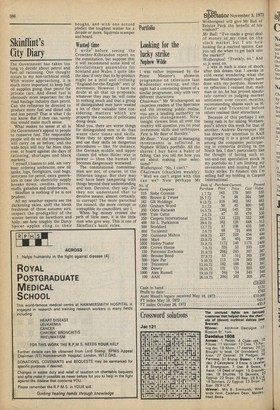

Portfolio

Looking for the lucky strike

Nephew Wilde

I was rather impressed by the Prime Minister's phone-in programme on television last Wednesday evening, and that night had a convincing dream of a similar programme, only with very different characters: Chairman:" Mr Wotherspool as countless readers of The Spectator and the investing public realise, you are a leading authority on portfolio management. Now, tonight viewers from all over the country will question you on your investment skills and techniques. First is Mr Bear of Burnley."

Mr Bear: "Your skill in managing investments is reflected in Nephew Wilde's portfolio. All the shares I buy have a habit of falling. Can you tell me how you set about making your selections?"

Wotherspool: "No, I can't."

Chairman (chuckles weakly): "Well we can't argue with that can we? Now perhaps Mr

Wotherspool will give Mr Bull of Belsize Park the benefit of his wisdom?"

Mr Bull: "I've made a great deal of money in ,rny time On the

stock market but I am now looking for a marked upturn. Can you tell me when to get back into

the market?"

Wotherspool: "Frankly, no." And

so it went on. 1 was in such a state of shock after this dream that I awoke in cold sweat wondering what the madman Wotherspool might have done with my portfolio. However on reflection I realised that, madman or no, he has proved absolutely correct in judging market sentiment over recent months, recommending shares such as H. Foster and Tricentrol before others realised their attractions.

Because of this perhaps I am being rash in for saking Wotherspool's advice this week for that of another, Andrew Davenport. He has drawn my attention to AAH suggesting it is a good gamble among the companies participating in consortia drilling in the North Sea. I don't particularly like the thought of having such an out-and-out speculative stock in my portfolio so I am limiting my investment and hoping for the lucky strike. To finance this I'm selling half my holding in Carpets International.

Previous page

Previous page