A Better Year for the Banks

Rise in Advances—Higher Earnings

THE experience of British banking in 1937 confirmed two theories which have long been cherished in Lombard Street : first, that in the later stages of a general business recovery there is an increased demand for bank accommodation, and, second, that banking profits are closely correlated with the level of advances. If we survey the " key " items in the banking set-up at the end of 1936 and compare them with the corresponding figures at the end of 1937 several tendencies at once become apparent. It is noticeable, in the first place, that deposits, although increased, were only very triflingly higher than in 1936, at least on the basis of year-end com- parisons. The increase last year was only about per cent., whereas in the 1935-36 period the rise was over 8 per cent. Similarly, the banks' cash holdings were notably stable in 1937, whereas they expanded by about 5 per cent. in the preceding year. The impression one gathers is that 1937 witnessed a definite slowing down in the rate of expansion of the credit basis.

THE BASIS OF BANK CASH.

Now the determinant of the banks' cash, and ultimately of their deposits, is the level of bankers' deposits at -the Bank of England. To compare this item in the Bank of England's weekly return at specific dates in two consecutive years may easily be misleading as the figures are subject to variations from many causes, but it does seem that the authorities at Whitehall and Threadneedle Street took the view last year that though the credit base should not be depleted, there was no need for any further enlargement. One significant fact was the decision last November to provide for the Christinas expansion in the active note circulation by means of a temporary increase of £20,000,000 in the fiduciary note issue.

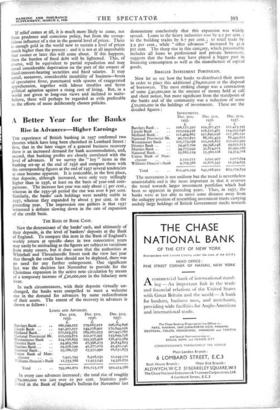

In such circumstances, with their deposits virtually un- changed, the banks were compelled to meet a welcome rise in the demand for advances by some redistribution of their assets. The extent of the recovery in advances is shown as follows :

LOANS AND ADVANCES.

Dec. 31st, 1935. Dec. 31st, 1936. Dec. 31st,

1937.

Barclayi Bank . . , , 160,549,222 179,665,011 196,264,896 Lloyds Bank .. 141,307,257 149,278,901 170,844,026 Midland Bank.. 177,023,372 189,265,053 207,947,787 National Provincial -Bk. 112,059,872 122,077,391 133,699,728 Westminster Bank ..

114,756,893

125,336,406 136,405,289 District Bank .. 24,963,760

27,398,273

30,834,823 Martins Bank .. 29,508,599

41,277,079

42,420,141 National Bank.. .. 15,186,137

15,551,990

16,631,853 17nion Bank of Man- chester

7,951,792

8,918,032

10,049,171

V'ilharns Deacon's Bank 11,755,768

11,955,042

14,356,872 Total . . • • 795,062,672 870,723,178

959,454,586 In every case advances increased ; the total rise of roughly 89,000,000 was just over io per cent. Statistics pub- .'shed in the Bank of England's bulletin for November last demonstrate conclusively that this expansion was widely spread. Loans to the heavy industries rose by 9.2 per cent. ; to the building trades by 6.7 per cent. ; to retail trade by 3.9 per cent., while " other advances " increased by 41.9 per cent. The sharp rise in this category, which presumably includes all loans to professional and private borrowers, suggests that the banks may have played a bigger part in financing consumption as well as the manufacture of capi:al goods.

SMALLER INVESTMENT PORTFOLIOS.

Now let us see how the banks re-distributed their assets in order to place this additional £89,000,oco at the disposal of borrowers. The most striking change was a contraction of some L40,000,000 in the amount of money held at call and short notice, but more significant from the standpoint of the banks and of the community was a reduction of some The movement is not uniform but the trend is nevertheless unmistakable and is the more important in that it reverses the trend towards larger investment portfolios which had been so apparent in preceding years. Thus, in 1937,- the banks were at last able to move some distance away from the unhappy position of resembling investment trusts carrying unduly large holdings of British Government stocks towards £20,000,000 in the holdings of investments. These are the detailed figures :

INVESTMENTS.

Dec. 31st, Dec. 31st, Dec. 31st, 1935. 1936. 1937-

Barclays Bank .. 106,127,320 109,367,472 102,423,395 Lloyds Bank .. 107,029,256 116,127,481 114,002,646 Midland Bank.. 111,464,862 127,892,038 117,386,191 National Provincial Bk.

