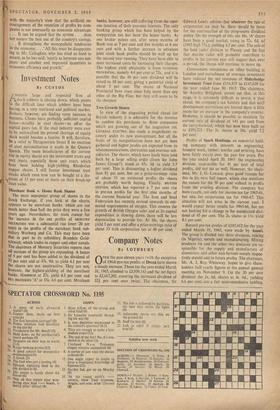

Company Notes

By LOTHBURY

VER the past eleven years (with the exception kf of 1964) pre-tax profits of Decca have shown a steady increase. Those for the year ended March 31, 1965, climbed to £3,939,143 and the net figure to £2,167,202, covering the increased dividend of 321 per cent over twice. The chairman, Sir

Edward Lewis, advises that whatever the rate of corporation tax may be, there should be room for the continuation of the progressive dividend policy. On the strength of this. the 10s. 'A' shares have been a good market, rising to 72s. 6d. xd (1965 high 75s.), yielding 4.5 per cent. The sale of the land radar division to Plessey and the fact that marine radar will probably contribute to profits in the current year still suggest that, over a period, the shares will continue to move up.

Government restrictions on office building in London and curtailment of overseas investment have reduced the net revenues of Haleybridge Investment Trust from £154,857 to £147,639 for the year ended June 30 1965. The chairman, Sir Aynslcy Bridgland, points out that, at this stage, it is extremely difficult to assess, a year ahead, the company's tax liability and that until development restrictions are limited there is little room for an increase in the company's revenue. However, it should be possible to maintain the current rate of dividend of 141 per cent from the carry-forward, which has now been built up to £191,321. The 5s. shares at 10s. yield 7.2 per cent.

Profits of Spark Holdings, an industrial hold- ing company with interests in engineering, foundry work, timber, textiles and printing, have been fairly steady over the past few years. For the year ended April 30, 1965 the engineering division, responsible for 41 per cent of total profits, did not do so well. However, the chair- man, Mr. J. G. Lawson, gives good reasons for this in his very full report. which also mentions the reason for the 50 per cent setback in profits from the printing division. The company has been caught, not only for income tax for 1965-66, but also for corporation tax for 1966-67. This situation will not arise in the current year. I would expect better results for 1965-66, but am not looking for a change in the maintained divi- dend of 45 per cent. The 2s. shares at Ils. yield 8.1 per cent.

Record pre-tax profits of £187,412 for the year ended March 31, 1965, were made by Amari. The group is divided into three divisions, mining (in Nigeria), metals and manufacturing. Mining produces tin and the other two divisions are re- sponsible for the supply and manufacture of aluminium and other non-ferrous metals respec- tively should add to future profits The chairman, Mr. A. J. Ray Whiteway, hopes to give share- holders half-yearly figures at the annual general meeting on Ndvcmber 9. On the 20 per cent dividend the is. 6d. shares at 4s. 6d., yielding 6.6 per cent, are a fair semi-speculative holding.

Previous page

Previous page