Investment Notes

By CUSTOS

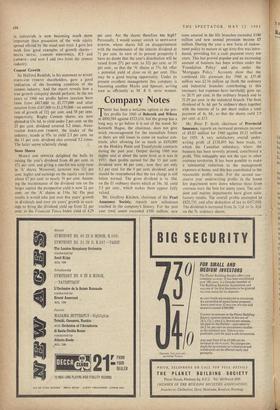

ANOTHER reason why this bull market is in need of a correction is that it is inducing more and more issues to come from the unit trusts, which make the prevailing shortages of shares in the market only worse. Following the block issues of Falcon and 'Domestic' we have this week another from British Industries First Trust. The small investor should appreciate that he is subscribing at a market peak, which may turn out bad timing for his entry into the market. It has been pointed out that in the twelve months to March the only unit trusts to beat the indices of the Times and Daily Mail were those confined to banks, insurance shares and investment trusts. And after the sharp rise of 30 per cent. or 40 per cent. in these share groups since the begin- ning of the year 1 would hesitate to buy even these excellent units for the time being. Selectivity in industrials is now becoming much more important than possession of the wide equity spread offered by the usual unit trust. I gave last week four good examples of growth shares- DELTA METAL, LAMSON INDUSTRIES, ICI and LAPORTE-and now I add two from the cement industry.

Cement Growth

Sir HalfOrd Reddish, in his statement to RUGBY PORTLAND CEMENT shareholders, gave a good indication of the booming condition of the cement industry. And the report reveals how a true growth company should perform. In the ten years to 1960 net profits before taxation have risen from £417,000 to £1,777,000 and after taxation from £167,000 to £1,139,000-an annual rate of growth of 324 per cent. and 58 per cent. respectively. Rugby Cement shares are now quoted at 63s. 6d. to yield under 2 per cent. on the 25 per cent. dividend covered 3.2 times. Asso- CIATED PORTLAND CEMENT, the leader of the industry, stands at 95s. to yield 2.3 per cent. on the 11 per cent. dividend also covered 3.2 times. The latter seems relatively cheap.

Store Shares

MARKS AND SPENCER delighted the bulls by raising the year's dividend from 40 per cent. to 474 per cent. and giving a one-for-ten scrip issue in 'A' shares. Moreover, turnover was 124 per cent. higher and earnings on the equity rose from about 67 per cent. to nearly 76 per cent. Assum- ing the maintenance of the dividend rate on the larger capital the prospective yield is now 24 per cent. on the 'A' shares at 116s. 9d. On past results it would take just over five years' growth in dividends and over six years' growth in earn- ings to bring the dividend yield up from 24 per cent. to the Financial Times Index yield of 4.29 per cent. Are the shares therefore too high? Personally, I would sooner switch to MONTAGUE BURTON, whose shares fell on disappointment with the maintenance of the interim dividend at 74 per cent. In view of its present prosperity I have no doubt that the year's distribution will be raised from 274 per cent. to 324 per cent. or 35 per cent., so that the `A' shares at 77s. 6d. offer a potential yield of close on 44 per cent. This may be a good buying opportunity. Under its present excellent management this company is becoming another Marks and Spencer, serving men as efficiently as M. & S. serve women.

Previous page

Previous page