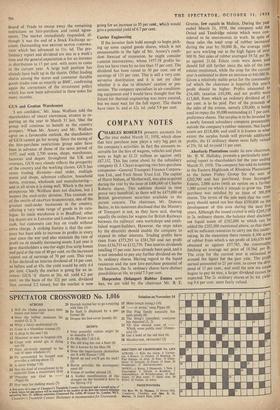

COMPANY NOTES

riHARLES ROBERTS presents accounts for k,the. year ended March 31, 1958, which show that hire purchase now plays a very big part in the company's activities. In fact the amounts re- ceivable for the hire of wagons, vehicles and plant were as high as £1.21 million as against only £87,352. This has come about by the subsidiary company (S. J. Claye) acquiring two hire-purchase companies—General Transport Finance Corpora- tion Ltd., and York Street Trust Ltd. The capital of Hurst Nelson, of Motherwell, was also acquired during the year by the issue of £400,000 of Charles Roberts shares. This addition should in time prove very beneficial, as there will be £475,000 of British government securities available to the parent concern. The chairman, Mr. Duncan Bailey, in his statement disclosed that the Ministry of Transport is not, as they have said, sharing equally the orders for wagons for British Railways between the railways' own workshops and estab- lished wagon-builders. However, the steps taken. by the directors should enable the company to expand its other interests. Trading profits have risen from £373,293 to £381,769 and net profit from £136,733 to £152,759. Two interim dividends totalling 15 per cent. have already been paid, and it is not intended to pay any further dividend on the 5s. ordinary shares. Having regard to the liquid resources and the new hire-purchase potential of the business, the 5s. ordinary shares have distinct possibilities at 10s. to yield 7.5 per cent.

Harpenden (Selangor) Rubber Estates now has, we are told by the chairman Mr. B. E. Greene, few equals in Malaya. During the year ended March 31, 1958, the company sold the

Oxted and Tandridge estates which were con- sidered to be uneconomic to work. In spite of these sales the total crop of rubber increased

during the year by 50,000 lb., the average yield per acre working out at the high figure of over 900 lb. Net sales of rubber averaged 19.7d. per lb. as against 21.6d. Estate costs were down and should fall still farther since the sale of the two estates mentioned, while the crop for the current year is estimated to show an increase at 840,000 lb. Given a relatively stable price for the commoditY (of which the chairman is hopeful) this year's profit should be higher. Profits amounted to £34,400, taxation £10,300, and net profits were £13,868, from which an ordinary dividend of 15 per cent, is to be paid. Part of the proceeds of the sales of the estates, namely £30,000, is being used to repay the 30,000 outstanding £1 7 per cent. preference shares. The surplus is to be invested by a newly formed subsidiary company presumably outside the company's rubber interests. Net liquid assets are £118,400, and until it is known to what extent the surplus funds will provide additional profits, the £1 ordinary shares seem fully valued at 25s. 3d. xd. to yield 11 per cent.

Aberfoyle Plantations under its new chairman, Mr. W. W. Halliday, presents a particularly inter- esting report to shareholders for the year ending March 31, 1958. The company has sold its holding in the Eastern Highlands of Rhodesia Plantations to the James Finlay Group for the sum of. £202,500 and has purchased, from Inyangant Estates, 2,000 acres (with an option on a further 1,000 acres) on which it intends to grow tea. This purchase was satisfied by an issue of 308,898 shares. The terms of the sale were that the com- pany should spend not less than £350,000 on the development of this area during the next five years. Although the issued capital is only £269,110 in 2s. ordinary shares, the balance sheet discloses net liquid assets of £182,000 to which can be added the £202,500 mentioned above, so that there will be sufficient resources to carry out this under- taking. In the meantime there remain 8,100 acres of rubber from which a net profit of £40,670 was obtained as against £57,765, the commodity fetching an average net price of 18.56d. per lb. The crop for the current year is estimated at around the figure for the past year. The profit earned amounted to 21 per cent. to cover the divi- dend of 15 per cent,, and until the new tea estate begins to pay its way, a larger dividend cannot be expected. The 2s. ordinary shares at 3s. xd. yield- ing 9.6 per cent, seem fairly valued.

Previous page

Previous page