Part 2: The superb oom

Condensed from the book by Martin D. Weiss

Between 1964 and 1974, the Western world was thrust headlong into the most accelerated period of business and financial activity of all time. In Britain, Japan, the United States and West Germany the pace of economic transactions, as measured by bank debits, soared from $7 trillion per year to over $30 trillion. New forms of short-term debt leaped into existence, Increased at five times the speed 0/' long-term debts and transformed the credit structure of the West. Most surprising of all, the largest, and apparently most powerful corporations of America lost the ability to defend themselves from a deepening business decline. I call this ten-year period "The Superboom." •

GM collision course

The history of General Motors can be divided into two eras: the first between 1908 and 1941 when there were frequent and sharp contractions in the economy; and the second between 1946 and 1974 when there was only one basic trend: up.. During the first era, the planners of GM held. the belief that the future was unpredictable. Chairman of the board, Sloan, said, -we could not control the environment or predict its changes." But, during the second era, this philosophy was turned on its head. General Motors drained its short-term liquidity to 8 per cent by the first quarter of 1975 and was forced to borrow heavily in the long-term bond markets, thereby raising its liquidity slightly to 11 per cent.

Suppose you're the president of General Motors. One morning you wake up to the news of a sudden turnaround in sales. Cash flow, the life blood of the organisation, is suddenly cut down to a trickle. What do you do? Sure the company is rich in assets, but almost all of these assets are locked up in plant, equipment and inventory, and for the moment at least, are totally useless. You rush to the phone and call up the financial experts: "How much do we have in cash?" "How many bills payable do we have?"

Within a few minutes the answer comes back: "We've got only $1 billion. That's cash, governments, time deposits; both GM and GMAC included. We've got commercial paper coming due, bank overdrafts and short-term loans of $41/2 billion — all to be paid immediately. Then for the next twelve months we have to meet still another $71/2 billion in current liabilities."

"Can they be stalled?" you ask.

"Highly unlikely. On the contrary, some of them have already made requests for earlier payment."

You hang up. Now you know how New York's Mayor Beame felt in early June. Things. must have deteriorated quickly in the past couple of weeks. You figure out that you have less than eight cents in cash for every dollar of short-term debt. That's five times lower than GM's cash position just before the inventory panic of 1920 and almost six times worse than the cash position immediately preceding the crash of 1929. In fact, in those days, most American giants like GM had relatively large cash hoards.

Alfred P. Sloan Jr., in his book my Years with General Motors, described how, in 1929, -as a result of the speed with which we acted when sates began to fall, we were able to reduce our inventories in line with the sales decline and to control costs so that operations remained profitable. Our sales declined 71 per cent from

$1,504 million in 1929 to only $43g million in 1932, 'but our inventories were reduced 60 per cent, or by $113 million. With this decline ot more than $1 billion in sales, net income fell $248 million, but we managed to earn $165,000 in 1932 while paying out $63 million in dividends ... GM made an orderly step by step retreat in all matters, including wage and salary. reductions."

Thus, at the low point of the crash they actually made a profit. Production slowed, but didn't shut down. Profits dropped, but remained in the black. Markets were drowned in a wave of selling, but the firm kept its head above water. Most important, the management of General Motors moved swiftly to improve liquidity. By the time the bottom of the crash was reached, it had built up more reserves than ever before — $1.84 of cash and equivalent per dollar of current debt.

Today, however, despite the fact that Henry Ford has written off 1975 as a bad car year, and despite a variety of other warning signals, GM is still optimistic.

In late 1974, Albert Sindlinger, perhaps one of the most astute consumer pollsters in the US, warned General Motors of an impending consumer panic. But GM's thinking and habit patterns were still locked into the era of expansion and upward trends. Predictions were acceptable only as long as they were optimistic or only slightly pessimistic. When the general trend was sharply down, the predictions fell on deaf ears. Finally, Sindlinger has broken away, from GM and the company has gone on its merry course of building bigger inventories in the blind hope that the government-engineered recovery will be a resounding success.

