Keynes and the developing world

Harry G. Johnson

Keynes himself was a British economist and economic policy operator, concerned with the economic and policy problems of the British economy, of Britain and the European economies in the World War I reconstruction period, and of Britain and the world financial system in the World War II reconstruction period, but always primarily with Britain. His only major work in what would now be called 'development economics' was Indian Currency Reform, based on a plan worked out at the India Office and researched from there (he later used pressure of academic business to refuse an official mission to India). His only major policy contribution as a British official involved a clear case of imperial-colonial exploitation : arranging to buy for British consumers in World War I a surplus of Indian wheat available at a price below the world market price because the India Office had held the price down with the aid of an export embargo to prevent the Indian peasant from becoming unwarrantedly affluent. It is true that towards the end of his career he publicly favoured international commodity agreements, a fact now being used to give intellectual support to the demands for 'a new international economic order'; but that is a culturally insignificant part of his literary legacy to modern economic culture.

If 'development' is defined in a broad, economic rather than political, sense, as economic growth, its sources, and policies for promoting it. Keynes certainly had ideas on it that were influential. But those ideas were social, a-scientific, and distracting in the worst sense of the term. They derived from, and were conditioned by, the opulent euphoria of deeply class-organised late nineteenth-century Britain, compounded with the contempt of the don and the civil servant for the intellectually inferior who live by working and by making money from organising the work of others.

In economic theory they were sharpened by the principle of Occam's Razor, on which the lazy economic theorist frequently cuts his own scientific throat—in economics, the principle that everything else can be related to one key macro-economic variable, a principle which unites (at least in their worst moments or in their vulgar followers) Marx (the rate of profit), Keynes (fixed capital investment), and Milton Friedman (the quantity of money). These led Keynes to three views: that, if the British economy were properly managed, it could accumulate all the capital it could use in a generation or so; that entrepreneurs would happily perform their entrepreneurial functions for modest after-tax incomes; and that policy directed at fixed capital investment was the

key to full employment and social bliss.

The first view has been decently forgotten by active economists in this more democratic age of 'rising aspirations': but its simple substitute has been the view that subsidisation of fixed investment is the key to the promotion of growth, with the only room for debate being between emphasising the subsidies themselves, or providing them indirectly via demand pressure, and if the latter whether via domestic inflation or via currency under-valuation. This emphasis on fixed industrial investment, and on demand policies and subsidies to encourage it, has implied the exclusion from Keynesian thinking of both the old English classical and neo-classical emphasis on human motivations which encourage or discourage investment and innovation, and the modern American emphasis on a completely different concept of 'capital', a concept which includes 'human capital' or ability, training, and self-improvement as a major form of capital and assigns to the accumulation of education and knowledge a major role in economic growth.

With regard to the narrower concept of 'development', the economic growth (especially in per capita terms) of the poor regions of the world, Keynes's intellectual influence fell to be exercised through his disciples. But the influence has been great— and, again, distracting in the pejorative sense. That influence can be associated with two theoretical concepts, each identifiable with a still-living first-generation disciple of the master; and, understandably, both ideas have been especially influential in the former British colonial region of the Indian subcontinent.

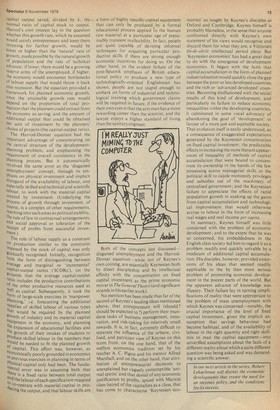

The first, and simpler, idea is that of 'disguised unemployment,' attributable to Joan Robinson, The concept, in its original context and formulation, was indisputably relevant and useful : it is simply the idea that in times of mass unemployment many of the formerly appropriately employed turn, not to the dole (or unemployment assurance and assistance), but to lesser types and degrees of economic activity that fail to use, or to compensate appropriately, the productive abilities they possess, but which do keep them out of the official measurements of the total of unemployed. (In fact, an American economist, Arthur Okun, gained international fame for a more sophisticated and quantified version of the same idea, elevated to the status of `Okun's Law'.) Where it proved superficially plausible, but fundamentally misleading, was in its transmogrification into a description, analysis, and policy principle for the poor countries, with their characteristic preponderance of

