Portfolio

On a spending spree

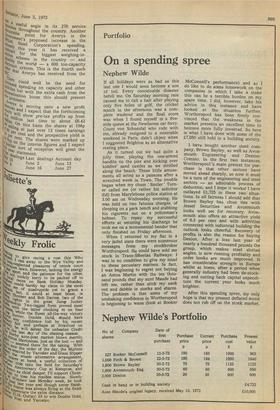

Nephew Wilde

If all holidays were as bad as this last one I would soon become a son of toil. Every conceivable disaster befell me. On Saturday morning rain caused me to call a halt after playing only five holes of golf, the cricket match in the afternoon was a complete washout and the final score was when I found myself in a fivemile queue at the Newhaven car ferry. Count von Schneidal who rode with me, already resigned to a miserable weekend in Paris, didn't object when I suggested Brighton as an alternative resting place. As it turned out we had quite a jolly time, playing the one-armed bandits on the pier and kicking over kiddies' sand castles as we strolled along the beach. These little amusements all acted as a panacea after a wretched week in Town. The trouble began when my chum ' Smiler ' Turner called me (or rather his solicitor did) from Marylebone police station at 3.00 am on Wednesday morning. He was held on two fatuous charges, of sleeping on a park bench and stubbing his cigarette out on a policeman's helmet. To repay my successful efforts at securing his discharge he took me on a monumental bender that only finished on Friday afternoon. When I returned to my flat in a very jaded state there were numerous messages from my stockbroker Wortherspool. He could have sold me stock in Trans-Siberian Railways: I was in no condition to give my mind to these pecuniary matters. In fact, I was beginning to regret not buying an Aston Martin with the ten thousand pounds that my aunt Maude had left me, rather than stick my neck out and dabble in stocks and shares. The problem is that some of my unshaking confidence in Wortherspool is beginning to wane (look at Booker McConnell's performance) and as I do like to do some homework on the companies in which I take a stake this can be a terrible burden on my spare time. I did, however, take his advice in this instance and have looked at the situation further. Wortherspool has been firmly convinced that the weakness in the market presents an excellent time to become more fully invested. So here is what I have done with some of the £7,050 still held in a building society.

I have bought another steel company, Brown Bayley, as well as Avonmouth Engineering and DexionComino. In the first two instances, Wortherspool 's main pretext for purchase is that other sectors have moved ahead sharply, so now it must be a turn of the engineering and steel sectors — an admirable process of deduction, and I hope it works! I have outlayed £1,725 in these two situations. In all fairness I should add that Brown Bayley has close ties with Jessel Securities and Avonmouth looks well set for recovery. Avonmouth also offers an attractive yield of 6.3 per cent and with activities connected with industrial building the outlook looks cheerful. Recovery of profits is also the reason for buying Dexion. After a loss last year of nearly a hundred thousand pounds the group, which makes steel slotted angles, is now running profitably and order books are much improved. It has considerable strength in Europe whilst at home, after a period when generally industry had been de-stocking and cutting back capital expenditure the current year looks much brighter.

After this spending spree, my only hope is that my present deflated mood does not rub off on the stock market.

Previous page

Previous page