Investment Notes

By CUSTOS

MFIE economy is probably in better shape than I the stock market would suggest. The hire- purchase debt rose in May for the first time since July, 1961, pointing to the recovery in motor- cars and other consumer durables. The report of A. E. REED, following on those of E. S. AND A. ROBINSON and WIGGINS TEAPE, showed that some recovery has even been felt in the depressed paper trade. Yet to everyone's disgust Throg- morton Street has become more bearish than Wall Street, which is making quite a good re- covery. Our trouble seems to be that new issues are hanging heavily over the market and that the insurance companies are content to take up their rights, but not to add otherwise to their equity holdings. The low-yielding shares will certainly not attract them under present conditions. Until distress selling—the mark of every slump—dries up, there can be no real recovery. There is much 'distress' about.

TV Shares As the Pilkingtonians would like to put the programme companies out of business, the publi- cation of their report naturally caused a further slump in these shares, but there was bound to be some recovery on second thoughts. Clearly the Government is not likely to implement the main

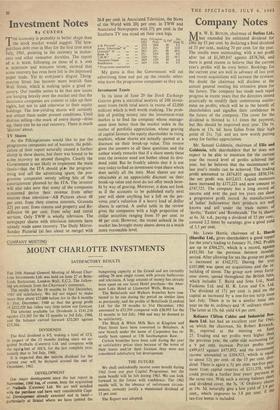

thesis—that the ITA should the program- ming and sell the advertising space, the pro- gramme companies merely selling bits of the entertainment planned by the ITA. The investor will also take note that many of the companies concerned derive their revenue from other sources than television—AB Pictures about 48 per cent. from their cinema interests, Granada 1121 per cent. from cinema and property and Re- diffusion 66 per cent. from relay and rental services. Only TWW is wholly television. The newspaper shares with television interests have already made some recovery. The Daily Mirror- Sunday Pictorial (at last about to merge) with 26.8 per cent. in Associated Television, the News of the World with 201 per cent. in TWW and Associated Newspapers with 371 per cent. in the Southern TV can stand on their own legs.

High, Pilkityton

74,3Fall Yield %

Div.

20/6 6 7.2 Price 12976/92 Price 33/3 21/- 37 (3.,..2 13.9 29/3 21/- 28 10.5 37/- 25/6 30 4.8 1( 23/9 16/- 33 51.1.

24/9 13/9 44 16/9 11/6 31 5.7

My guess is that the Government will cut advertising time and put up the rentals: other- wise leave the programme companies as they are.

Investment Trusts

In its issue of June 29 the Stock Exchange Gazette gives a statistical analysis of 240 invest- ment trusts (with total assets in excess of £2,000 niillion) which is well worth studying. The prob- lem of putting money into the investment-trust market is to find the company whose manage- ment does better than the market index in the matter of portfolio appreciation, whose gearing of capital favours the equity shareholder in rising markets, whose shares are actually quoted at a discount on their break-up value. This review gives the answers to all these questions and the author wisely remarks that if a share meets these tests the investor need not bother about its divi- dend yield. But he frankly admits that it is not easy today to find an investment-trust share which does satisfy all the tests. Most shares are not obtainable at an appreciable discount on their break-up value and most do not offer much bene- fit by way of gearing. Moreover, it does not look as if the accounts to be published early next year will show anything but a fall on the pre- vious year's valuation if a heavy load of dollar shares is carried. A useful table in the review gives the companies with a high proportion of dollar securities ranging from 35 per cent. to 48 per cent. However, the recent setback in the market has brought many shares down to a much more reasonable level.

A.B. Pictures.

Assoc. Television* 'A' Granada. 'A' Rank T.W.W..

Thomson Organ. ...

Rediffusion ...

• Programme contractors

Previous page

Previous page