Investment Notes

By CUSTOS

("r HE cause of the setback this week was not 1 Mr. Macmillan, but the threat of a break- down in the Common Market negotiations. This makes for great uncertainty, not only in the stock market, but in business generally. A post- ponement of our entry would probably mean a further setback in trade as well as in markets. The low-yielding shares of the merchant banks, which had been looking forward to a great ex- pansion of their financial business, have been particularly weak. Common Market or no, some recent reports show that companies can still make excellent profits at home. HOOVER, for example, reported a rise in profits for the six months ending Tune of nearly 50 per cent. Earn- ings are now running at an annual rate of nearly 80 per cent., compared with 60 per cent. in the corresponding period last year. The mar- ket has expectations of a dividend of at least 35 per cent. as against last year's 25 per cent., so that the 5s. 'A' shares at 32s. 6d. return a potential 5.4 per cent. Gus also pleased the market with a 4 per cent. increase in trading profits and the dividend raised by 2.1 per cent. to 40 per cent. for the year ending March. The 5s. 'A' shares at 57s. 3d. now return 31 per cent. It was perhaps a pity, that a one-for-three scrip issue in 'A' shares was also given, for it is too large to point to an inevitable increase in the next annual dividend rate.

A Placing

A placing of the 5s. shares at 9s. 3d. of COPPERAD, makers of heating, ventilating and air- conditioning equipment, took place last week. At the placing price the shares yield 5.9 per cent. on the forecast dividend of 111 per cent., which is expected to be,covered 2.4 times by earnings for the year to March next. Profits have increased six- fold in the last eight years and there is good reason to believe that in this industry there is still plenty of growth ahead. At the present premium of ls. 3d. over the placing price the shares seem to be a reasonable purchase.

Recovery in Boilers?

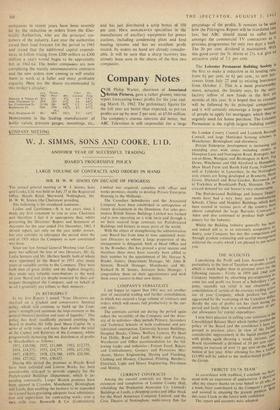

Having referred on a previous occasion to the better prospects of BABCOCK AND WILCOX, I was interested to see a report from a firm of brokers calling attention to the improved outlook of the boiler manufacturers. The profits of these

companies in recent years have been severely hit by the reduction in orders from the Elec- tricity Authorities, who are the principal cus- tomers of the industry. Last year the authorities raked their load forecast for the period to 1965 and stated that the additional capital expendi- tures to follow (rising from £200 million to £300 million a year) would begin to be appreciably felt in 1963-64. The boiler companies are now completing the mainly unremunerative contracts and the new orders now coming in will enable them to work at a fuller and more profitable capacity. Here are the shares recommended in this broker's circular:

Lots Presem rimes

1962 Price 01 V. Covered Yield

Babcock & 3% ik:ox 20/3 3I/- 9% 1.6 5.8% John Thompson 5/- 10/6 1513 157„ 1.6 4.8%

Int. Combustion 5/- 21/101 24/- 30% 1.2 5,1 %

Hoplonsons 54/6 57/6 131% 2.2 4.7% ex.c. Hick Hargreaves £1 68/- 68/6 224% 2.5 6.6%

HOPKINSONS is the leading manufacturer of boiler valves, pressure gauges, mountings, etc., and has just distributed a scrip bonus of 100 per cent. HICK HARGREAVES specialises in the manufacture of ancillary equipment for power stations, including condensing plant and feed heating systems and has an excellent profit record. Its orders on hand are already consider- able. It will be seen that a sharp recovery has already been seen in the shares of the first two companies.

Previous page

Previous page