Back into gold

Nephew Wilde

The way fireworks illuminated the dark sky last Saturday night and seconds later fizzled into oblivion reminded me of the talks at Downing Street. For after initial hopes had been raised that unions, management and Government would all haul together, in reality there was little to support such optimism. Now, however, Mr Heath has taken the tough line and enforced controls. What puzzles me, though, is what happens after ninety days, when we are on the threshold of Europe. It is plain to anyone who has crossed the Channel that the Continental food prices are higher than ours. If we are not careful England will be overflowing with Continentals after our food, after our clothes and Italians drooling at the mouth over our women!

So I see the natural sequence of events leading to another crisis point in about three months' time. As for VAT, I am sure when we change to this system, prices will again start to spiral even to the extent possibly of causing a consumer strike.

When I telephoned my stockbroker, Wotherspool, however, I found that after Mr Heath's new measures had been announced, the market had made some recovery. Wotherspool was all for me putting my cash reserves into equities. However, I am prepared to tread cautiously. And I feel fortunate that I have a good overseas mix to my portfolio. The particular share that I notice is in the news is Ralli. With Trafalgar House bidding for Bowater, the terms for the proposed merger with Ralli look too generous.. I think the outcome will be Ralli withdrawing from the issue and linking with a big overseas trader such as Inchcape. At least it will always be a share to provide interest, whatever the state of the market.

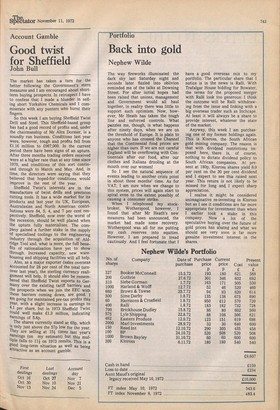

Anyway, this week I am purchasing one of my former holdings again. This is Kinross, the South African gold mining company. The reason is that with dividend restrictions imposed here, there is, of course, nothing to dictate dividend policy to South African companies. At present at 180p, Kinross shares yield 8.9 per cent on the 30 per cent dividend and I expect to see this raised next year. This return is not likely to be missed for long and I expect sharp appreciation.

I realise it might be considered unimaginative re-investing in Kinross but as I see it conditions are far more appropriate for investment than when I earlier took a stake in this company. Now a lot of the speculative buying over the future of gold prices has abated and what we should see very soon is far more genuine investment interest in the shares.

Previous page

Previous page