AT&T

I estimate that before a liquidity crisis reaches panic proportions, probably before the end of 1976, the American Telephone and Telegraph Company will be forced to drastically slash its dividends, and perhaps eliminate them entirely, as a temporary emergency measure.

The reasons are threefold.

First, in a general business decline accompanied by an acute cash shortage, telephone service can easily become one of the first targets of cost-cutting by business, government institutions and families. Long-distance .telephone calls are particularly vulnerable. In the first six months of 1974 the growth in revenue from long-distance calls fell from the 14 and 15 per cent of 1972 and 1973 toll per cent. By the third quarter of 1974 the growth had fallen to 8 per cent — a net decline, after allowing for inflation.

Toll calls must still be considered a luxury which can be easily replaced by postage stamps, especially when there is higher unemployment, less income, and more time to write letters. And, it just so happens that AT&T has been heavily dependent on long-distance business for earnings, with overseas calls bringing the greatest profits of all. In 1966 local service revenues were 20 per cent larger than toll revenues. But in 1973 they were running almost neck and neck. In short, as much as 50 per cent of AT&T's profits came from a predominantly luxury service, which could temporarily disappear in a sharp' business decline.

The second reason is rooted in the problem of fixed plant and equipment costs — approximately 689 dollars' worth backing up each phone currently in service. As soon as companies and families make that eventful decision to discontinue their extensions or, worse yet, to do without a private phone entirely, Ma Bell is left holding the bag with billions of dollars of temporarily underused or useless equipment.

The third and

by far the most 2. AT&T compelling rea

son AT&T may 15 have to slash its dividend is the overwhe lming burden of fixed interest charges. The company has a total debt of some $29 billion — approximately equivalent to the total national debt of a West Germany or a. France. Moreover the graph above shows that since the mid-'fifties, when the mid-century expansionist fever, described in part 1, first overcame the company, the liquidity of AT&T has simply disintegrated. In 1956, net revenues were nearly fourteen times larger than interest charges. By September 1974, they were only 4.5 times larger. Whether AT&T's credit rating is downgraded or not remains to be seen. But one thing is certain: the company is burdened with this debt for many years to come.

10

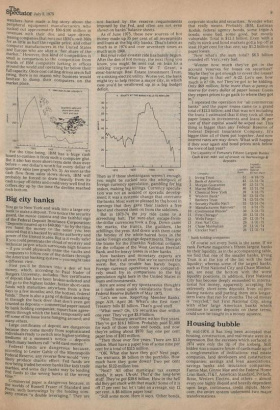

INTE REST COVERAGE

1950 1960 1970

IBM

'Some say that "a share of IBM isn't $200 to $300 or $400. It's a treasure you tuck in the vault with a life insurance policy, college diploma, and last will."

No wonder virtually every University, city, trust fund, and pension fund still has wads of IBM stock. As of November 1974, Morgan Guaranty still had enough IBM stock under its guidance to theoretically buy up 100 per cent ownership of Merrill Lynch. and still have enough left over to pick up Si per cent control of International Telephone and Telegraph Company. In the long-term future IBM and others in the computer industry could become the most powerful corporations in the world. For the immediate term, however, the problems facing IBM are bound to bring large stockholders down from their dreamworld and precipitate one of the biggest avalanches of common stocks ever witnessed in the history of Wall Street, resulting in a price possibly below $50 per share.

The first of these problems is the vulnerability of computer sales. In the 'sixties, with a religious zest unsurpassed by the emissaries of Hare Krishna or the Reverend Sun Myung Moon, IBM salesmen ran off to the far corners of the corporate world and converted companies by the thousands.

