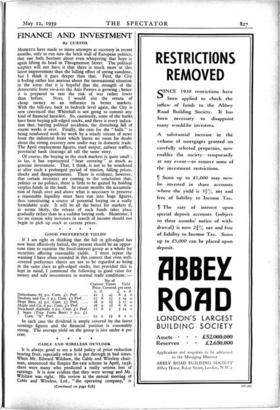

GOOD PREFERENCE YIELDS

If I am right in thinking that the fall in gilt-edged has now been effectively halted, the present should be an oppor- tune time to examine the fixed-interest group as a whole for securities offering reasonable yields. I must repeat the warning I have often sounded in this context that even well- covered preference shares are not to be regarded as being in the same class as gilt-edged stocks, but provided this is kept in mind, I commend the following as good value for money and safe investments in normal trade conditions : - No. of

Current Times Yield Price. Covered. per cent.

s. d. £ s. d.

Debenhams 61 p.c. Cum. Li Pref.

21

3 4+ 6

2 0 Doulton and Co. 5 p.c. Cum. f r Pref.

17 6 5f 5 14 0

Hope Bros. 51 p.c. Cum. Li Pref.

18 9 21 5 17 0 Maple and Co. 6 p.c. Cum. Li Pref. 18 9 21 6 8 0 Neuchatel Asphalte 5 p.c. Cum. Li Pref. 17 6 5 5 14 o J. Sears (True Form Boot) 7 p.c. Li Cum. "A" Pref.

23 0 2+

6

2 0

In each case the dividend is amply covered by the latest earnings figures and the financial position is reasonably strong. The average yield on the group is just under 6 per cent.

Previous page

Previous page