Skinflint's City Diary

In another article in this week's Spectator, Lord Kingston argues well the case against the particular scheme for land nationalisation which I claim to have fathered, and which I christened 'freehold redemption.' The idea, and all that follows from it, is the substitution on all landed property of a free 100-year ground lease in place of the freehold interest which would belong to the state.

Freehold redemption, called by another name, has been taken up in a pamphlet prepared in no deeply penetrating econometric sense with only a single modification — the reduction of the 100year term to 99 years — by the Campaign for Land Nationalisation. Their tract, which I'm naturally delighted to welcome, is by Jack Brocklebank, Joan Maynard, Nicholas Calder, Robert Neild and Oliver Stutchbury.

At the time of the last Labour Conference ip Blackpool, I wrote in The Spectator of October 14 for the first time on freehold redemption, and in a nutshell said: There is one single simple act of legislation acceptable, if properly explained, to almost all concerned with a healthy capitalist system moving forward into the next century at an unprecedented pace. This proposal of mine, if effected, should make estate duty, gift, wealth and capital taxes as well as much of income tax unnecessary.

The legislation might be called a 'National Freehold Redemption Act.' It would be a measure providing nothing more or less than the removal by statute of a private, corporate or charitable owner's freehold interest in land or buildings he possessed and the granting in substitution of a free 100-year leasehold interest vested in the owner by the state. A new and major department of state — a Ministry of Land — would at once be set to work to prepare a latterday Domesday Book and be empowered to redeem, 'deal in and re-lease property in anticipation of reversions 100 years later.

Freehold redemption would not only be equitable but socially correcting and relatively unobtrusive. There would be a constant constraint, through the gradual deflation of property values during the expiry period of leases, on the wage and price inflation we have become obliged to believe we must live with in a post-Keynesian. world, in addition to the enormous opportunity for change that will become urgent by the turn of the century.

Freehold redemption, in spite of the formidable support it is receiving, will make little progress within the official Labour movement, unused to the financial pit-face of capitalism, possibly because they will be unwilling to give electoral comfort to sensible opinion by allowing it to emerge that estate duty and capital gains thresholds will gradually rise.

Open letter

However, all this is for the future. Inflation is now the problem and needs attention within days, and in consequence I am addressing this open letter to Mr Heath — or, for that matter, to Mr Wilson — in order to do something about it in time for their conference speeches.

The Rt Hon Edward Heath, MP, 10 Downing Street, London SW1 Dear Prime Minister, As a critical supporter of the Conservative Government may I suggest that a degree of inflation is less disruptive if the electorate believe that the means are at hand to reduce it in a politically and socially acceptable manner. There is a single measure that would reduce the personal and corporate borrowing base from which so much inflation results, readily available. This calls for no more than that you or a responsible minister say, in the most moderate tone, that an investigation is to be made into the possibility of directing new institutional investment gross funds including insurance companies and pension funds — in accordance with the public interest as between equities and gilt edged and also as between domestic, commercial and industrial property. The effect of such a statement, before any measure was enacted, would be immediately to reduce equity prices, and the level of property values, at the same time raising the price of gilts and reducing their yields as a hedging switch was made by the institutional managers. There would be a tendency for the reverse yield gap to be corrected.

The borrowing base reduced by the fall in property and equity values would lower inflation, at the same time as adding to confidence through a rise in the price of Government Stock. Domestic property values would fall, as would interest rates, to the general benefit of first-time purchasers.

I realise that only with the greatest reluctance would a Conservative Government be willing to guide institutional investment, but these are exceptional times, and thus I hope you will forgive me for trespassing on your attention by this letter.

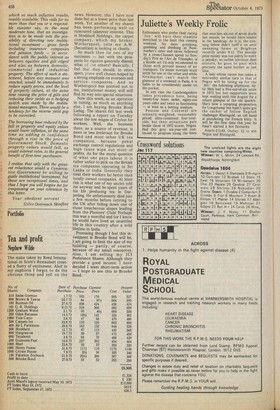

Your obedient servant Giles Overreach Skinflint news. However, this I have now done but at a lower price than last week. Yet another of my shares has been performing well on rumoured takeover interest. This is Stoddard Holdings, the carpet company, which my broker, Wotherspool, tells me A.W. (Securities) is looking at closely.

So much then for two of my successes — but with the prospects for equities generally dismal, what of he others? Basically, I feel that they should: in retrospect, prove well chosen helped by a strong emphasis on overseas and service companies. And as Wotherspool has pointed out to me, institutional money will still find its way into special situations.

Now this week, as an operation in timing, as much as anything else, I am buying Brooke Bond Liebig. The shares fell last week following a report on Tuesday about the low wages of Ceylon for workers. Well, the business there, as a source of revenue, is more or less irrelevant for Brooke Bond and most other UK tea companies, because penal exchange control regulations and high taxes wipe out most of profits. As for the moral question of what one pays labour it is rather unfair to pick on the British tea companies operating in Sri Lanka or India. Generally they treat their workers far better than locally owned companies. At least this is what one of my uncles told me anyway and he spent years of his life producing tea in Darjeeling. He unfortunately died just a few months before retiring to the UK after falling down one of those treacherous slopes leading from the. Planters' Club! Perhaps this was a merciful end for I know he would have lived an unsettled life in this country after a wild lifetime in India.

Promising though I feel this investment in Brooke Bond will be, I am going to limit the size of my holding — partly, of course, because of my small resources. Alas, I am selling my ICI Preference Shares. Although they provide a good income, I have decided I want short-term action — I hope to see this in Brooke Bond.

Previous page

Previous page