people in rural districts who seem to do little or nothing to contribute to agricultural output. The notion that there exist masses of 'disguised unemployed' people leads easily into the idea that 'development' involves merely the mobilisation and transfer of these presumably costless productive resources into economic activities, primarily investment or industrial production, at an obvious and virtually costless social economic gain. What is required to realise this gain, gratifyingly enough, is merelY cleverness on the part of the conomist in outwitting the stupidity of the competitive system, and determination by the political leaders in generating the social will needed to implement the appropriate economic policies.

Tremendous efforts have been made, notably in India, to define operationally and to measure the amount of 'disguised unemployment,' and to develop and incorporate into policy and into cost-benefit analysis of policy proposals and projects the implicit difference between the money and the social (alternative opportunity) cost of labour; and also to discredit the 'neoclassical' alternative approach, represented particularly by T. W. Schultz's Transforming Traditional Agriculture. Schultz argued that farmers are efficient in exploiting the technology available to them, that the phenomena of 'disguised unemployment' are symptoms of a low-productivity technology, and that the conversion to a superior technologY involved an inter-connected complex of changes involving not merely the technologY itself but the supply of appropriate inputs (fertiliser, water, seeds, pesticides) including the education of the farmer himself. Schultz was clearly right, as centuries of agricultural economic history have shown: but the city man's contempt for the farmer, and the Keynesian belief that there is something wrong with the economy that is attributable to the competitive system and that could be understood and set right by a feat of econnmic brilliance, have remained in control of the theory and policy of economic develor ment.

The second extremely influential Keynesian idea was the so-called Harrod-Doma,r equation, the centre-piece of R. F. Harrod s extension of the Keynesian model for ale explanation of short-run unemployment in a capitalist system into a model of self" sustaining economic growth in such system. The equation states, briefly, that .the growth of fixed capital will generate Just sufficient increased sales and profits .t° justify the investment involved in increasingi the capital stock ifg, the growth rate, is ecllu! to s, the proportion of full-employment-01

Capital output saved, divided by k, the normal ratio of capital stock to output. Harrod's own interest lay in the question Whether this growth rate, which he assumed would satisfy 'entrepreneurs and keep them investing for further growth, would be lower or higher than the 'natural' rate of growth, made possible by the natural growth of Population and the rate of technical advance: if lower, there would be a growing reserve army of the unemployed, if higher, the economy would encounter bottlenecks Of labour supply that would throw it back into recession. But the equation provided a framework for planned economic growth, since the attainable growth rate would depend on the proportion of total production that the planners could extract from the economy as saving, and the amount of additional output that could be obtained Per unit of investment by the planners' Choice of projects (the capital-output ratio).

The Harrod-Domar equation had the important advantage of concentrating on the central structure of the developmentPlanning problem, and emphasising the requirement of overall consistency in the Planning process. But it automatically involved the same error as the 'disguised unemployment' concept, through its emPhasis on physical investment and implicit disregard of' the availability of labour, and especially skilled and technical and scientific labour, to work with the material capital created by investment. (Underlying the Process of growth through investment, of course, is a complex of other requirements, reaching into such areas as political stability, the rule of law in.contractual arrangements, and social approval or toleration of the receipt of profits from successful investment.) The role of labour supply as a constrant Oil production similar to the constraint irnPosed by the stock of capital, was only gradually recognised. Initially, recognition took the form of distinguishing between average and marginal or 'incremental' caPital-output ratios ('ICORs'), on the grounds that the average capital-output ratio includes the productive contributions of the other productive resources used as \;,\Iell as capital. Subsequently, it took the Orrn of large-scale exercises in 'manpower Planning,' i.e. forecasting the additional suPplies of skilled labour of various types that would be required by the planned growth of industry and its material capital e,quiPment in the economy, and planning !he expansion of educational facilities and the growth of their intakes of students to Produce skilled labour in the numbers that would be needed to fit the planned growth °f capital. This effort was, however, as eaccinomically poorly grounded in economics Previous exercises in planning in terms of PnYsical capital only had been. The fundaTental error was in assuming both that Mere is a fixed ratio between total output flcl the labour ofeach specification required c) co-operate with material capital in pro 4cing the output, and that labour skills are

