Company Notes

BROWN BAYLEY STEELS LTD. suffered as other companies in this field by a consider- able decline in orders; consequently the trading profit for 1961 fell to £702,131 against £1,079,072 for 1960. Higher wages and costs aggravated the situation and although the tax charge was less, the net profit fell from £600,962 to £459,543. Itowever, the 16 per cent. maintained dividend is adequately covered by earnings of 53.2 per cent. The company is committed to a capital scheme of about £2 million, over the next three ar four yeais, which can be met from its own resources. The 10s. shares at 32s. yield 5.1 per cent.

Hoffman Manufacturing, as manufacturers of ;steel ball and roller bearings, have a better story to tell, as pre-tax profits rose to £1,893,412 and

'although the net profit was lower at £942,661 ,against £1,022,675, there is excellent cover of ;76.9 per cent. for the maintained dividend of 120.5 per cent. This company also has planned -.;ca pital expenditure for £836,000 with adequate :'net quick assets of over £2 million to take care of it. The 5s. shares at 35s. 6d. yield 2.9 per cent.

.\

frilere is no doubt that the dividend would have been increased had it not been for the Chancel- 1or's plea for dividend restraint.

'Both companies are controlled by the Brown Bayley Group, whose chairman is Mr. J. W. Garton.

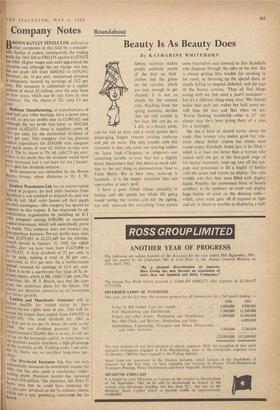

cratton Warehouses Ltd. has an uninterrupted record of progress. Its mail order business from Bradford is not confined to dispatch by post but also by rail. Mail order houses sell their goods on their catalogues—this company has spared no expense in this respect. It has improved its ad- ministrative organisation by installing an ICT 1301 computer costing £190,000; an expensive al')ital investment, which will undoubtedly prove its worth. This company does not transact any hire-purchase business. Pre-tax profits have risen from £2,879,881 to £3,221,449 for the thirteen- month period to January 31, 1962, for which Profits after tax have risen from £1,675,000 to L1,792,835. A final dividend of 25 per cent. is to be paid, making a total of 38 per cent., equivalent to 35.1 per cent. for .a twelve-month period--covered by earnings of 61.9 per cent. There is to be a one-for-ten free issue of 5s. or- dinary shares, which at 80s. yield 2.2 per cent. The chairman, Mr. W. J. Roach, says that the com- pany has ambitious plans for the future. The shares are therefore attractive as an investment for future growth.

London and Manchester Assurance will in ifuture qualify

for trustee status by their eleven-for-ten rights issue at par. This will in- crease the issued share capital from £493,992 to i1i037,383. The total dividend for 1961 is -) '.'s. 81d. net of tax per 5s, share, the same as for 160, The net dividend payment for 1962 should exceed £320,000, that is to say, Is. 6d. net 0.f tax on the increased capital,'or even more,- as the directors usually distribute a high percentage ,o.f the available profit. Yielding under 2 per cent., I?c 5s. shares are an excellent long-term our- chase, The Provincial Insurance Co. has not only substantially increased its investment income for v.?.1., but has also made a satisfactory under- writing profit. profit. Premium income has increased Lseo.ver £10 million. The chairman, Mr. Peter F. I, j-7, Scott, says that. he could have increased the ' -'Ii Per cent. dividend on the 5s. ordinary shares, '411 eh are a very promising investment for the . future.

Previous page

Previous page