Company Notes

By LOTHBURY

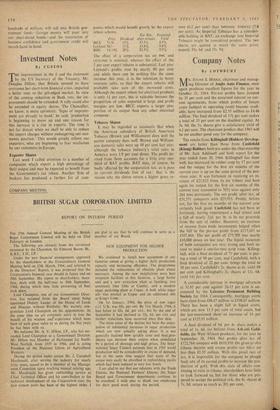

R. JULIAN S. HOIXie, chairman and manag- ing Director of Anglo Auto Finance, once again produces excellent figures for the year to October 31, 1964. Pre-tax profits have jumped by 55 per cent and the unearned interest on cur- rent agreements, from which profits of future years (subject to operating costs) become avail- able, have increased from £2.33 million to £4.46 million. The final dividend of 174 per cent makes a total of 35 per cent on the doubled capital. At 5s. 9d. the Is. shares give a satisfactory yield of 6.1 per cent. The chairman predicts that 1965 will be yet another good year for the company.

The results from Killinghall (Rubber) Develop- ment are better than those from Castlefieid (Kiang) Rubber; both are under the chairmanship of Mr. Jack Addinsell and both report for the year ended June 30, 1964. Killinghall has done well, has increased its rubber crop by 17 per cent and the output for the first six months of the current year is up on the same period of the pre- vious year. It was fortunate in receiving an in- crease of £21,923 from its tin tribute and here again tin output for the first six months of the current year amounted to 7034 tons against only 264 tons previously. The net profit, after tax, of £31,571 compares with £25,933. Profits, before tax, for the first six months of the current year certainly look good. Castlefield has not been so fortunate, having experienced a bad winter and a fall of nearly 21d. per lb. in Its net proceeds from the sale of rubber. However, an increase of income from trade investments helped offset the fall in the pre-tax profit from £117,607 to £107,864. The net profit of £75,709 was nearly £10,000 down on last year. The liquid resources of both companies are very strong and both in- tend to make a one-for-two scrip issue. Killing- hall, with a final dividend of 75 per cent, is pay- ing a total of 90 per cent, and Castlefield, with a final dividend of 22 per cent, brings the total to 30 per cent. Castlefield's 2s. shares at 6s. yield 10 per cent and Killinghall's 2s. shares at 12s. 6d. yield 144 per cent.

A considerable increase in mortgage advances at 31.85 per cent against 26.15 per cent is an- nounced by the Leicester Permanent Building Society for 1964. Consequently, mortgage assets have risen from £88.67 million to £108.67 million. There has been a slight fall in liquid assets, which are now 11.3 per cent of total assets. but the last-mentioned show an increase of 19 per cent at £125.95 million.

A final dividend of 9d. per 4s. share makes a total of Is. 6d. (as before) from Ashanti Gold- fields, the West African producer, for the year to September 30, 1964. Net profits after tax of £722,764 compare with £610,950. On gross profits Ghana income and excess profits tax takes no less than £1.35 million. With this penal rate of tax, it is impossible for the company to'plough back any of its earned profits to increase the pro- duction of gold. With this state of affairs con- tinuing to exist in Ghana, shareholders have little to look forward to, but for those who arc pre- pared to accept the political risk, the 4s. shares at 7s. 9d. return as much as 20j per cent.

Previous page

Previous page