90,727,857

88,262,433 88,443,622 Westminster Bank .. 105,173,036 111,056,812 112,012,995 District Bank

29,417,700 29,398,248

29,621,613 Martins Bank .. 34,773,942 32,814,071 31,392,280 National Bank.. .. 15,882,119 15,380,108 14,314,768 Union Bank of Man- chester ..

2,110,721 2,091,907

2,077,694

Williams Deacon's Bank

9,703,386

12,878,342 11,504,635

Total .. 612,410,199

645,268,9,2 623,179,839 their more normal—and more remunerative—function of xtending short-term credit to industry.

LOWER BILL HOLDINGS.

Another item which the banks allowed to run down last year so as to make room for additional loans was the holding of bills. This consists nowadays of substantial holdings of Treasury Bills as well as commercial paper and there is no reliable means of telling, for the banks as a whole, what proportion the one type bears to the other. It is surprising, all the same, that during a period when French holdings of Treasury Bills probably declined, the British banks were able to contract their aggregate portfolios of bills by some £3o,000,000 without producing any marked hardening in average discount rates. These are the details of the banks' bill holdings :

Dec. 31st,

1935

Dec. 31st, 16 6 Dec. 31st,

.1937 Barclays Bank .. • • 60,695,872 59,248,252 43,604,135

Lloyds Bank ..

63,377,093

45,070,460 43,017,115 Midland Bank.. .. 69,264,993

74,413,998

83,158,554 National Provincial Bk. 40,039,944 44,190,103

35,490,435

Westminster Bank

43,929,070

44,741,280 31,781,304 District Bank .. 8,113,319

6,533,395

5,479,737 Martins Bank .. 1,325,100 1,284,450 1,290,443 National Bank.. ..

5,629,377 1,549,675

1,490,680 Union Bank of Man- chester .. 316,458

360,933

345,327 Williams Deacon's Bank 2,350,192 2,499,609 2,085,549 Total 291,041,378 279,892,155

247,739,279 It is thus apparent that, broadly speaking, the banks met a considerable increase in the demand for loans in 1937 by drawing off funds from money at call, investments and bills. The influence on the set-up of the banks' assets and liabilities is measured by certain marked changes over the year in the ratios which are the key to the banking position. The ratio of cash to deposits was scarcely altered at a fraction over the conventional ro per cent. but the advances ratio increased from just under 4o per cent. to about 43 per cent, Now this is still substantially below the so to 55 per cent...average with which we were familiar in 1928-29, and even if invest- ments and advances are taken together as an aggregate proportion of deposits the combined figure of just under 70 per cent. does not seem excessive. The maximum ratio beyond which it is believed the banks do not choose to increase their total commitments in these two categories is 75 per cent. of deposits. The inference must be, therefore, that even if the credit basis is not expanded by official policy, the banks still have scope forincreasing their advances moder- ately without being forced to cut down their gilt-edged holdings.

• BETTER EARNINGS.

Few people can have expected that last year would bring an all-round increase in banking dividends and, with one or two exceptions, the previous year's rates were maintained. The really satisfactory feature is that, considered collectively, the banks' earnings were the highest since 1929. The "true " profits of the banks may differ, of course, from the pub- lished figures which are always subject to inner reserve policy, but in view of the uncertainties of the business out- look it is reasonable to assume that the disclosed profits for 1937 were struck at least as conservatively as those of 1936. On this assumption and " grossing up " the figures so as to allow for income-tax and N.D.C. provision, it appears that earnings rose. last year by about 11 per cent. The main source of this improvement was the swing-over of resources, already described, from the relatively less remunerative categories of money at call, bills and invest- ments, into the more remunerative channel of advances. Average figures during the year rather than year-end com- parisons provide the best guide to the banks' experience in this respect, and 'they confirm that the trend towards larger advances operated throughout the year. One other important tactor was also at work making for higher earnings and that was a happier experience in the matter of bad debts. The course of business in 1937 was not such as to create any new crop of bad debts, while recovery in many branches of Industry, such as cotton textiles, heavy engineering and ship- building, must have caused much rejoicing in and around Lombard Street at the repayment of many a loan which had previously been written off out of profits, although not

BILIS DISCOUNTED.

Previous page

Previous page