Mr. Crosland Gets It Wrong

By NICHOLAS DAVENPORT THE time has surely come for us all to take a more sensible view of the ordinary share (commonly called the 'equity') and its owners. This applies not only to the investor and the economist, but to the politician and the sociologist as well. We have lately been entertained by a ferocious debate between the new Right and the new Left of the Labour Party on the subject of share ownership and control. In his Conservative Ettemy Mr. Anthony Cros- land belabours the new Left writers in the Universities and Left Review who have con- tended that ownership is still sufficiently concen- trated to secure control through the system of interlocking directorships and that to the extent that non-owning managers do exercise control theY do so in the interests of the owning class. in his chapter on 'Insiders and Controllers' Mr. Crosland has no difficulty in knocking holes ihrough the statistics and facts of the new Left th, esis, but goes much too far in claiming that tnere is a real and significant difference between Itie new managers—the self-perpetuating olig- archies- and the old owner-capitalists. The new nianagers, he says, may pursue the goals of growth, profits and personal wealth—so do n'allagers everywhere, he adds, including Russia -. but because they do not have 'the same rela- tionship to private property' (i.e., the equity 811are) as the old owners had, there are 'signifi- cant differences in the nature of the profit-goal and the degree of responsibility with which eco- ,11°Tnic power is exercised.' There are still to be d 'ruthless and dedicated profit-maximisers,' but the typical large corporation run by its rnanagers now pays regard, he contends, to good Ilublic and labour relations (its sense of social re sPonsibility) as much as to growth and high Profits. So Mr. Crosland welcomes the mana- gerial revolution—the new enlightened form of caPitalism--and writes off share ownership as meaningless or unimportant.

,, How wrong Mr. Crosland is! Not quite so 4..nsurdly wrong as Burnham was in his 7a/roger/a/ Revolution, but just as ignorant of l,e reill set-up of the new capitalism. Of course, ne capitalist system changes. Keynes gave it epennomically a new lease of life and the Labour .1,!rtY gave it politically a new social conscience. 1;ne share registers have changed in character tteicause of the wider spread of wealth and ille growth of institutional funds seeking invest-

iii equity shares. But it is still capitalism.

e nationalisation of six industries by a Labour `rovernment did not upset the system; it did not el'en diminish the inequalities of wealth; it left commanding heights of the economy' still ,!1 Private hands. There is still an 'owner class,' ti"Itit more broadly based, and while the owners iP sometimes engage in fierce competition and 14,Knover battles, they generally act as a single 1 `Zaas through the City establishment—interlock- ing directorships are not necessary for that

purpose—when their vital interests are affected. All the many new managers I have known had exactly the same relationship to private property as the old owners. After all, it is a free-enterprise system in which everyone is on the make and pursuing his own private interest and profit. The only reason why the new managers of the big corporations appear to Mr. Crosland as not seeking to maximise company profit as ruth- lessly as the old owners did in the past is simply because they find it extremely difficult to do so. They find themselves up against the trade unions who are seeking to maximise wages. They find themselves up against the immobility of labour and the directions of government departments compelling them to site their factories in areas of high unemployment. And, finally, they find themselves up against the Treasury, which has been restraining domestic demand, cutting profit margins and increasing costs. Mr. Crosland's ex- cuses must have given them a good, if hollow, laugh.

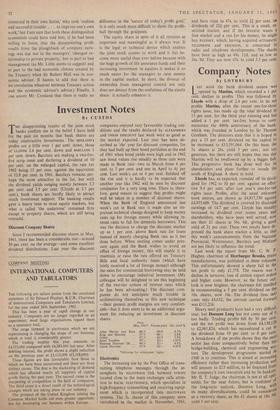

The difficulties which the new managers en- counter in trying to maintain growth and in- crease profits are at last being noticed by the academic economists who pushed their college funds wholesale into equity shares some twenty years ago. Mr. Ian Little, of Nuffield College, has been investigating what he calls rHiggledy Piggledy Growth' in the November issue of the

journal of the Oxford institute of Statistics. The period he has taken is 1951-59 and if he finds in these booming times that 'in spite of the heavy ploughing back of profits the growth of ad- justed pre-tax earnings per share has lagged behind earned incomes, especially in industries most concerned with exports and investment.' then God help all equity share owners when he comes to review the period 1961-69. If the figures had been more up-to-date, he adds, the growth of pre-tax earnings would undoubtedly have been much slower still. These discoveries do not come as any surprise to those of us in the City who have been investing in equities for over thirty years. We have long been aware of the fact that the great boom in equity shares in the Fifties was due to the sharp rise in dividends far out- stripping the rise in earnings and to the extensive capital rights which were offered to shareholders on the relaxation of dividend and capital re- straints. We have all known for a long time that equity values could not continue 'to ride the surf of reduced taxation and dividend re- laxation. We are all very grateful to Mr. Little for being disturbed by 'the lack of significant correlation between ploughback and growth' and for reminding us that 'unless there is some funda- mental change in the economy making for greater profitability of capital the prospect for equities is worse than past performance sug- gests.' But why did he not say all this,to Mr. Crosland when he came to read and advise on the new material in The Conservative Enemy?

Mr. Crosland is profuse in his thanks to Mr. Little and Sir Robert Hall, 'busy men heavily

immersed in their own duties,' who took 'endless and successful trouble . . . to improve one's own work,' but I-am sure that both these distinguished economists could have told him, if he had been willing to listen, that the disappointing profit results from the ploughback of company earn- ings was due not to the managers' changed re- lationship to private property,' but in part to bad management (as Mr. Little seems to suggest) and in part to the bad economic climate created by the Treasury when Sir Robert Hall was its eco- nomic adviser. (I hasten to add that there is no correlation whatever between Treasury action and the economic adviser's advice.) Finally. L can assure Mr. Crosland that there is really no

difference in the 'nature of today's profit goal.' It is only much more difficult to shoot the profit- ball through the goalposts.

The equity share in spite of it all remains as important and meaningful as it always was. It is the legal or technical device which enables the joint stock system to work and it has be- come more useful than ever before because with the huge growth of life assurance funds and their increasing investment in equities it makes it so much easier for the managers to raise money in the capital market. In short, the divorce of ownership from managerial control not only does not detract from the usefulness of the equity share: it actually enhances it.

Previous page

Previous page