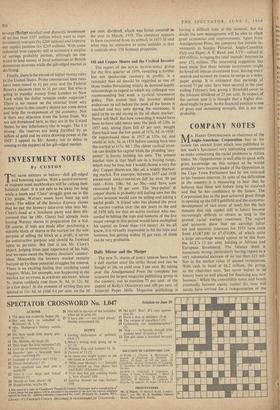

COMPANY NOTES

MR. HARRY OPPENHEIMER as chairman of the Anglo-American Corporation has in his review (an extract from which was published in last week's Specunor) very interesting comments to make concerning the racial problems in Africa today. Mr. Oppenheimer is well able to speak with great knowledge on this subject as he would probably have become leader of the Opposition in the Cape Town Parliament had he not returned to his business interests. In spite of the difficulties in the country it is reassuring to hear that he believes that these will before long be resolved and that he has confidence in the future. The Corporation has in the past achieved great things in opening up the OFS goldfield and the economic development of vast areas of land; but the fact remains that risk capital will in future become increasingly difficult to obtain as long as the present racial warfare continues. The report and accounts show that net earnings (after tax and minority interests) for 1958 have risen from £5,067,040 to £7,454,006, of which quite a large percentage would appear to be due from the ACC's 13 per cent, holding in African and European Investment. The balance sheet is immensely strong, particularly having regard to a very substantial increase of no less than £21 mil- lion in the market value of quoted investments. With cash in hand at £6.2 million, the group, as the chairman says, 'has never before in its history been so well placed for financing any new business.' When the convertible notes and bonds eventually become equity capital the time will surely have arrived for a reorganisation of the Capital structure—the ordinary capital is only £5 million against net assets of £97 million. The chair- man makes no reference to the current outlook; hut undoubtedly the revenue from gold, copper and diamond interests will show an increase for N59 making it possible to improve on the 8s, dividend payment for 1958. The 10s. ordinary shares at 198s. 9d. yield 4.02 per cent.

The preliminary figures of City of London Real Properly for the year ended April 12, 1959, show an increase in the trading profit to a record of

million against £1.54 million with a substan- tial increase in the net profit of nearly 50 per cent. (due to a much lower tax charge) over the previous period at £833,000. This excellent result is due to the large post-war development of the company's Commercial properties. The dividend has been stepped up from 9 per cent. to 15 per cent. so that the £1 ordinary shares at 66s. yield as much as 4.54 per cent. This is a good return on a property company having such a fine financial record.

Richardsons Westgarth, turbine and general engineers and boiler makers, have issued pre- liminary figures showing a net profit for the year ended March 31, 1959, £48,600 lower at £610,000, but as the company belongs to the Nuclear Power Consortium it can be assumed that its contribu- tion to this body and its development expenditure On this side of the business have been very much heavier than last year. In fact the tax figure at £465,000 is nearly half that of last year and has saved a greater fall in the net profit. At I5s. 6d. the 10s. ordinary shares yield 5.53 per cent. on the 8 l per cent; dividend.

One of several new issues in the industrial market last week was that of Lesbrook Ltd. for 1.500,000 2s. ordinary shares placed at 4s. I Id. each. The company carries on business as engin- eers in Birmingham and the greater part of its i manufacture of component parts goes to the tele- vision and radio trade. It makes components also for motor vehicles, electrical goods. mining equip- ment and a wide range of other products. Accounts "till be made up to March 31, 1960, when it is expected that net profits (subject to tax) will be around £100,000 and a dividend of 25 per cent, is forceast. The 2s. shares are now 6s. 9d.

The Managers of First Provincial Unit Trust have just offered 500,000 units at 10s. 6d. in their Reserve Trust. This particular trust was formed

aS recently as 1953, and since that date it has shown the remarkable appreciation of 125 per cent, in its Portfolio. The trust has power to invest in a niaximum of 75 securities out of a total of 100 in the commercial and industrial field. It should continue to do well under excellent management. The units give a return of 1.4 3s. 6d. per cent, at the issue price.

Previous page

Previous page