a form of highly specific capital equipment that can only be produced by a formal educational process applied to the human raw material at a particular age of presumably transient malleability. In fact, people are quite capable of devising informal techniques for acquiring particular productive skills if there are strong enough economic incentives for doing so. On the other hand, as the evident failure of the post-Sputnik emphasis of British educational policy to produce a new type of technologically-oriented Englishman has shown, people are not stupid enough to embark on forms of industrial and technological training which government claims will be required in future, if the evidence of their own eyes is that the arts man has a more rewarding career than the scientist, and the lawyer enjoys a higher standard of living than the sanitary engineer.

Both of the concepts just discussed— disguised unemployment and the HarrodDomar equation—while not of Keynes's own coining, are essentially Keynesian both by direct discipleship and by intellectual affinity with the concentration on fixed capital investment as the prime economic mover in The General Theory(and significant strands in his earlier work).

No mention has been made thus far of the second of Keynes's leading ideas mentioned above, that entrepreneurs will (should? should be expected to?) perform their mundane tasks of business management, innovation, and risk-taking for relatively small rewards. It is, in fact, extremely difficult to separate the influence of the urbane, civilised, and patrician view of Keynes on this score from, on the one hand, that of the welfare economics tradition set. by his teacher A. C. Pigou and his mentor Alfred Marshall, and on the other hand, that attribution of entrepreneurial decisions to unexplained but vaguely contemptible 'animal spirits' and that denial of any economic Justification to profits, spiced with Marxist class hatred of the capitalists as a class, that has come to characterise 'Keynesian eco

nomics' as taught by Keynes's disciples at Oxford and Cambridge. Keynes himself is probably blameless, in the sense that anyone confronted directly with Keynes's own statement of his views would recognise and discard them for what they are, a Victorian fin-de-siècle intellectual period piece. But 'Keynesian economics' has had a great deal to do with the emergence of development economics. It began with the faith that capital accumulation in the form of planned industrialisation would quickly close the gap between the poor or less developed countries and the rich or 'advanced developed' countries. Becoming disillusioned with the social results of this kind of development, and particularly its failure to reduce economic inequalities within the developing countries, it culminated in some vocal advocacy of abandoning the goal of 'development' in favour of a more just and equitable society. That evolution itself is easily understood, as a consequence of exaggerated expectations generated by the Keynesian concentration on fixed capital investment; the predictable effects in increasing the more blatant appearances of inequality of methods of capital accumulation that were bound to concentrate its ownership in the hands of the few possessing scarce managerial skills or the political skill to cajole monopoly privileges and subsidies out of the machinery of centralised government ; and the Keynesian failure to appreciate the effects of rapid population growth in soaking up the gains from capital accumulation and technological improvement that would otherwise accrue to labour in the form of increasing real wages and real income per capita.

In summary, Keynes himself was little concerned with the problem of economic development; and to the extent that he was so concerned, his embeddedness in the English class society led him to regard it as a problem readily and quickly solvable by a modicum of additional capital accumulation. His disciples, however, provided extensions of his ideas that seemed readily applicable to the by then more serious problem of promoting economic development in the poorer parts of the world. But the apparent advance of knowledge was illusory. Their failure lay in turning simplifications of reality that were appropriate to the problem of mass unemployment with which Keynes was concerned—notably, the crucial importance of the level of fixed capital investment, given the implicit assumption that savings behaviour had become habitual, and of the availability of labour in the right quantity and right skillmix to man the capital equipment—into unverified assumptions about the facts of a different reality about which a quite different question was being asked and was demanding a scientific answer.

Previous page

Previous page