Spoiled for choice

PORTFOLIO JOHN BULL

I calculate that Bowmaker provides a way into one or other of two good shares at the moment —First National Finance Corporation or C. T. Bowring, the insurance brokers. The reason is that both companies are bidding for Bow- maker. First National Finance, which calls itself a financial conglomerate, entered the lists first with an offer for the Bowmaker equity worth around 22s 6d a share. That was not at all wel- come to the Bowmaker board of directors and they began to look round for an alternative suitor. Luckily their financial -advisers were Rothschild,• who count amongst the firm's clients C. T. Bowring, a company which wants to add a second financial service to its tradi- tional insurance broking activities. So Bow- ring has come forward with an offer of just under 26s a share, the difference being that this one has the blessing of the Bowmaker board. Bowmaker in fact stands at 27s 6d because the general expectation, which I share, is that. First National Finance will bid again. And in one sense First National Finance can afford to pay more than Bowring because it has an existing hire purchase business, small enough to be easily injected into the Bowmaker organisation and so produce some substantial cost savings.

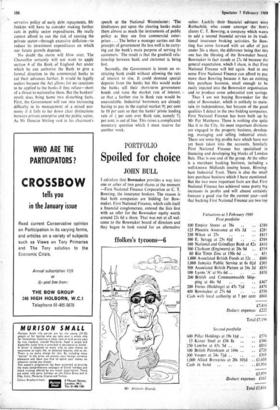

Thus I am not buying Bowmaker for the sake of Bowmaker, which is-unlikely to main- tain its independence, but because of the good qualities I detect in the two bidding companies. First National Finance has been built up by Mr Pat Matthews. •There is nothing else quite like it in the City. Its most important divisions are engaged in the property business, develop- ing, managing and selling industrial estate. There are some big profits here which have not yet been taken into the accounts. Similarly First National Finance has specialised in financing and developing big blocks of London flats. That is one end of the group. At the other is a merchant banking business, including a well-known Midlands issuing house, Birming- ham Industrial Trust. There is also the small hire purchase business which I have mentioned. But the two most important facts are that First National Finance has achieved some pretty big increases in profits and will almost certainly forecast a good rise for the current year—and that backing First National Finance are two top Valuations at 5 February 1969 First portfolio

100 Empire Stores at 76s .. £380 125 Phoenix Assurance at 45s 3d £281 330 Witan at 25s £413 500 E. Scragg at 23s 444 £584 100 National and Grindlays Bank at 82s £410 500 Clarkson (Engineers) at 20s 9d £519 60 Rio Tinto Zinc at 150s 6d .. 451 1,000 Associated British Foods at 12s .. £600 1,000 Jamaica Public Service at 6s Old £303 500 Associated British Picture at 34s 3d £856 100 Lyons 'A' at 91s 6d £458 200 British and Commonwealth Ship- ping at 46s 9d £467 200 Fortes (Holdings) at 47s 744 £476 400 Bowmaker at 27s 6d £550 Cash with local authority at 7 per cent £668 £7,416 Deduct: expenses £222 Total £7,194 Second portfolio 600 Pillar Holdings at 19s 144 £574 15 Kaiser Steel at £36 fts £546 250 Lonrho at 65s '3d £816 100 British Petroleum at 144s £720 300. Vosper at 24s 744 £369 1,000 Allied Breweries at 20s 1044 .. £1,038 Cash in hand .. £1,916 £5.979 Deduct: expenses £163 Total £5,816 City institutions. each with large shareholdings, Hambros Bank and Phoenix Assurance.

C. T. Bowring is a different proposition, but it is also in the middle of a strong expansion of profits. Bowring consists chiefly of a group of general, life and pension brokers together with a life insurance company (Crusader In- surance) and some small shipping interests. Profits last year rose from £2,858,000 before tax to £3,900,000. Bowmaker's profits are also on a strong upward trend—£2 million in 1966-67, £2.34 million in 1967-68 and £3 mil- lion expected for the current year. Con- sequently, on a conservative assumption about Bowring's prospects for the current year, the Bowring/Bowmaker combination would be selling at a very reasonable twenty times earn- ings at today's share prices. Accordingly I have bought 400 Bowmaker for my first portfolio.

The Board of Trade's decision to refer the pro- posed merger of Unilever and Allied Breweries to the Monopolies Commission has pushed my holdings in Allied Breweries right back to what I paid for the shares some weeks ago, 20s 1044. The question now is whether to wait for the Monopolies Commission to make up its mind— in about four months' time—and whether, if the merger is stopped by the Government, Allied Breweries can hold its present price. On the second question I am fairly sure that the share price is safe. In the annual report pub- lished last month, the chairman, Sir Derek Pritchard, told shareholders that trade during the opening quarter of the year in the group's important branded products 'is buoyant and markedly better than a year ago.' That puts a floor under the Allied Breweries share price. There is, therefore, not much risk involved in waiting for the Government's decision on the merger and because I believe that there are several shillings profit to be made if Unilever is allowed to proceed, I shall maintain my shareholding for the time being.

Previous page

Previous page