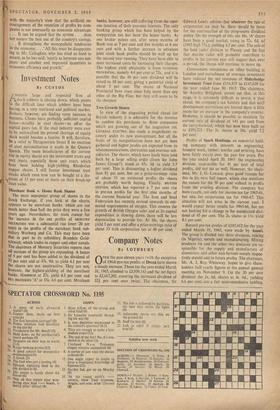

THE ECONOMY & THE CITY

Why Equities Rise

By NICHOLAS DAVENPORT

Aeveryone in the City knows, Mr. Callaghan as changed the investment climate in a technical sense in more ways than one. He has made equity shares more 'highly geared' and therefore more speculative, and at the same time he is making them rise in market value because he is limiting their supply. This is one of the curious effects of the new corporation tax. By divorcing personal taxation from corporate taxation a company is obliged to deduct income tax at the standard rate (8s. 3d.) from the gross dividend it pays to its shareholders and hand it over to the Inland Revenue. But it can deduct from its profits the gross interest it pays to its debenture holders before accounting for cor- poration tax. So if the company wishes to raise more money from the public to finance its ex- pansion it will be less costly for it to issue debenture or loan stock than to issue ordinary (or preference) shares. Before the Callaghan revolution our companies used to issue ordinary shares on 'rights' terms to the tune of nearly £300 million a year. Now the rate has fallen to under £80 million a year. So the market supply of ordinary shares is being sharply restricted, although the demand for them—from pension funds, unit trusts, life assurance funds and pri- vate investors—has been only moderately—and perhaps only temporarily--reduced (I would

guess from about £580 million to £450 million a year). This explains the current rise in equity share prices, which seems such an illogical re- sponse to Mr. Callaghan's money squeeze and rising costs.

As the debenture or loan stock of a company increases in volume, so the proportion of equity capital to the total capital diminishes. This makes the equity more 'highly geared,' so that a rise or fall in total profits has a much sharper effect upon equity earnings. Most conservative boards of directors do not like the idea of their equity becoming more speculative and will there- fore try to finance themselves more out of re- tained earnings. (This was, of course, Mr. Callaghan's intention—to encourage more com- pany investment and discourage dividend distri- bution.) But this also will tend to make the market price of the equity rise..The more a com- pany reinvests its earnings, the greater will be (or should be) the potential earnings of the equity—and the more highly valued it will be- come in the open capital market.

Here is another curious effect of the Callaghan tax revolution. The higher the market price, the less inclined will the holder be to sell that equity and incur the capital gains tax of 30 per cent. So the rich holders of rising equity shares will seek to hand them over to some family trust. If ever there was a maldistribution of private capital before, it will therefore become much worse as a result of the new taxation. This may surprise Mr.

Callaghan, but it will not surprise those of us who have always argued against a capital gains tax. In my view, a small, graduated, annual wealth . tax is the only fair and effective way of taxing the capital owner.

Incidentally, there is another point which favours the very rich capital owners. Having plenty of liquid funds, they have no need to realise stock in the market to meet heavy ex- penses like house-moving or new motor-cars.

But the modest capitalist will have to sell— and pay capital gains tax—to meet such ex- ceptional expenses. So the capital gains tax again fails to provide equity as between one class of taxpayer and another. It will soon dawn on the small capitalist that, under the new dis- pensation, he should avoid the Stock Exchange for the investment of his first £5,000 to £10,000.

He should concentrate on buying a house—the more expensive the better—seeing that each householder is free of capital gains tax when he comes to sell his property. I visualise a great rush on house-buying and -owning in the next few years, which I am glad to see Mr. Crossman is not discouraging. Indeed, there is a bright prospect before the man who is ingenious and skilled enough to buy a dilapidated property cheaply, restore it, embellish it and sell it again at double the price tax-free—and occasionally repeat the process, but not so often that it becomes a taxable business.

The capital gains tax is tending to accentuate the rise in equity share values in another way.

The life assurance funds, which hold about £2,000 million of equities, have to pay a capital gains tax of 371 per cent on switching and the managers are finding it almost impossible to operate under such a system. The old-established life companies have been buying 'gilts' and the 'blue chips'—Marks and Spencer, ICI, and the like—at varying prices down the years and if the Inland Revenue insist on calculating capital gains tax on the principle 'first in, first out,' the managers have the expensive and tedious task of going through their books every time they make a sale to find the cost price of the bargain. So they prefer to stay put. Incidentally, while this practice tends to make the supply of equity shares all the shorter, it also tends to make Govern-

ment bonds a much more restricted market. In other words, if the Bank of England should ever

want to manipulate the rate of interest down- wards—as it ought—it will find the life funds unwilling to co-operate because of the tax on switching. I am sure that the tax on gilt-switching will have to go.

I cannot help feeling that Mr. Callaghan will have to reform his great tax revolution when he has had more experience of these curious market

twists. I am not questioning the divorce of per- sonal taxation from corporate taxation, which 1

think is a sound tax principle. Nor am I criticising the principle of a corporation tax. But in my opinion the ideal one is (a) a flat

payment of from 15 per cent to 25 per cent by way of royalty to the state and (b) a tax on undistributed profits, which would mean greater recourse to the open capital market (why have the best capital market in the world if we don't

use it?). This would make for a much livelier

private-enterprise sector and the maximum col- lection of income tax. I wonder whether Mt.

Callaghan is re-reading what his servant, Mr. Nicholas Kaldor, said when he was writing the famous memorandum of dissent on the Royal Commission on Taxation: 'We do not disagree

C01. Pa

• .

no . .

in ing see Pa ecc

b the majority's view that the artificial en- iragement of the retention of profits by com- lies is not necessarily an economic advantage. . It can be argued that the system . . . does ensure the best use of the country's savings. . It strengthens the monopolistic tendencies the economy... ,' All this must be disappoint- to Mr. Callaghan, who has tried so hard to ure, as he has said, 'equity as between one tax- rer and another and improved incentives to inomic efficiency and growth.'

Previous page

Previous page