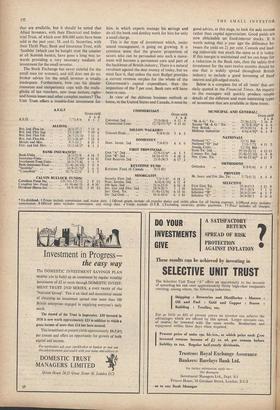

Below is .a complete list of all 'units' that are daily quoted in the Financial Times. An inquiry to the managers will quickly produce simple details of the different and most interesting types of investment that are, available in these trusts.

MUNICIPAL AND GENERALS

Gross yield

s. d.

"M. & G." Tst. 25/8-22 5 16 6

1* 6 4 6

Second "M. & G." Tst. .. 4171-4/101* New British .. 19/0-20/11 6 0 3 Midland Industrial .. 4/61-4/9f* 6 1 9 NATIONALII National "C" .. 13/14 Bid National "D" 2nd .. 7/11-7/71 6 11 5 Amalfi. Ccrts. 12/104 Bid

Scots Tst. 2nd... .. 19/11-20/11 .. 21/41-22/101 6 9 8

.. 14/41-15/4f* 66 1131 151

Century Tst. 2nd ..

Nat. Cons. Tst. ..

ORTHODOM

Orthodox • • .. .. 8/8-9/61 6 5 9

PROVEDT Bk. Insce. and Fin. Shs. Tst. 5/71-6/ If 6 0 4 SELECTIVE First Unit Tst. .. .. 35/9-37/3

Selective "A" .. 19/3-20/9 6756 12 0

Selective "B" .. 20/0-21/6* 011 405 Selective "C" .. .. .. 26/9-28/3

4! Ex-dividend.. t Prices include commission and stamp duty: Offered prices include all transfer duties and yields allow for all buying expenses. § Offered price includes commission,. 11 Offered price includes commission and slimy duty. aYields exclude D.T.R. 11 Excluding' securities profits payments. tt Price includes all charges.

Previous page

Previous page