THE BANKING OUTLOOK

EFFECT OF THE GOLD STANDARD

BY ARTHUR W. KIDDY

Jr this article had been written at the commencement of the year, the statement that the year 1924 had on the whole been one of satisfactory progress in financial and economic affairs would have been generally admitted.

some of this optimism has been chilled by a clearer Last year, in fact, closed on a note of optimism. To-day recognition of the many difficult problems which have still to be faced. Nevertheless, I do not think there has been anything so far in the developments of 1925 which need to be regarded as seriously modifying the favourable verdict pronounced upon the general trend of events in the previous year. Briefly and imperfectly summarized, the outstanding features of 1924 were the acceptance of the Dawes Report, followed by the com- mencement of the financial reconstruction of Germany, the flotation of more than one loan, having for its object the financial rehabilitation of some of the Central European States, and the great change over in this country froth a Labour Government to a Conservative Administration with a substantial majority. These developments led to a certain increase in financial activities during the second half of last year, and to hopes of a general revival of international trade this year, while a feature, of course, of the closing month of 1924 was the material improvement in the American Exchange on London. So far as the banks themselves were concerned, the year was also a satisfactory one. It was not simply that profits themselves were rather higher, but there was a general tendency to return to rather more normal conditions and, thanks to a small rally in trade here and to greater activity in international finance and trade, the banks were less dependent upon channels such as Treasury Bills for the employment of their resources, and, as will be seen from the following figures of some of the larger of the Clearing Banks, signs of more general activity are apparent in the very general increase in loans and advances, and also in acceptances :- Loans and Accept- Dec. 31st. Deposits. Advances. ances.

ft will also be noted, however, that on balance deposits

£ £ £

Bank of Liver- 1923 64,537,818 37,927,980 7,852,472

pool & Martins

1924 61,290,020 37,431,444 8,254,768

Barclays Bank ..

1923 1924 301,549,963 301,026,825 132,520,239 140,078,976 7,877,387 11,308,303

Glyn, Mills & Co.

1923 1924 27,775,514 30,153,507 5,862,493 7,340,743 1,742,274 1,882,344

1923 340,168,551 141,405,774 19,176,523 Lloyds Bank .. 1924 339,989,727 164,714,331 22,701,940

1923 360,267,722 188,737,732 36,552,606 Midland Bank .. 1924 355,774,872 190,691,323 39,203,319 National Pro- 1923 263,786,055 127,074,515 10,708,228 vincial Bank 1924 254,921,144 131,242,924 12,948,372 tWestminster Bank 1923 1924 269,502,092 272,832,400 101,302,025 121,946,012 12,099,401 16,430,325 :Williams Deacons 1923 34,372,244 19.213,089 3,104,070 Bank 11924 34,836,369 18,683,878

2,970,674_. were somewhat lower, and the explanation of that fact furnishes a further key to the position, and to the general outlook. At the annual meeting of Lloyds Bank the chairman explained that the holdings of long-dated investments had been reduced by nearly £22,000,000, and the reason for their realization was twofold. There was an excellent profit. to be taken, while by selling its investments the bank had increased its power to finance trade requirements. And what was true with Lloyds doubtless applied in varying degree to all the banks, and if the total investments were calculated of the eight banks mentioned above it would be found that there was a decline for the year of no less than £41,000,000. Now, if other influences such as increased loans and advances had not operated it is clear that the decline in deposits would have been much greater than it was, because when a bank sells its own investments to its customers the effect, of course, must be to reduce the deposits. Therefore the most cursory glance at the banking balance sheets of last December reveals three outstanding features, namely, great liquidity, more activity in trade, as shown in the rise both in Loans and Acceptances, and great strength in the matter of inner reserves, for in most instances it is probable that the profit secured from the sale of investments has not gone to the credit of Profit and Loss, but to Special Funds for increasing the strength of the general banking position. This same prudence has also been displayed in the matter of allocation of profits, for although in the case of the " Big Five," for example, the aggregate profits for the year showed an expansion of 31,200,000,110 bank increased its dividend, the whole of the profits being used for allocations to Special Funds, and to increase the Carry Forward.

• AN OBSCURE OUTLOOK.

And, while withdrawing nothing I have said previously with regard to the improvement established in the general position, both internationally and locally, during the past year, I fancy it will be found that the prudent and cautious attitude of the banks will be found to be abundantly justified, for in not a few respects the outlook suggests that the end of the post-War financial problems has by no means been reached. Trying as was the period of the War itself it must be remembered that some of the many War restrictions were after all of. a character protecting the liabilities of the banks, and although it was also a period of enforced investment in Securities destined to depreciate severely for a time it was also a period of large profits resulting from the activities of certain industries. With the removal of the embargo on gold, however, the responsibilities of the banks and of Lombard Street generally will be greatly quickened and increased. Moreover, the responsibilities will be all the greater because, however cogent may be the arguments in favour of a return to the Gold Standard (and I believe them to be sufficiently cogent to warrant early action) no one will deny the difficulties likely to attend the resumption of the responsibilities of the free gold market. Among those difficulties, so far as the near future is concerned, I should be inclined to give special prominence to the three following considerations : the likelihood of British purchases of American Securities being prompted by a return of the pound to the dollar parities, the possible shortage of European harvests, and the unsatisfactory labour outlook in the country. But while I might be inclined specially to emphasize the last factor, I am not at all sure that it may not constitute one of the strongest arguments in favour of a return to gold because, if it is true that competi- tion with foreign countries in industrial and manu- facturing activities is impossible under our present scale of wages, working hours, &c., then the sooner the truth is forced upon us—however painful the process— the better it will be.

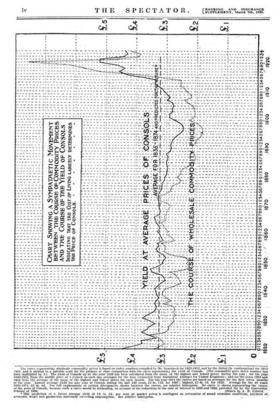

Nevertheless, I suggest that in these manifestly difficult problems which may have to he faced in the near future, we have an adequate explanation of the prudence and caution which have been displayed by the banks in the past few years, and in the strong banking position which has been secured. We also find ground for en- couragement that these problems will ultimately find a successful solution. The curve representing wholesale commodity prices is based on index numbers compiled by Mr. Sauerbeck for 1820-1912, and by the Statist (in continuation) for 1913 1924, and Is plotted to a suitable scale for the purpose of close comparison with the curve representing the yield of Consols. (The commodity price index number has, been multiplied by 3.) The yield of Consols up to the year 1839 has been calculated from the mean of the highest and lowest prices during the year ; for the year, 1840-1922, from the middle price at 1 o'clock on each day averaged for the year (extracted from Statistical Abstract for United Kingdom) ; and for the years 1923 and 1924 from the average of the mean of the highest and lowest prices for each month. For the year 1914 the curves are based on averages for the first seven months' of the year. Lowest average yield for any year of Consols during the last 100 years, £2 8s. 11d. for 1897 ; highest, £5 8s. 5d. for 1920. Average for the 40 years 1835-1874, £3 4s. &l. For full explanations of certain divergencies shown between the curves, see relative letterpress. No curve is shown representing the course.. of the price of Consols, because such a curve would be misleading, on account of the reductions in the rate of interest in 1889 and 1903, provided for by the Conversion Scheme of 1888. [Drawl by A. H. GIBSON. • This prediction of a future average yield of £3 rs. Cd. per cent. at market prices is contingent on restoration of sound economic conditions, payment of ' s.eonomic wages and production materially exceeding consumption. See relative letterpress,

Previous page

Previous page