In 1971, despite the continued spurt in business activity, computer sales in the US reached a saturation point, and were it not for the growth of World Trade's earning IBM would have been recording no year-to-year gains in net in recent years. Subsequently domestic earnings were inflated by outright purchases of IBM equipment — a hedge against inflation for the customers but a possible headache for IBM's management, which prefers long-term income from leasing operations.

Contrary to popular myth, there is nothing particularly special about computers that sets them apart from other big-ticket items on the market. They merely process the stream of data, directly linked to the stream of business transactions. And these business transactions, as discussed earlier, are apparently following a typical boom-bust pattern. As soon as business decelerates — and there is abundant evidence, that the deceleration has already begun — the computer bubble will most likely be punctured. It is then that IBM's second and perhaps more ominous problem could come to the surface — competition from customers. IBM

watchers have made a big story about the peripheral equipment manufacturers who sucked out approximately $90-$100 million in revenues with their disc and tape drives; leasing companies that rent out IBM's own 360s for as little as half the regular price; and other computer manufacturers in the United States and Europe who are after a "fair share of the market." However, this kind of competition is small in comparison, to the competition from hoards of IBM computers lurking in offices around the world and operating far below their full capacity. Once cost cutting drives are in full swing, there is no reason why business would hesitate to dump their computers on the market place.

For the time being, IBM has a huge cash hoard to cushion it from such a computer glut. But it also has more short-term debt than ever before — one dollar's worth for every dollar of quarterly sales (see graph No. 3). As soon as the cash flow from sales slows down, IBM will probably be forced to draw heavily from its cash to pay off debts and could very well find its coffers dry up by the time the decline reached rock bottom.

Big city banks

You go to New York and walk into a large city bank to make a deposit. You notice the security guard, the movie camera and the faithful sign of the Federal Deposit Insurance Corporation: "Deposits insured up to $40,000." So by the time you hand the money to the teller you teel assured that it's backed by all the authority and power of the United States. But is it really safe? If you could penetrate the cloud of mystery and technical jargon which surrounds high finance — if you could physically enter the vaults and computers to follow one of the dollars through the American banking system — you might take a different view.

First you'd be thrown into a den of hot money, which, according to Paul Nader of Rutgers University, includes "hot certificates of deposit that have been broker-solicited and will go to the highest bidder, hotter short-term funds with maturities anywhere from a few days to a few months; and, the hottest, federal funds." There is also a gang of dollars sneaking in through the back door that don't even get counted as deposits — commercial paper issued by bank holding companies; repurchase agreements through which the bank temporarily sell off some of its loose loans hanging around; and many others.

Large certificates of deposit are dangerous because they come mostly from sophisticated individuals ready to switch into higher yielding mediums at a moment's notice — deposits which many bankers call "wild card money." Federal funds are dangerous because, according to Lester Gable of the Minneapolis Federal Reserve, any reverse flow would "very likely produce chaotic effect. Fed funds are now being traded between banks like kids trade marbles, and some day banks may be lending Fed funds to the wrong banks at the wrong time."

Commercial paper is dangerous because, in the worlds of Russell Fraser of Standard and Poors, such borrowings by the holding comPany creates "a double leveraging." They are not backed by the reserve requirements imposed by the Fed, and often are not even shown on banks' balance sheets.

As of June 1975, these new sources of hot money made up 35 per cent of all investments and loans at the big city banks. That's twice as much as in 1974 and over seventeen times as much as in 1960.

But your roller-coaster ride has barely begun. After the den of hot money, the next thing you know, you might be sent out on loin to a sinking corporation like W. T. Grant, a inear-bankrupt Real Estate Investment Trust, or a sinking electric utility. Worse yet, the bank might try to help rescue a major city, in which case you'd be swallowed up in a big budget deficit, Then as if these shenanigans weren't enough, you might be sucked into the whirlpool of foreign currency speculation, gambling for big stakes, making big killings. Currency speculation was not an isolated or sporadic development; it was a systemic change that overcame the banks. Most were so pleased by the boost in earnings that they gave their traders a free hand and cheered them on from the sidelines.

