Battle for savings

PORTFOLIO JOHN BULL

My first task this New Year is to sell my holding of War Loan at a loss of about £100. I have attended every false dawn in the gilt- edged market since the first business day after devaluation. And I would continue to hold the stock if I thought that there would be no more international currency crises during 1969; if I thought that the fast pace of inflation in 1968 was unlikely to be repeated and if. I thought the widespread disillusionment with government stocks could be eliminated by a few good sets of trade figures. But I don't.

I start 1969, therefore, with roughly £2,000 of cash in hand out of a portfolio worth over £7,000 gross, which is a high level of liquidity. Indeed, as I believe that the equity market will move sideways for the next few months, I have too much cash and I shall buy good shares when I find them. First, thought some analysis of the forces which determine the general direction of the market. And as it is a market, a supply-and-demand classification is useful.

The supply of equities, which may have shrunk in 1965, stood still in 1966 and 1967 and enlarged slightly in 1968, could, I suspect, expand significantly in 1969. Capital gains tax, which has locked so many investors into stocks which they would otherwise have sold, is not quite the inhibiting force which it was. Part of its effect has always been psychological, a determination not to pay the tax rather than a cool assessment of whether the likely profit on a particular switch amounted to more than the resulting tax liability. Much more impor- tant is the way in which industry has turned to the equity market for finance once again. Even allowing for the extra tax bill, rights issues seem much cheaper than loan issues (which now have to carry an 81 per cent or 9 per cent coupon to succeed). At the same time there is a steady stream of companies seeking a public quotation. So on both these counts, the supply of equities is expanding. Only the great spate of mergers and takeovers is work- ing the other way as equities are swapped for packages containing loan stock as well as ordinary shares.

The question is, therefore, whether the de- mand for equities is expanding as fast as the supply. One important determinant is not likely to be so potent this year—the course of company profits. Rising earnings and dividends put people into the market, a falling trend line pushes them out again. In 1968 some very big increases in profits were achieved Oct plus 50 per cent). I do not think that we will see a repeat in 1969.

On the other hand, inflation, which frightens people out of cash and fixed-interest securities (see gilts) into refrigerators, cars and ordinary shares, could very easily be as sharp this year as it was last. That is to say, the flight from money goes on.

Finally, one must reckon up the effectiveness of unit trusts and insurance companies in getting new classes of people to put their money into equities. New groups are entering this field all the time. Last weekend's papers were full of advertisements placed by Schroders to promote its new unit trust. The Prudential and the Pearl Assurance companies joined the ranks about three months ago. Look round any railway station and see how many posters sing out the merits of a particular financial institution. The truth is that a major battle for savings is just beginning, a development which I read as bullish for equities. There is oppo- sition, of course. The Government is known to be working on plans for beefing up the image of the national savings movement. And some sort of contractual savings scheme seems a certainty for the next budget. All the same, the demand for equities seems likely to be sub- stantially enlarged over the coming months.

Thtts when I forecast that the equity market will move sideways over the coming months (Financial Times index between 470 and 520) I am putting forward a conservative opinion.

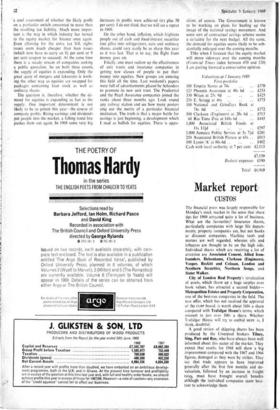

Valuations at 1 January 1969 First portfolio 100 Empire Stores at 74s - £370 125 Phoenix Assurance at 40s 6d • • £253 330 Witan at 25s 9d . • £425 250 E. Scragg at 46s • • £575 100 National and Grindlays Bank at 74s 6d • • £372 500 Clarkson (Engineers) at 20s 6d • • £513 60 Rio Tinto Zinc at 148s 6d .. • • £445 1,000 Associated British Foods at lls 110 £597 1,000 Jamaica Public Service at 5s 7td £281 250 Associated British Picture at 65s .. £813 100 Lyons 'A' at 80s 6d £402 Cash with local authority at 7 per cent £2,113 £7,159 Deduct: expenses £190 Total £6,969

Previous page

Previous page