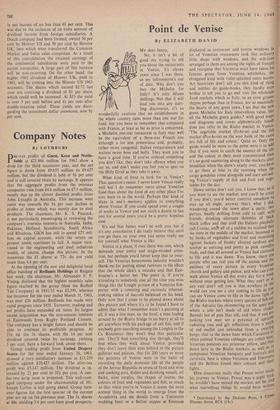

Investment Notes

By CUSTOS

ARECOVERY quickly followed On Monday's black day in the markets. The indication that markets were becoming 'political' was obvious last Friday when the excellent results from COURTAULDS failed to help the market. This company's profits—up 50 per cent—exceeded even the most optimistic expectations and the dividend was raised from 2s. 6d. to 3s. id. (15.4 per cent) excluding the second of the three tax-free dividends of 6d. per unit from capital profits. The directors' profit forecast for this year of £281 million seems likely to be sur- passed. The American subsidiary is booming and the man-made fibre production in this country is breaking records. At 70s. 6d. Cour- taulds yield 4.4 per cent, excluding the tax- free payment. This, of course, helps ICI, whose holding in Courtaulds is now worth over £100 million—about £30 million more than the price which Mr. Chambers paid for the block of shares acquired in last year's takeover fight. ICI at 62s. 9d. are now yielding 4.3 per cent. If we were not having political worries ICI would be nearer 70s. With their wider spread of interests I prefer these shares to Courtaulds.

Motor Components I referred last week to the coming bad report of WILMOT-BREEDEN. The text of it was much worse than 1 expected, for the market knew nothing of the severe losses of the French sub- sidiaries, which amounted to £850,000 before crediting overseas investment income (mainly from the Italian company) of £136,538. Morgan Grenfell and French chartered accountants are

making an independent report on this French catastrophe. Apart from France the 1962 results were reasonably good. Group profits were £1.1 million against £1.3 million in the previous year and the outlook for the British companies in the present year is promising. The trouble is that the French loss cannot be offset against the UK profits for tax purposes. So no final dividend is being paid on the Ordinary shares and the payment of the Preference dividend has been deferred. The Ordinary shares have fallen to 8s. and the 20 per cent Convertible Preference to I Is.

Wall Street

America has its scandal as well as Britain and being concerned with racial segregation it is much more serious than the Profumo scandal here. Nevertheless, many investors feel that Wall Street otTers a greater potential rise than London, for the Dow Jones index is being talked up from 718 to 800. Who can see a I& per cent rise in Throgmorton Street? Two American companies which might appeal to the English investor are wootwoitins and HOOVER—house- hold names on both sides of the Atlantic. The American Woolworths has increased its divi- dends this year to $2.80 but is still moderately priced at $70 to yield 4 per cent before and 6.5 per cent after double taxation relief. The value of its holding in English Woolworths is no less than S77 per share. The American Hoover company produced an excellent 1962 report, showing a rise in sales of 17 per cent and a rise

in net income of no less than 61 per cent. This was due to the inclusion of an extra amount of dividend income from foreign subsidiaries. A Dutch company had been formed, owned 50 per cent by Hoover US and 50 per cent by Hoover UK, into which were transferred the Common Market and Swiss sales companies. As a result of this consolidation the retained earnings of the continental subsidiaries were paid to the parent companies. A large part of this increase will be non-recurring. On the other hand, the higher 1962 dividend of Hoover UK, paid in 1963, will be coming into the Hoover US 1963 accounts. The shares which earned $2.72 last year are receiving a dividend of $I per share, which could well be increased. At $33 the yield is over 3 per cent before and 4+ per cent after double-taxation relief. These yields are disre- garding the investment dollar premiums, now 9,1. per cent.

Previous page

Previous page