Account gamble

Weighing the risks

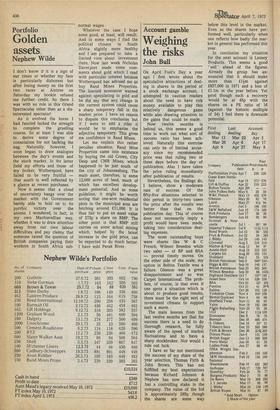

John Bull

On April Fool's Day a year ago I first wrote about the speculative attractions of dealing in shares in the period of a stock exchange account. I attempted to caution readers about the need to have risk money available to play this relatively dangerous game while also drawing attention to the gains that could be made. Now twelve months is behind us, this seems a good time to work out what sort of success ratio has been achieved. Naturally this exercise can only be of limited accur acy since my recommended price was that ruling two or three days before the day of publication. Also I have taken the price ruling immediately after publication of results.

Nevertheless, the findings do, I believe, show a moderate rate of success. Of the fifty-five situations selected in this period in thirty-two cases the price after the results was better than that on the publication day. This of course does not necessarily imply a profit would have been made, taking into consideration dealing expenses.

The most outstanding buys were shares like W & C French, Wilmot Breedon while two sales — of BP and BSA — proved timely moves. On the other side of the scale, my option in Bolton Textile was a failure. Gleeson was a great disappointment and so was Carpet International. The prob lem, of course, is that even if one spots a situation which is about to produce good results, there must be the right sort of investment climate to support such a move.

The main lessons from the last twelve months are that for success there is a need to do thorough research, be fully aware of the speed of market fluctuations and to have a sharp stockbroker. Nor would I rule out luck.

I have so far not mentioned the success of my share of the year selection, Thomas Firth & John Brown. This has not fulfilled my best expectations because Richard Johnson & Nephew has now declared it has a controlling stake In the company. The value of the bid is approximately 285p though the shares are some way below this level in the market. Even so the shares have performed well, particularly when one reflects how badly the market in general has performed this year.

In conclusion my situation for the next account is Lesney Products. This seems a good ' sell ' ahead of the figures. Already the group has announced that it should make more than £lim against £857,000 in 1971 and a loss of £1.1m in the year before. Yet good though such a recovery would be at 45p with the shares on a PE ratio of 16 (against the historic multiple of 34) I feel there is downside potential.

Previous page

Previous page