MONEY MARKET.

STOCK EXCHANGE, FRIDAY AFTERNOON.

This is the first week since the commencement of the pressure for money that we have had to notice decided and unequivocal symptoms of weakness in the Stock Market. All descriptions of Stocks have been very heavy during the week. The first indications of the fall that has occurred appeared in the Heavy Stocks. Large sales of both New and Reduced Three-and-a-half per Cmts., on Monday and Tuesday, having depressed both markets considerably below our last quotations. The operations were undertaken principally by the broker employed by the Scotch Banks. The effect of these transactions upon Consols was counteracted by the purchases for Money, and several large ones for the January Account, which continued to he effected in the latter Stock. On Wednesday, and on each succeeding day, however, several large amounts of Consols have been sold for Money ; and the price has given way under the pressure occasioned by them, to an extent of more than 1 per cent, below the prices of last week. It is pretended that the sales of Consuls have been made on the behalf of some large American houses, who, finding a difficulty of oh- taming money upon several of the Transatlantic sectuities now in their posses- sion, have succeeded iu hypothecating them with some of our leading capi- talists; who, instead of lending money, have lent Consols upon them, which Consols the borrowers have entered into an engagement to replace at the expi- ration of the period for which the loan has been effected. We believe, however, that the sales in question have been occasioned by the continuance of the sales -of Exchequer Bills by the Bank of England, which have been of considerable extent and of almost daily occutrence. These Securities are in a very de- pressed state; and it is the general opinion that the Government will be com- pelled to augment the interest to 3d. per day. The exportation of gold conti- nues. There has been a demand for bar gold for Hamburg, and several applications for purchase have been made to the Bank Directors; which, with questionable policy, the Directors have refused, this forcing them to send sove- reigns instead.

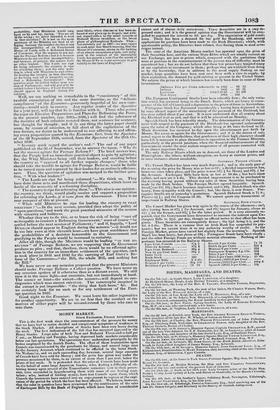

The state of the American Money.market has operated upon the price of their Securities here, and the various State Debts which are usually current on our Exchange, are now at prices which, compared with the quotations they were at previous to the commencement of the present sera of difficulty, must be considered low ; but we do not believe that these low prices have tempted many of our capitalists to investment in them ; perhaps they are withheld from doing an by the knowledge, that in addition to the usual supply floating on our market, large quantities have been sent over bete with a view to supply, by their realization, the Element' for gold existing at present in the United States. We subjoin the prices at which business has recently been done in some of these investments.

AMbania Five per Cents. redeemable in 1852 .. 92 23

Indiana • • 1859 .. 90 91

Louisiana • • • . 1044-7.50-52 .. 98 100 New Jersey • • 1864 .. 102 The European Continental Stocks have been tolerably firm ; the only varia- tion which has occurred being in the Dutch 13 Is, labia are heavy in conse- quence of the fall of Consols and a depression in the prices of them in Amsterdam. Portuguese Stock has fluctuated considerably ; having been depressed to 53 by some absurd report of the uncertainty of the pa) went of the Dividend, but bas since rallied about 2 per cent. It is now understood that all anxiety about the Dividend is at an end, and that it will be edit ei tied on Monday. Spanish Stock has been tolerably steady. The determination of clue Govern- ment with respect to the payment of the Dividends has operated unfavourably upon the value of the Coupons; which after heing at 40, have declined to 31. Much discussion has occurred to-day upon the advertisement put forth by Messrs. Rica non as agents for the Government ; and it is the source of uni- versal regret to the Bondholders, that gentlemen of their high character should have felt it necessary to place themselves in epposition to the Finance Minister, particularly- at the present juncture, when the financial embarrassments of the Government render the most zealous cooperation of all persons connected with it an almost imperious duty. The only Railway Shares which are in demand, are those of the London and Birmingham : the others, without exception, are heavy at current prices, and in some instances almost unsaleable.

SATURDAY, TWELVE O'CLOCK.

The Consol Market has been very much depressed' and in the early part of the morning the price for Money was as low as 87; adecided improvement has, however, since taken place, and the price is now 871 for Money and 87if a for the Account. Exchequer Bills have been as low as 10 dis. ; but have since rallied, and now are 5 4 dis. This decided improvement is to be attributed to the morning having passed without any sales of these Securities having been made by the Bank broker. The Foreign Market opened languidly. Spanish Stock:was 18L I9A ; but it hassince improved, and is 19i. Dutch Stock was also heavy, front sympathy with the Consols; but, like them, is now firmer. Por- tuguese Stocks are at yesterday's quotations. Spanish Deferred Stock is 71 8; Passive 5i ; and the Coupons 31 33. We cannot quote any transactions of importance in Railway Shares.

SATURDAY, FOUR O'CLOCK,

The Consol Market has given way again in the course of the afternoon ; and, after having been at 871 a for Account, and 874 buyers for January, closes at H7A- for the former, and 87.4 for the latter per iod. It is very currently re- pot ted, that the Government have determined to increase the interest upon Ex.. chequer Bills to 26d. per day, though no official notice to that effect has been given. These Securities are consequently firmer ; the lid. being 35, and the 2d. 4 2 dis. There is a rumour that an Irish Bank has suspended its pay- ments; but we cannot trace it to any authority worthy of credit. lii the Foreign Market, prices have varied but slightly from the morning's. Spanish Stock has been heavy, but closes at 19A ; Portuguese Bonds have been steady ; and the other Foreign Funds are without material alteration. Nothing of im- portance has occurred in the Railway Shares.

3 per Cent. Consols 87* t Danish 3 per Cents. 74 75 Ditto for Account 87* Dutch 21 per Cents 521 1 3 per Cent. Reduced 861 * Mexicali 6 per Cents 22*

New 31 per Cent Anus 95/ i Portuguese Regency 5 p. Cts. 55*

India Stuck Ditto 3 per Cent. 35* Batik Stock 252 Ditto Spec Cents 1836 Saip . 23 dis.

Exchequer Bills 5 2 dis. Prussian (1818)5 per Cent .. — Belgian 5 per Cents 99* 100 Russian (1899)5 per Cent ... 1054 6

Brazilian 5 per Cents 79 80 Spanish (1835) 5 per Cent... 19*

Previous page

Previous page