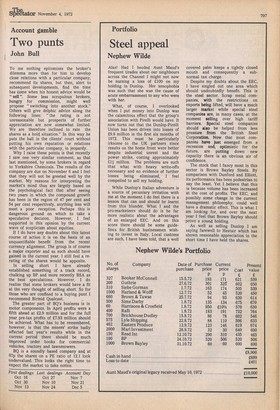

Portfolio

Steel appeal

Nephew Wilde

Alas! Had I heeded Aunt Maud's frequent tirades about our neighbours across the Channel I might not now be nursing a loss of £100 on my holding in Dunlop. Her xenophobia was such that she was the cause of acute embarrassment to any who were with her.

What, of course, I overlooked when I put money into Dunlop was the calamitous effect that the group's association with Pirelli would have. It now turns out that the Dunlop-Pirelli Union has been driven into losses of £9.8 million in the first six months of 1972. This must be particularly irksome to the UK partners since results on the home front were better despite industrial unrest and the power strike, costing approximately £11 million. The problems are such that what with heavy write-offs necessary and no evidence of further losses being eliminated, I feel compelled to sell my holding.

While Dunlop's Italian adventure is a source of pecuniary irritation with me at the moment I do feel there is a lesson that can and should be learnt from this blunder. What I and the pro-marketeers should do is be far more realistic about the advantages of an enlarged EEC. And on this score there should be some guidelines for British businessmen wishing to invest in Italy. Local customs are such, I have been told, that a well covered palm keeps a tightly closed mouth and consequently a subnormal tax charge.

Despite my doubts about the EEC, I have singled out one area which should undoubtedly benefit. This is the steel sector. Scrap metal companies, with the restrictions on exports being lifted, will have a much larger market while special steel companies are, in many cases, at the moment selling over high tariff barriers. Special steel companies should also be helped from •less pressure from the British Steel Corporation. Now that most companies have just emerged from a recession and, optimistic for the future, are putting down new capacity there is an obvious air of confidence.

The stock that I fancy most in this sector is Brown Bayley Steels. By comparison with Dunford and Elliott, its performance has been pedestrian to say the least. Yet I believe that this is because volume has been increased at the cost of profits. The EEC, and possibly some change in the current management philosophy, could well have a dramatic effect. This is what I am looking for, and over the next year I feel that Brown Bayley should • prove a sound holding.

As well as selling Dunlop I am saying farewell to Hestair which has shown reasonable appreciation in the short time I have held the shares.

Previous page

Previous page