But in 1973-74 the joy ride came to a screeching halt. The sure-shot escape-fromthe-dollar currencies took a flop. Down came the marks, the francs, the guilders, the schillings, the yens. And down with them came the heyday of the white-haired boys in the banks' foreign exchange departments. They got the blame for the Franklin National collapse, for the collapse of the West German Herstatt Bank, and for heavy losses in other banks.

Now bankers and monetary experts are saying that it's all over, that we've survived the worst. But, the trouble has barely begun. Foreign currency operations were comparatively small fry in comparison to the big speculation right here in the United States in loans and investments.

Here are some of my spontaneous thoughts as I made some quick calculations from the Federal Reserve Bulletin of May 1975.

"Let's see now. Reporting Member Banks, page A18, April 30. What's the first item? Treasury bills $5 billion. That's good stuff.

"What next? Oh, US securities due within one year. They've got $3.9 pillion. "Next, Treasury securities within five years. They've got $16.1 billion. Probably paid $1,000 for each of those notes and bonds, and now they're selling about $970. Say one per cent paper loss of $161 million. "Then those over five years. There are $3.5 billion. Must have a paper loss of some nine per cent for a total of $315 million.

"OK. What else have they got? Next page. Tax warrants. $6 billion in the portfolio. How much have they gone down? Two per cent maybe. $122-million loss. "Next? 'All other municipal tax exempt bonds,' it says. Uh-oh! That'd the long-term stuff. They've got $39.6 billion. How in the hell did they get stuck with that much? Some of it is off 17 per cent but let's take an average, say 12 per cent. A $6-billion paper loss! "Still some more. Here it says, 'Other bonds, corporate stocks and securities.' Wonder what that really means. Probably IBM, Eastman Kodak, federal agency bonds, some triple-A bonds; some bad, some good, but mostly vulnerable. Total is $12.3 billion. Even with a rally in stock and bond markets gotta lop off at least 10 per cent for that one; say $1.2 billion in paper losses. Now what's the sum total? $6.5 billion rounded off. Very, very bad.

"Wonder how much they've got in the account 'reserves for losses on securities?' Maybe they've got enough to cover the losses? What page is that on? A-22. Let's see, how much is it? Oh, no! They've got to be kidding. Only $69 million; little more than a penny in reserve for every dollar of paper losses, Guess they expect prices to go gack to where they got in." I repeated the operation for all commercial banks" and the paper losses came to a grand total of $12.5 billion; and that was not including the loans. I estimated that if they took all their paper losses in investments and loans 96 per cent of their capital would be wiped out. This thing is bigger than any Federal Reserve of Federal Deposit Insurance Company. It's bigger than all of them put together. And now interest rates are way down. What will happen if they soar again and bond prices sink below the lows of last year?

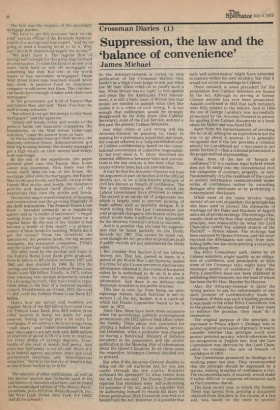

The Liquidity of Fortune's Fifteen Largest Banks Cash & est. mkt. val. of invest. vs. borrowings &

Of course not every bank is the same. If we rank Fortune magazine's fifteen largest banks by their liquidity, as in the accompanying table, we find that one of the smaller banks, Irving Trust is at the top of the list with the best liquidity; whereas some of the largest banks, such as First National City and Chase Manhattan, are near the bottom with the worst liquidity positions. In addition, First National City has become deeply enmeshed in international hot money, apparently accepting the extremely short-term deposits from oil-producing nations and putting them into longerterm loans that run for months. The oil money is "recycled," but First National City, along with other large American banks which continue to accept deposits on these terms, could soon be caught in a money squeeze.

