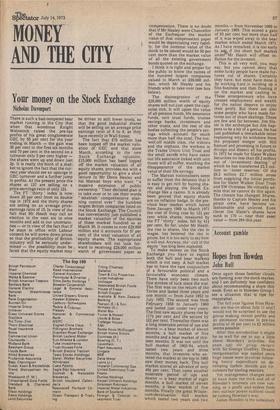

:Account gamble

Hopes from Howden

John Bull

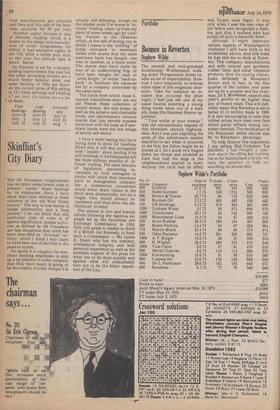

Once again those familiar clouds are forming over the stock market and I am definitely less confident about recommending a share this week. Even so in Howden Group I see a situation that is ripe for reappraisal.

The full year figures from Howden are due on about July 11 and I would not be surprised to see the group making record profits and an estimated increase in pre-tax profits of 40 per cent to E2 million seems possible.

After this introduction it might be as well for me to say a little about Howden's activities. Six years ago the group merged with Sir George Godfrey. Drastic reorganisation was needed since huge losses were involved following heavy expenditure on developing carbon dioxide gas circulators for cooling reactors.

Yet management changes seem to have done the trick and all of Howden's interests are now running at a profit and orders from two nuclear power stations could be coming Howden's way.

James Howden is the subsidiary that manufactures gas circulars and fans and this side of the business accounts for 60 per cent. Another useful division is that of Howden Godfrey which is a leader in the design and manufacture of screw compressors, for ' which it had exclusive rights in the UK. After a rather poor start to the year the outlook here is much better.

So Howden is set for a healthy trading improvement this year but the other promising factors are a , much better balance sheet and asset backing of 105p per share, , At the current price of 85p selling at 12+ times earnings and yielding -1.7 per cent, the shares have a lot

4 of merit, The JH Vavasseur conglomerate has set down some formal rules to present ' insider ' share dealings by its employees. Since I have more than once referred in these columns to the old Wall Street maxim "The way to lose money is inside information and a long pocket," I do not think that this particular code of rules is of special significance. Insider activities as defined by JH Vavasseur are less dangerous than what has been described as ' in-house' activity, which I think I may claim to have been one of the first in the press to attack.

No doubt it is naughty for merchant banking employees to pick up a sly position in some company that they have heard is going to be the subject of a bid, though it is

usually self-defeating, except on the modest scale. Far worse is inhouse ' trading, taken up from my piece of some weeks ago by Lindsay Vincent in the Observer which, at the risk of boring you to death, I repeat is the ' stuffing "of funds entrusted to merchant banks with shares that the same merchant bank has bought, one way or another, at a lower price. The shares may have come by way of an underwriting flop, or have been bought for cash at ' arms length 'or worse ' back-toback ' to facilitate the takeover bid by a company controlled by the same bank.

The funds from which these financial instutitions draw are our old friends those collectors of sucker money, the unit trusts, as well as the pension and charitable funds, and discretionary account hoards that lazy private trustees hand over with the lease as if merchant banks were the last refuge of saintly self-denial.

1 have a nasty feeling the City is trying hard to show Sir Geofrrey Howe that it will deal stringently with ' insider' share dealing if he will overlook in hisCompanies bill the more dubious practice of ' inhouse' trading. The mere mention of legislation preventing investment by fund managers in stocks with which their merchant bank or management company has a commercial connection would lower share values in the short term dramatically, but on a longer view would protect investments and thus draw the disillusioned investor, The answer is root and branch reform following the rigorous example set by the Securities and Exchange Commission in 1934. Only one guess is needed to think of a British Joe Kennedy to head such a Commission — Mr James D. Slater who has the intellect, professional integrity and bold personal experience as well as the probable support of the press for what has to be done quickly and against what will undoubtedly turn out to be the bitter opposition of the City.

Previous page

Previous page