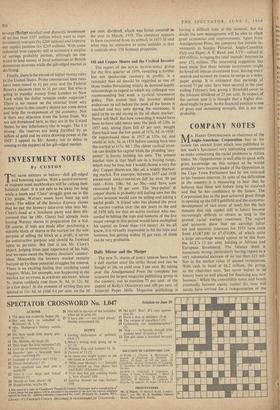

INVESTMENT NOTES

By CUSTOS

THE same mixture as before—dull gilt-edged and booming equities. With a record turnover of business most stockbrokers will be cutting their holidays short, It is not safe to be away for long while a tooth and 'Clore' struggle goes on in the City jungle. WATNEY MANN have been up and down. The editor of the Sunday Express claims that he put the brewery take-over idea into Mr. Clore's head at a luncheon party and then dis- covered that he (Mr. Clore) had already been buying Watney shares in preparation for a bid. Of course, if bids are made after purchasing a sizeable block of shares in the market for the sole purpose of selling the block at a profit, it serves no constructive purpose and should be frowned upon as parasitic. But that is not Mr. Clore's object, judging from past experience of his bids, and we.must await the Watney directors' counter- blast. Meanwhile the brewery market remains buoyed up by these potential struggles for control.

There is an exciting feeling that anything could happen. What, for example, was happening in the

market for DurroNs BLACKBURN BREWERY, whose Ss. shares suddenly rose from 9s. 9d. to 12s. 9d. in a few days? At the moment of writing they are quoted at Ils. 6d. to yield 4.4 per cent, on the 10

per cent. dividend, ,which was better covered in the year to March, 1959. The company appears to have recovered from its setback in 4957-58 and what may be attractive to someoutsider is that it controls oVer 550 licensed properties.

Oil and Copper Shares and the Cyclical Investor

The report of the ROYAL DUTCH-SHELL group for the first quarter of 1959, revealing a further but not spectacular recovery in profits, is a reminder that oil should be regarded as one of those trades fluctuating widely in demand-supply relationships in regard to which my colleague was recommending last week a cyclical investment policy. This means that the investor should endeavour to sell before the peak of the boom is reached and buy only during the recessions. It used to be an old saying in the oil share market : Never sell Shell. But how rewarding it would have been to have sold SHELL near the peak of 220s. in 1957 and, seeing them fall 45 per cent, bought them back near the low point of 117s. 9d. in 1958! Or repurchased them in 1957 at 135s. 6d. and resold at 165s. 3d. in 1958 before coming back into the market at-117s. 9d.1 The clever cyclical inves- tor can double his capital while the plodding 'stay- putter' is barely holding his own. The present market view is that Shell are in a buying range, which may be true, but I would choose a very flat day. Copper shares are, like oil, a widely fluctuat- ing market. For example, between 1957 and 1958 RHODESIAN ANGLO-AMERICAN fell by over 50 per cent.—from 108s. 9d. to 50s.—and have now recovered by 70 per cent. The 'stay-putter' in copper shares is probably still feeling sore but the active investor would now be selling and taking a useful profit. A friend who has plotted the price of MAGMA COPPER over the ten years to the end of 1958 tells me that an active investor who suc- ceeded in hitting the tops and bottoms of the five major swings in this period would have multiplied his capital no fewer than 114 times! As we all know, it is virtually impossible to hit the tops and bottoms, but getting within 10 per cent. of them can be very profitable.

Daily Mirror and the Merger

The new 5s. shares of DAILY MIRROR have been a dull market since the strike threat and can be bought at 24s. to yield over 5 per cent. By taking over the Amalgamated Press the company has acquired the largest magazine publishing group in the country, not to mention 75 per cent, of the capital of Kelly's Directories and 100 per cent. of Imperial Paper Mills. Magazine publishing is having a difficult time at the moment, but no doubt the new management will be able to effect great economies and improvements. Apart from Amalgamated Press, the company has outside in- vestments in Sunday Pictorial, Anglo-Canadian Pulp and Paper, A. E. Reed, and ATV—valued at £19 million, bringing the total 'outside' interests to over £32 million. The interesting suggestion has been made that these outside investments might be hived off into an investment trust, leaving DAILY MIRROR and SUNDAY PICTORIAL 10 merge as a news- paper group. It is estimated that earnings of around 75 per cent, have been secured in the year ending February last, giving a threefold cover to the forecast dividend of 25 per cent. In respect of the current year it is thought that a higher divi- dend might be paid. As the financial position is one of great and increasing strength, this is not im- probable.

Previous page

Previous page