Housing bubble

By mid-1974, it has long been accepted that housing, construction, and real estate were in a depression. But the excesses which surfaced in 1974 were only the tip of the iceberg. Still hidden was a massive house of cards made up of a conglomeration of institutions: real estate companies, land developers and construction companies; savings and loan associations, savings banks and insurance companies; Fannie Mae, Ginnie Mae and the Federal Home Loan Bank; IT&T, American Standard, Potlach, Boise, Western Electric, and others — almost every one highly illiquid and heavily dependent upon large, continuous credit inputs. Moreover, the entire system underwent two major transformations. The first was the creation of the secondary mortgage market.

"We have to get this economy back on the road" says an official of the Kennedy Administration to a savings and loan expert, "and we're+ going to need a housing boom to do it. Why can't the thrift institutions supply the money?"

-We don't have it. The regular flow • of savings isn't enough for this great leap forward in construction. To raise the kind of money you want, we'd have to sell off mortgages or something like that. But who in the world wants to buy secondary mortgages? Those Wall Street ticker-tape watchers would never buy them. A pension fund or insurance company would never buy them. The commercial banks have enough trouble with their own mortgages."

So the government got hold of Fannie Mae and Ginnie Mae, and said: -Here. You buy the stuff in lump amounts." •

"But where do we get the Money to buy these mortgages?" said the agencies. "Simply sell bonds, notes and stocks to the pension funds, the insurance companies, the foundations, or the Wall Street ticker-tape watchers," came the answer from on high. So the savings and loans got their money, the Kennedy-Johnson-Nixon Adminstrations got their big housing booms, the money managers got a high return on their money and everybody was happy.

By the end of the superboom, the paper pyramid piled. onto the Fannie Mae home owner was enormous. First there was the house itself; then on top of the house, the mortgage; piled onto the mortgages, the Fannie' Mae stocks and bonds; and finally, on top of the Fannie Mae stocks and bonds, the insurance policies and mutual fund shares of the institutions that own the stocks and bonds.

The second major transformation of housing and construction was the growing illiquidity of the thrift institutions. The Federal Home Loan Bank — intended primarily as a regulating agency and as "a lender of last resort" — began making loans to the savings and loans on a regular basis. By the end of the 'sixties it had become a lender of first resort — a primary source of fresh funds for housing. Where did it get the money? From the investors, the speculators, the pension funds, the big money managers, the insurance companies, FNMA and the ticker-tape watchers, of course. The debt owed by the savings and loans to the Federal Home Loan Bank grew gradually from $1 billion to $31/2 billion between 1957 and 1962 and then doubled by 1966. By 1974 the savings and loans owed the Federal Home Loan Banks some $20 billion. Finally, in 1975, rather than releasing new savings desperately needed for a housing recovery, they have tried to repay these debts in the fear of a renewed liquidity crunch. Nevertheless, as of June, 1975, the s and l's still owed the Federal Home Loan Bank $17 billion.

Here's how the money and numbers are juggled. Most of the $20 billion borrowed from the Federal Loan Bank plus $2.8 billion from other sources is being set aside for cash reserves, freeing savings plus a bit extra for mortgages. If we subtract the borrowings from -cash assets" and "other investment securities" the s and l's are left with only $800 million in reserves or about 4/10 of a cent in. reserves for every „dollar of savings deposits. Fourtenths of one cent! A measly half penny. And even that 'half penny' is not all cash. Much of it is in federal agency securities, state and local government securities, and "miscellaneous securities." Never in the history of America has so much been backed by so little!

The analysis of other institutions, as well as the precise sources and formulas used in the calculation of statistics cited here, can be found in the unabridged edition of 'The Money Panic.' (Available, price $15 from Weiss Research, Inc., 542 West 112th Street, New York, NY 10025. Add $2 for airmail.)

Previous page

Previous page