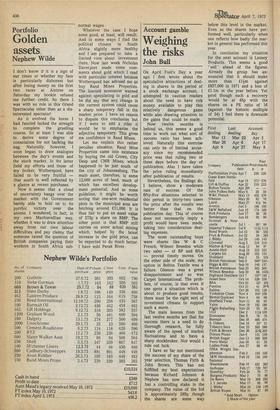

Portfolio

Golden assets,

Nephew Wilde

I don't know if it is a sign of our times or whether my face is particularly dishonest but after losing money on the first two races at Aintree on Saturday my bookie refused me further credit. So there I was with no role in this Grand Spectacular other than as a disinterested spectator!

As ' it evolved the horse I had fanCied lacked the strength to complete the gruelling course. So at least I was able to derive some degree of consolation for not backing the nag. Naturally, however, I soon began to draw analogies between the day's events and the stock market. In the latter field my efforts and those of my broker, Wotherspool, have failed to be very fruitful — that much is well reflected by a glance at recent purchases.

Now it seems that a cloud of uncertainty hangs over the market with the Government barely able to hold on to its pyrrhic victory over the unions. I wondered, in fact, in my own Machiavellian way, whether it was to draw attention away from our own labour difficulties and pay claims that someone raised the question of British companies paying their workers in South Africa sub normal wages.

Whatever the case I hope some good, at least, will result. And in some ways I find the political climate in South Africa slightly more healthy and I am prepared to take a limited view about investment there. Now last week Nicholas Davenport made some comments about gold which I read with particular interest because Wotherspool has advised me to buy Rand Mines Properties. The learned economist warned against speculating in gold and he did say that any change in the current system could cause a sharp temporary fall in the market price. I have no reason to dispute this conclusion but if I were to add a rider it would be to emphasise the adjective temporary. This gives me confidence in Rand Mines.

Let me explain this rather peculiar situation. Rand Mine Properties came into existence by buying the old Crown, City Deep and CMR Mines, which happened to be just south of the city of Johannesburg. The main asset, therefore, is some 12,000 acres of land, much of which has excellent development potential. And as some guideline, it might be worth noting that one-acre residential plots in the municipal area are fetching around £11,000. It is thus fair to put an asset value of 2'72p a share on RMP. The other point is that RMP still carries on some actual mining which, helped by the latest increase in the gold price, can be expected to do much better. I have sold Perak River.

Previous page

Previous page