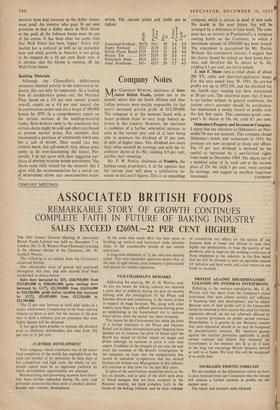

Company Notes

M-12: GARFIELD WESTON, chairman of Asso- ciated British Foods, points out in his annual report that the South African and Aus- tralian interests were mainly responsible for last year's increased pre-tax profit of £13,709,000. The company is at the moment faced with a major problem from its very large bakery in- terests in this country. However, the chairman is confident of a further substantial increase in sales in the current year and of at least being able to maintain the dividend of 31 per cent, in spite of higher taxes. This dividend was more than twice covered by earnings and with the Is. ordinary shares at 6s. 9d., yielding 4.5 per cent, justifies their retention.

Mr. F. W. Pontin, chairman of Pontin's, the holiday-camp proprietors, is of the opinion that the current year will show a satisfactory in- crease on last year's figures. This is an expanding coMpany which is always in need of new cash. No doubt in the near future this will be arranged by a debenture or loan stock. The com-

pany has an interest in Pontinental's, a company owning hotels on the Continent, to which a

maximum amount of. £500,000 has been loaned.

The repayment is guaranteed by Mr. Pontin. Without this continental interest, I suggest that the shares should be valued on their home busi- ness, and therefore the 2s. shares at 3s. 3d., yielding 6.1 per cent, are fairly valued.

J. and F. Stone runs a retail chain of about 200 TV, radio and electrical-appliances shops. et For the year ended June 30, 1965, the pre-tax profits are up to £952,100, and the dividend for the fourth year running has been maintained at 30 per cent. The chairman states that if there is no further setback in general conditions, the current year's accounts should be satisfactory. has maintained a steady record of profits over the last few years. This consumer-goods com- pany's 5s. shares at I8s. 6d. yield 8.1 per cent.

Oddenino's Property and Investment Company. I regret that my reference to Oddenino's on Nov- ember 19 was not accurate. This company closed Oddenino's hotels and restaurants in 1955; the premises are now occupied as shops and offices. The 15 per cent dividend is declared on the capital as increased , by a one-for-four rights issue made in December 1964. The shares are of a nominal value of 5s. each and at the current price of 23s. 6d. yield 3 per cent, twice covered by earnings, and suggest an excellent long-term

Previous page

Previous page