Account gamble

Snap nap

John Bull

Dixons Photographic is a major beneficiary of any consumer boom. And conditions over the last two years have worked fully in its favour. This is reflected by the upsurge in profits from £226,000 in 1970 to £828,000 in 1971 and £2.3 million in 1972.

Dixons is a well structured group and its retail activities have led the way, making rapid progress. There were 128 stores at the end of last year and a further twentyfive new outlets are planned this year. This growth in size is important for reasons other than those purely on the profit front. For it gives Dixons better bargaining power when it comes to direct dealing with the Japanese consumer goods manufacturers.

Products sold include cameras, photographic equipment, hi-fl goods, radio and TV sets (both black-and-white and colour).

The group's chairman hopes to build Dixons into the most powerful group in the business. Advances already made into Europe are the acquisition of a Swiss photographic retailing firm and a Dutch hifi and camera chain. The wider geographic spread of activities will certainly help the group if there is a severe credit squeeze in this country. This, in fact, is what happened in the mid-sixties when Dixons was badly hit.

So Dixons certainly looks on the right path for the future. What of the results for the year to the end of April and the more Immediate interim figures due, I am told, in the first two weeks of January? Well, the market appears to anticipate profits of £4 million.

My information, however, leads me to suspect the market is setting its sights too low. And I forecast a good advance for the half-year, when the chairman, Mr Stanley Kalms, has said he expects to announce a further major advance in the company's profitability. And for the full year I am going for profits ot around £4.7 million. At 152p, the shares are selling at a prospective PE ratio of only 12.

Dixons is fast getting back into the market's good books but still its low rating Is a poor reflection of the progress made and prospects. I think the interim figures should lead to a reappraisal in which case this is a good share for 1973.

Certainly some encouragement can be drawn from the high level of spending this Christmas. And like jewellery companies such as Ratners, which should benefit from the changeover from purchase 'tax to VAT, I feel that camera retailers such as Dixons will be favourably placed.

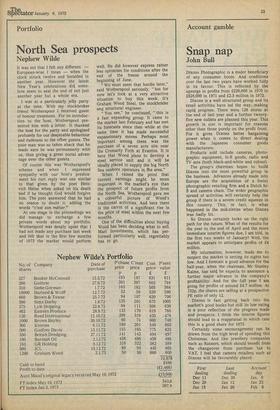

First Last Account dealing dealing day Dec 11 Dec 28 Jan 9 Dec 29 Jan 12 Jan 23 Jan 15 Jan 26 Feb 6

Previous page

Previous page