Portfolio

In the red

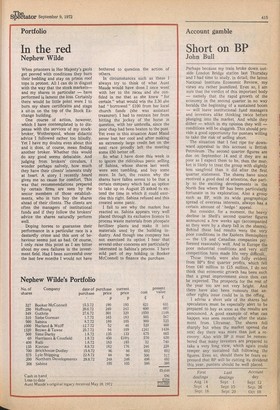

Nephew Wilde

When prisoners in Her Majesty's gaols get peeved with conditions they burn their bedding and stay on prison roof tops in protest. All I can do in disgust with the way that the stock markets— and my shares in particular — have performed is lament the loss. Certainly there would be little point were I to burn my share certificates and stage a sit-in on the top of the Stock Exchange building.

One course of action, however, which I have contemplated is to dispense with the services of my stockbroker, Wotherspool, whose didactic advice I followed rather too blindly. Yet I have my doubts even about this and it does, of course, mean finding another broker. Whether this would do any good seems debatable. And judging from brokers' circulars, I wonder perhaps naively, how much they have their clients' interests truly at heart. A story I recently heard gives me no cause for comfort. This was that recommendations prepared by certain firms are seen by the senior members of those establishments, who in turn buy the shares ahead of their clients. The clients are often the managers of institutional funds and if they follow the brokers' advice the shares naturally perform well.

Doping horses to guarantee their performance in a particular race is a dastardly crime and this sort of behaviour seems just as bad. Of course, I only raise this point as I am bitter about my own failures in the investment field. Had I been successful over the last few months I would not have bothered to question the action of others.

In circumstances such as these I always try to think of what Aunt Maude would have done. I once went with her to the races and she confided in me that as she knew "for certain” what would win the 2.30 she had "borrowed " £100 from her local church funds (she was assistant treasurer). I had to restrain her from hitting the jockey of the horse in question, with her umbrella, since the poor chap had been beaten to the post. Yet even in this situation Aunt Maud never lost her cool and after making an extremely large credit bet on the next race proudly left the meeting some £50 better off.

So what I have done this week is to ignore the ridiculous panic selling of Sabina, whose shares last week were sent tumbling, and buy some more. In fact, the reason why the shares have fallen seems to be that a certain company which had an option to take up on August 25 asked to extend the time in which it could exercise this right. Sabina refused and this created some panic.

I fail to see why the market has reacted so. Sabina appears very well placed through its exclusive licence to process waste materials from phospate fertiliser plants and make it into materials used by the building industry. And though one company has not exercised its option I hear that several other concerns are particularly interested in Sabina's process. I have sold part of my holding in Booker McConnell to finance the purchase.

Previous page

Previous page