Investment Notes

By. CUSTOS HERE are some practical suggestions for trustees. For the 'narrower range' half, just switch into the short-to-medium dated govern- ment bonds which fit in with your requirements. Gross redemption yields up to 6.85 per cent. can be secured. Then buy some partly paid deben- tures recently issued and so avoid stamp duty. For example, Wiggins Teape 61 per cent. at 981 to yield £6 17s. per cent. (This is 25 per cent. paid.) Then switch into some convertible debentures. Stamp duty can be saved on the City Centre convertible loan stock at 4s. 9d. (5s. paid). Interest is paid at 5 per cent. until December 31, 1964, and at 61 per cent. thereafter, but con- version rights are offered into ordinary shares in December, 1962, at 60s., in December, 1963, at 62s. and in December, 1964, at 64s. The shares have been as high as 65s. 9d. this year. As other issues of attractive debentures are made, pur- chases should be made in the partly paid form so as to allow time for sales of gilt-edged stock to be made at perhaps rising prices.

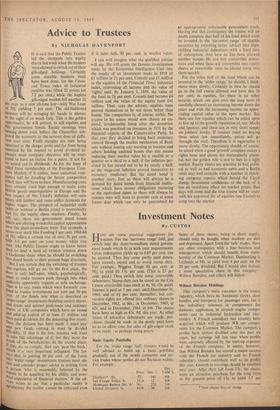

Basic Equity Portfolio For the 'wider range' half, trustees would be well advised to build up a basic portfolio gradually out of the steady consumer and ser- vice trades whose profits do not fluctuate widely. For example :

Price Div. '.',.

Div.

Yield % Distillers" 10s. ..

37/-

141 4.0 Ind Coupe Tetley 5s. .. 13/6 12 4.4 Montague Burton 10s. 'A'

76/-

274 3.6 United Drapery 5s, .. 49/6 30 3.0

Some of these shares, being in short supply. should only be bought when markets are dull and depressed. Apart from the 'safe' trades, there are other companies with a fine business and management which should benefit from mem- bership of the Common Market. Outstanding is Leylands at 98s. to yield over 4 per cent. on the 20 per cent. dividend. But I would also include a more speculative share in this category-- Wilmot Breeden; and others will follow.

Wilmot Breeden Holdings This company's main customer is the motor industry, which buys its 'hardware' (locks, door handles and bumpers) for passenger cars, but it has subsidiary interests in components for domestic appliances, in aircraft engine compo- nents and in industrial hydraulics and elec- tronics. A French subsidiary has recently been acquired which will produce WB car compo- nents for the Common Market. The company's profits have almost doubled over the past six years, but earnings fell last year when profits were adversely affected by the start-up expenses of the French company. It seems, however, that Wilmot Breeden has scored a major success with the French car industry and its French subsidiary should contribute well to its profits this year. Growth in earnings should be resumed next year. After their fall from 17s., the shares seem an attractive purchase for the long term at the present price of 15s. to yield 3.7 per

New shares free of stamp. cent. The convertible 20 per cent, preference can be bought at 17s. to yield nearly 6 per cent. These shares have the right between October 1 and December 31 in 1963 or 1964 to convert share for share into ordinary shares of 5s.

Previous page

Previous page