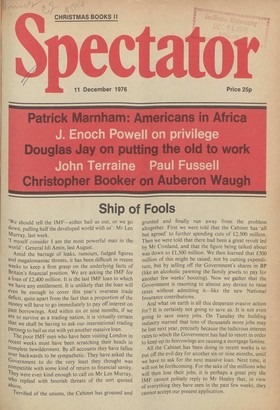

Ship of Fools

'We should tell the IMF—either bail us out, or we go down, pulling half the developed world with us': Mr Len Murray, last week.

1 myself consider I am the most powerful man in the world': General Idi Amin, last August.

Amid the barrage of leaks, rumours, fudged figures and megalomaniac threats, it has been difficult in recent Weeks to keep a firm grasp on the underlying facts of Britain's financial position. We are asking the IMF for a loan of £2,400 million. It is the last IMF loan to which we have any entitlement. It is unlikely that the loan will even be enough to cover this year's overseas trade deficit, quite apart from the fact that a proportion of the money will have to go immediately to pay off interest on Past borrowings. And within six or nine months, if we are to survive as a trading nation, it is virtually certain that we shall be having to ask our international trading Partners to bail us out with yet another massive loan.

The poor IMF men who have been visiting London in recent weeks must have been scratching their heads in complete bewilderment. By all accounts they have fallen over backwards to be sympathetic. They have asked the Government to do the very least they thought was compatible with some kind of return to financial sanity.

hey were even kind enough to call on Mr Len Murray, Who replied with boorish threats of the sort quoted above.

Terrified of the unions, the Cabinet has groaned and grunted and finally run away from the problem altogether. First we were told that the Cabinet has 'all but agreed' to further spending cuts of £2,500 million. Then we were told that there had been a great revolt led by Mr Crosland, and that the figure being talked about was down to £.1,500 million. We then learned that £500 million of this might be raised, not by cutting expenditure, but by selling off the Government's shares in BP (like an alcoholic pawning the family jewels to pay for another few weeks' boozing). Now we gather that the Government is resorting to almost any device to raise taxes without admitting it—like the new National Insurance contributions.

And what on earth is all this desperate evasive action for? It is certainly not going to save us. It is not even going to save many jobs. On Tuesday the building industry warned that tens of thousands more jobs may be lost next year, precisely because the ludicrous interest rates to which the Government has had to resort in order to keep up its borrowings are causing a mortgage famine.

All the Cabinet has been doing in recent weeks is to put off the evil day for another six or nine months, until we have to ask for the next massive loan. Next time, it will not be forthcoming. For the sake of the millions who will then lose their jobs, it is perhaps a great pity the IMF cannot politely reply to Mr Healey that, in view of everything they have seen in the past few weeks, they cannot accept our present application.