Each way bet

PORTFOLIO JOHN BULL

I think that the potential in Gallaher has been underestimated. I refer to the fact that the current share price-27s 3d—is only a very modest amount above the Philip Morris offer for half the equity (25s a share). I have, there- fore; bought 700 of the shares for my second, speculative, portfolio.

At its very crudest the situation can be read like this: as the Gallaher board has described Morris's offer as 'quite inadequate,' the chair- man, Mr Mark Norman (who is a managing director of Lazards, the merchant bankers); and his fellow directors must believe that they can prove both to Philip Morris and to the public at large that 25s a share is a mean bid. Indeed, Gallaher, I think, must be pretty con- fident that its prospects justify a price in excess of 30s to go around talking of 25s a share as 'quite inadequate.'

Simple faith in Mr Norman is not, how- ever, my only reason for buying Gallaher. Most unusually, we are, in this bid battle, far away from the exalted prices which have been seen in other recent proposals. At 25s Gallaher is selling at 121 times last year's earnings. That is .a sober, conservative rating. Cigarette con- sumption may be flat, but it is still possible to.,make sharply increased profits out of the business, as the recent performance of Int-. perial Tobacco (Players and Wills) shows. Gallaher is not an inefficient firm. Its profit margins at the last calculation were 4.1 per cent on sales compared with 4.3 per cent for Imperial Tobacco. What Gallaher has lacked is marketing flair.

Enter Mr Stuart Cameron. He joined the Gallaher board early last year from Colgate- Palmolive. He is marketing director. The .first thing he did was to double the value of coupons on Kensitas cigarettes. You can't afford to do that, said the competition. But the profit figures for the relevant period show that the result was almost certainly a plus for Gallaher. Since then two new brands have been introduced—Conquest and Senior Service Ex- tra—backed up by some hard-hitting advertis- ing ('Save 3d not bits of paper'). The result has been that the long decline in Gallaher's market share has stopped. The figure was as low as 27 per cent in 1967 and is now 28 per cent. None of this guarantees that profits will be higher this year—indeed, the cost of new brands will eat into the surplus. But it does show that Gallaher has the beginnings of..a. recovery under way. It may not amount to . very much. But at a price-earnings ratio of ,121 it doesn't have to. Mr Norman does not have to pull very much out of the bag to make the shares look cheap.

There is, however, a third way of looking

at. Gallaher—and that is from the Philip Morris angle. Philip Morris is a successful American company under a vigorous chair- man and chief, executive, Joseph F. Cullman III. It has increased its share of its own tough market. It is expanding fast overseas and has diversified as far as Personna razor blades, confectioneries and men's grooming aids. It believes in fifty-fifty partnerships with foreign companies. It believes in dividends. And it can point to a most successful joint venture in Australia. In short, I shall not be the least bit unhappy to end up a minority shareholder in an American-run Gallaher. I am told that the seven questions asked of Philip Morris by the Gallaher board—what will you do about pro- motion expenditure, management, production, leaf buying, royalties, health research and diversification?—will all receive reassuring answers when the formal documents are pub- lished. Thus the Gallaher situation boils down to this: if Phillip Morris obtains Control of Gallaher I am in a recovery position backed by much stronger management talents than hitherto. If Gallaher heads Philip Morris off, then the chances are that I shall have a short- term capital gain.

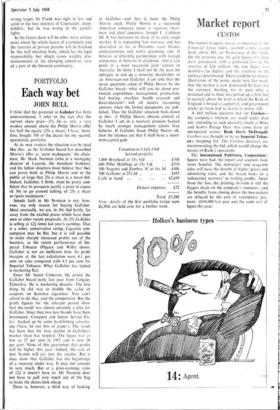

Valuation at 3 July 1968 Second portfolio 1,000 Brayhead at 15s 4-1d /768 600 Pillar Holdings at 13s 14d .. £394 500 Negretti and Zambra 'A' at 16s 3d £406 700 Gallaher at 27s 3d £953 CAI in hand .. .. £2,839

Deduct: expenses f72

Total £5,288

Note: details of the first portfolio (value now £6,304) are held over for a further week.

Previous page

Previous page