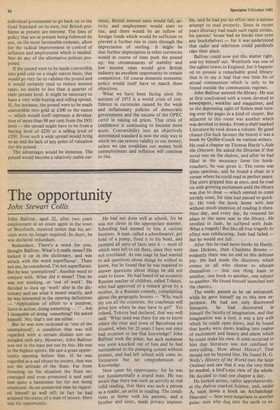

Gold to the rescue?

William Rees-Mogg

No economic policy which does not attack both unemployment and inflation is now worth considering. With unemployment at the 3 million mark, it is obviously necessary to take measures which will reduce it. But inflation not only remains at a dangerously high level, but has at least helped to cause the unemployment. Therefore, a policy of attacking unemployment which is itself inflationary can actually lead to higher unemployment.

There are two reasons why inflation causes unemployment. The first is that price increases have a deflationary effect on economic acitivity. When prices are put up, fewer goods are sold and therefore it is the nature of rising prices to create unemployMent. The second is that inflation naturally leads to high interest rates. This has long been observed and there is a very relevant quotation to be made from Keynes's tract on monetary reform (1923): 'When the public take alarm faster than they can change their habits, and, in their efforts to avoid loss, run down the amount of real resources, which they hold in the form of money, below the working minimum, seeking to supply their daily needs for cash by borrowing, they get Penalised, as in Germany in 1923, by prodigious rates of money-interest. The rates rise, as we have seen in the previous chapter, until the rate of interest on money equals or exceeds the anticipated rate of the depreciation of money. Indeed it is always likely, when money is rapidly depreciating, that there will be recurrent periods of scarcity of currency, because the public, in their anxiety not to hold too much money, will fail to provide themselves even with the minimum which they will require in practice.'

In the early stages of an inflation, when the rates of price increase are low, these effects are more than offset by the increase in the supply of money and by the encouragement to business of the expectation of profit by the rise in the value of stocks. In the later stages of inflation, it is normal for the real value of the money supply to fall. In August 1923, the real purchasing power of the whole German note issue had fallen by approximately 98.8 per cent from the level in December 1920, despite the enormous increase in the number of notes issued. This contraction in the real value of the money supply inevitably reduced the real level of activity in the economy. The causes of world recessions, such as the present one, are always complex, but a major factor is the relationship between the level of the rate of interest and the level of Profitability in business. Investment will only be made if there is an expectation that the profit from the investment will be higher than the cost of financing the investment over its lifetime.

When normal interest rates are extremely high businessmen do not expect to be able to make a profit by borrowing money. They may be forced to borrow money in order to keep their existing businesses going, but they will be very reluctant to borrow in order to make speculative expansions of their businesses. As investment is necessary to maintain full employment, high interest rates cause unemployment by discouraging investment. The present level of world interest rates, particularly in Britain and the United States, does in fact make it unprofitable to invest, and makes high unemployment inevitable.

It is no good, for reasons which were first explained by John Locke in the early 1690s, to try to depress the rate of interest artificially. Any measures to reduce the rate of interest must be the real measures which operate through the market and not artificial measures which operate against the market.

The first real measure that is open to a Government is to adopt a rational rule for its own budget policy and to stick to it. There is no reason why governments should not borrow in order to finance productive capital investment. There is every reason why governments should not borrow in order to finance their current expenditure or transfer payments. It is almost inevitable that such borrowings will both push up the rate of interest and therefore damage business investment and, because they are seldom fully funded they will tend to increase the rate of inflation of the money supply.

We do not need to invent any new rules, though we do need to bring back and improve the rules that used to exist. The division between above the line and below the line expenditure in the budget should be revived and all current expenditure should be covered by taxation. The Government ought to go back to the rule of a balanced budget; they should put capital expenditure including the investment but not the losses of public sector industry below the line. That would give a reasonable future expectation for the requirements of government finance and would allow the market to foresee what calls the Government would be likely to make upon the savings of the community. This in itself would be helpful, but it would not be anything like sufficient to bring down interest rates to the point which is required. Interest rates now reflect the high expectations of inflation and a general decline in confidence in paper currencies. The decline in gilt-edged and bond markets shows that fewer and fewer people are prepared to hold currencies for the long term. As most currencies are at a significant risk of hyper-inflation, long-term investment in this rubbishy money has indeed become very foolish.

Apart from inflation itself, the fluctuations in the floating exchange market have helped to erode confidence in all currencies. The chance of a speculative profit by holding a currency does not counterbalance the fear of future loss. The pound has gone in a few months from $2.40 to below $1.80. What a way to encourage speculation and destroy confidence.

It is not merely coincidence that the period of convertible fixed rate currencies was a time of lower interest rates; it is unlikely that long-term interest rates can be restored to reasonable levels unless the world returns to a fixed rate system as well as to balanced budgets.

The problem is that the currencies of the world have deteriorated so much in quality and confidence that to make one type of paper convertible into another type of paper, when both are of low grade, does not add much to confidence in either. You cannot validate pig by pork. You cannot make people trust a lie by making it fully convertible into a fraud.

To get low interest rates, the world will therefore have to restore convertibility into gold at a fixed price. The interest rates on an instrument convertible into gold would be very low. The short-term interest rates on a currency that is convertible into gold at a fixed price would be unlikely to be over 2 per cent.

The ideal course would be to have another international conference on the model of Bretton Woods and reach international agreement on a new exchange system with a strengthened International Monetary Fund and gold convertibility for all major currencies at a fixed rate. Despite the interest in gold in Washington, there is no chance of obtaining such agreements in time to stop British unemployment from rising still further, or in time to do the present Government any good.

It is obviously far more difficult for an individual government to go back on to the Gold Standard on its own, but British problems at present are extreme. The lines of policy that are at present being followed do not, on the most favourable estimate, allow for the radical improvement in control of inflation and employment which is needed. Nor do any of the alternative policies proposed.

If the pound were to be made convertible into gold coin on a single nation basis, that would go very far to validate the pound and it would certainly tend to reduce interest rates, no doubt to less than a quarter of their present level. It might be necessary to have a very wide buying and selling spread. If, for instance, the pound were to be made convertible into gold at £300 to the ounce — which would itself represent a devaluation of more than 98 per cent from the 1931 level — the spread might have to be from a buying level of £250 to a selling level of £350. Even such a wide spread would bring to an end the lack of any point of' valuation for the pound.

The advantages would be immense. The pound would become a relatively stable cur rency, British interest rates would fall, activity and employment would start to rise, and there would be an inflow of foreign funds which would be sufficient to prevent a further rise in costs through the depreciation of sterling. It might be that further depreciation in other currencies would in course of time push the pound up, but circumstances of stability and low interest rates would give British industry an excellent opportunity to remain competitive. Of course domestic economic policy would itself have to match these objectives.

What we have been facing since the autumn of 1973 is a world crisis of confidence in currencies caused by the weak and inflationary policies of democratic governments and the success of the OPEC cartel in raising oil prices. That crisis of confidence is continuing to become more acute. Convertibility into an objectively determined standard is now the only way in which we can restore validity to our money; unless we can revalidate our money both unemployment and inflation will continue to rise.

Previous page

Previous page