Investment Notes

By CUSTOS

rr HE setback in markets is no reason to sell 1 good equity shares at the present time. At the same time there is no reason to buy them except when they fall to really attractive prices. The Callaghan credit squeeze affects some sec- tions of the economy more than others. For example, the motor trade is passing through a difficult time, sales of new and used motor-cars being respectively 12 per cent and 9 per cent down in September. This will affect associated trades, as the interim report of SHEEPBRIDGE indicated. The cut-back in private housebuilding has also hit ALLIED IRONFOUNDERS, but the coming rise in council building foreshadowed by the Minister of Housing should bring some recovery in this case. There is clearly no general recession of the Selwyn Lloyd type sufficient to cause widespread selling of equity shares. This is borne out by the interim report of ici. Sales

are well up but profit margins are down because old plant has had to be worked to the limit to satisfy demand. ICI shares at 42s. 9d. are near the bottom of the year and yield 5.8 per cent on a 121 per cent dividend not too well covered.

Metropolitan Estates and Property

The chairman of METROPOLITAN ESTATES AND PROPERTY, Mr. C. E. M. Hardie, was frank and illuminating about the difficulties facing property companies under the new taxation. As they usually distribute their net income in full they are badly hit, for, after paying corporation tax, they will have to pay the full rate of income tax on the profits they distribute. There are various ways of mitigating this onerous taxation. Mr. Hardie rightly rejected the device of imposing a holding company on top with a large measure of loan capital, which would simply be tax- dodging. He has also rejected (a) liquidation as impracticable for a company of this large size— the very few companies which have attempted this have run into difficulties—and (b) the reduc- tion of capital in part by the disposal 01 realisable assets (this has disadvantages by way of capital gains tax and upsets the borrowing potential of the group). But he is still consider- ing a merger with another group which would enable the capital structure to be reorganised and attract less tax. In the meantime he remains convinced that the best way out for a well- managed property company is to go on expand- ing its investments and pushing up its income. This he has been doing so successfully—he has a call on Prudential finance—that he has put up the dividend by 1 per cent and hopes to do so again in 1966-67. Apart from new invest- ments reversions alone are worth £200,000 a year in extra income. Shareholders can happily retain their holdings now priced at Ils. 6d. to yield 5 per cent on the higher dividend of 111 per cent. But l hope Mr. Hardie will not rule out the possibility of diversification. When he is expanding his investments he might con- sider investing outside the property market.

Oil Shares

Oil shares were flat on CONTINENTAL OIL'S de- cision to stop drilling on their first test well in the North Sea. A leading firm of brokers points out the relative attractiveness of BURMAH OIL, which has only an indirect interest in North Sea gas. Two thirds of Burmah's dividend-paying capacity are derived from its holdings of BP (large) and SHELL. Thanks to the over-spill clause BP should be able to maintain its dividend for the time, but I think will probably make a small cut from 19.8 per cent gross to 171 per cent gross. Shell may have to cut from a gross equivalent of 51 per cent to 40 per cent. These dividends will be `franked' income in the hands of Burmah. Its trading income from the Indian continent will be down this year and it will probably lose the small tax-free capital return from BP. All told this will probably reduce the Burmah gross equivalent dividend from 22 per cent to 174 per cent. At 54s. the shares would then yield 6.5 per cent against 5.8 per cent for BP and 5.8 per cent for Shell.

Previous page

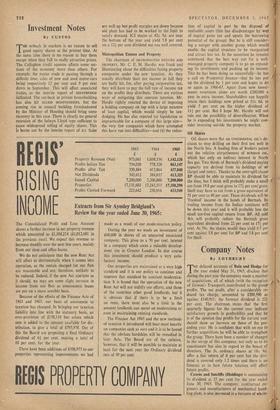

Previous page