Inflation-proof

PORTFOLIO JOHN BULL

Australian mining shares have been plunging sharply. The list on Monday night sounded like the roll call after a massacre: Great Boulder down 35s at 107s 6d (1968 high-186s); North Kalgurli, 18s 9d down at 83s 9d (1968 high- 143s); Hampton Properties, 15s 9d down at 36s 3d (1968 high-72s 6d); Western Mining 8s 6d down at 90s (1968 high-150s). As it happened, Rio Tinto Zinc, in which I have an interest (60 shares bought at 125s a time at the end of April) rose Is 44cl to 126s ex dividend on Monday, and followed this up with a 7s rise on Tuesday. That was an encouraging sign; but the shares have been as high as 160s 6d this year. What has brought them back has been a somewhat disappointing interim statement. It causes me to consider whether RTZ should still be held as a long-term investment, par- ticularly when Australian issues are under a cloud.

The latest figures show only a small increase in net profits despite the inclusion of earnings from Borax and Capper Pass for the first time. This is partly explained by a huge jump in the tax charge payable by the Palabora copper mine. There have also been teething troubles in the new zinc smelter complex at Avonmouth and strikes at Broken Hill Australia (which has affected other linked RTZ operations). These misfortunes have not yet been sorted out. The upshot is that the directors now say that the net profit for the whole year may be a litIle lower than the figure for last year. The only

cheer offered to shareholders is confidence that the new investment at Avonmouth (144 million) will make an important contribution to total income 'after this year.'

All of this is hardly ideal background for the announcement of a rights issue. But the direc- tors have decided to ask shareholders for £25 million in new equity funds. However, in spite of this cold douche to my enthusiasm for the group, I have decided not only to maintain my investment but also to take up my rights. In the first place, I am impressed by the wide spread of interest which eTz has in some pretty fast growing areas of the world. I do not be- lieve for one moment, for instance, that it is right to sell a stake in the Australian economy just as exciting mineral finds " are being made. Speculators have simply misjudged in what pro- portion and over what time scale the benefits accrue to particular companies. At the last count 42 per cent of wrz's assets were in Australia. But a further 24 per cent were situated in North America, again not an area frorri which I particularly want to exit at the moment.

Secondly, I am impressed by wrz's manage- ment skills. The enormous hydro-electric scheme under way in Canada indicates what can be achieved—power already sold forward for forty years. Hydro-electric operations,- onCe they are completed, are virtually inflation proof because they have no fuel costs and tiny labour costs. Thus the Churchill Falls deal re-presents the pro- vision of a secure income for the group over a very long period. I am, therefore, keeping my an, confident that within a short time the share price should perk up again. Certainly I can detect no panic amongst the institutional holders.

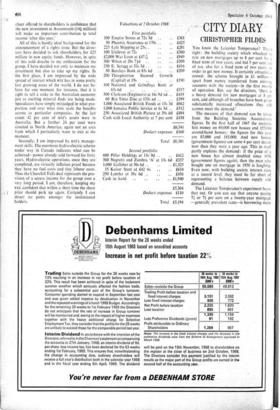

Valuations at 2 October 1968 First portfolio

100 Empire Stores at 72s 3d .. • • £361 50 Phoenix Assurance at 170s .. • • £425 225 Lyle Shipping at 25s.. .. • • £281 100 Unilever at 72s .. £360

£2,000 War Loan at £4716

£949 300 Witan at 20s 7fd £309 250 E. Scragg at 33s 3d .. £416 50 Barclays Bank at 83s 6d £209 200 Throgmorton Secured Growth (Capita)) at 19s £190 100 National and Grindlays Bank at 63s 6d £317 500 Clarkson (Engineers) at 16s 9d xd £419 60 Rio Tinto Zinc at 133s xd £399 1,000 Associated British Foods at 13s 3d £662

1,000 Jamaica Public Sei-vice at 6s 3d ..

£312

250 Associated British Picture at 39s 6d•

£494 Cash with Local Authority at 7 per cent £438 Deduct: expenses £160 Total £6,381 Second portfolio

600 Pillar Holdings at 13s 9d £412 500 Negretti and Zambra 'A' at 13s 6d £337

1,000 Gallaher at 30s 6d .. .. £1,525 15 Kaiser Steel at £42 6s .. £634 250 Lonrho at 36s 6d .. .. £456 Cash in hand. .. .. £1,940 £5,304 Deduct: expenses £110 Total £5,194

Previous page

Previous page