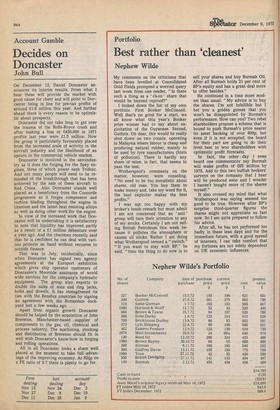

Portfolio

Best rather than cleanest'

Nephew Wilde

My comments on the criticisms that have been levelled at Consolidated Gold Fields prompted a worried query last week from one reader, "Is there such a thing as a ' clean ' share that would be beyond reproof?"

I looked down the list of my own portfolio. First Booker McConnell. Well that's no good for a start, we all know what this year's Booker prize winner had to say about exploitation of the Guyanese. Second, Guthrie. Oh dear, this would be really shot down on two counts, operating in Malaysia where labour is cheap and producing natural rubber, mainly to be used by tyre manufacturers (hints of pollution). There is hardly any share of mine, in fact, that seems to pass the test.

Wotherspool's comments on the matter, however, were consoling. "No need to be too moralistic about shares, old man. You buy them to make money and, take my word for it, the best exploiter makes the best profits."

I was nqt too happy with my broker's brash remark but must admit I am not concerned that an ' anti ' group will turn their attention to any of my stocks. Certainly I am not selling British Petroleum this week because it pollutes the atmosphere or causes oil slicks. Rather I am doing what Wotherspool termed a "switch." "If you want to stay with BP," he said, "then the thing to do now is to sell your shares and buy Burmah Oil. After all Burmah holds 21 per cent of BP's equity and has a great deal more to offer besides."

He continued in a tone more modest than usual: "My advice is to buy the shares. I'm not infallible but I bet you a golden guinea that you won't be disappointed by Burmah's performance. How can you? Two rebel shareholders propose a scheme that is bound to push Burmah's price nearer its asset backing of over 600p, but even if it is not accepted, the board for their part are going to do their level best to woo shareholders with optimistic profit forecasts.

In fact, the other , day I even heard one commentator say Burmah will make profits of £65 million by 1975. Add to this two bullish brokers' surveys on the company that I hear will be produced soon and I wonder I haven't bought more of the shares myself." It also crossed my mind that what Wotherspool was saying seemed too good to be true. However after BP's surprise third-quarter figures the shares might not appreciate so fast now. So I am quite prepared to follow his advice.

After all, he has not performed too badly in these lean days and for the immediate future, with a good spread of interests, I can take comfort that my fortunes are not solely dependent on UK economic influences.

Previous page

Previous page